Framework #5 Risk

In today's post, we are going to dive into risk. It is important to understand the risk and know what the worst-case scenario of your investment is. We are looking for investments with more upside than downside so you got to understand the risks.

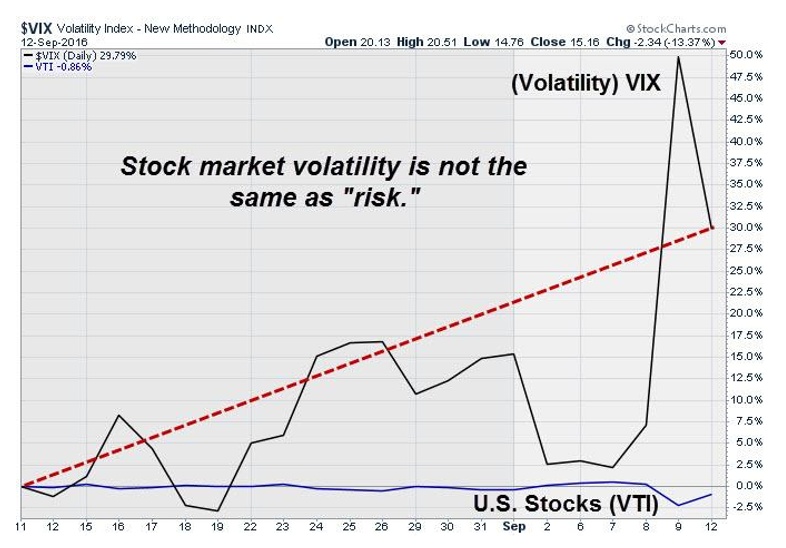

A lot of scholars argue that risk is the volatility of a particular investment, however, that is not the case. The ‘real’ risk is the permanent loss of capital. As you can see in the figure, volatility represents opportunities because you van buy at a lower price multiple times. Loss of capital should be avoided at all time and that’s the real risk.

Price is the most important factor when it comes to risk. A high price with an exuberant valuation usually leads to low long-term returns. We will dive into what drives returns in the next framework.

Link to framework #4: https://app.getquin.com/activity/ZLoyBPYUaz