🌍🌌🛰️---𝐀𝐤𝐭𝐢𝐞𝐧𝐯𝐨𝐫𝐬𝐭𝐞𝐥𝐥𝐮𝐧𝐠---🛰️🌌🌍

I see something you don't see and that is...👀

🅼🅰🆇🅰🆁 🆃🅴🅲🅷🅽🅾🅻🅾🅶🅸🅴🆂

US57778K1051

Many may associate Maxar Technologies with various images about the Ukraine war. Maxar provides satellite imagery, allowing the military, political, but also intelligence agencies to more accurately assess the military and humanitarian situation. So next time you watch NTV or other news services, pay attention to where these images come from (usually marked in the report). So the pun at the beginning is indeed true....Maxar Technolgies and its customers see things that we don't see at first. So give a friendly wave up. Maxar immediately recognizes the speeding Lambo that will splash water in your face with squealing tires ;)

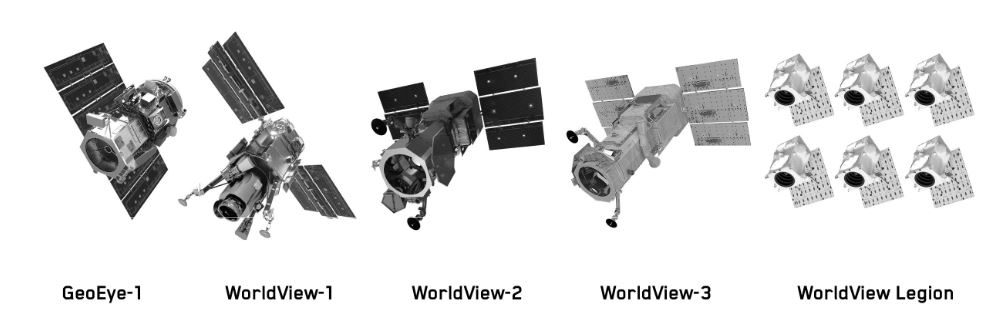

Basically, Maxar Technologies is in the business of "Space Technology Solutions". In this field they deliver, create and design whole satellites as well as spacecraft components for communication. Maxar also provides satellite imagery and analytical data to forecast changes around the globe, be it military, weather related, and various other surveys (you name it). [1] In the images you can see a number of satellites that Maxar currently offers.

"What we do" according to homepage [1]:

"Maxar partners with innovative businesses and more than 50 governments to monitor global change, deliver broadband communications and advance space operations with capabilities in Space Infrastructure and Earth Intelligence."

"Our offerings" as per Annual Report 2021 [3]:

-Communications and imaging satellites and payloads;

-Platforms for space exploration and hosting instruments for Earth science;

-Space subsystems for power, propulsion and communication;

-Satellite ground systems and support services;

-Space-based remote sensing-solutions;

-Space robotics; and

-Defense systems.

Revenue segments [3]:

-Earth Intelligence: 61% of revenue (of which 99% service; 1% intersegment).

-Space Infrastructure: 39% of sales (of which 91% products; 9% intersegment)

Revenue by region [3]:

-United States 81%

-Asia 5.1%

-Europe 4.6%

-Australia 4.1%

-Middle East 3.1%

-South America 1%

-Canada 0.5%

-Other 0.6%

𝖪𝖾𝗇𝗇𝗓𝖺𝗁𝗅𝖾𝗇 [𝟤]:

-KGV 2021: 46.9

-KGV 2022e: 52.6

-KGV 2023e: 14.2

-KGV 2024e: 8.46

-PEG 2022e (P/E/growth rate): 3.5 (rule of thumb: < 1 = very favorable)

-PEG 2023e: 0.95

-Sales growth:

2022: 2,4%;

2023: 8%;

2024: 5,2%

-EBIT growth:

2022: -14%;

2023: 58%;

2024: 32,6%

-Dividend yield 2021: 0.13%

-EPS growth Aerospace/Defense sector next 5 years: 10.25% [4]

-Aerospace/Defense sector P/E: 22.4

-PEG Aerospace/Defense sector: 2.18

𝖱𝗎𝖻𝗋𝗂𝗄 - 𝖶𝖺𝗌 𝗐ü𝗋𝖽𝖾 𝖡𝗎𝖿𝖿𝖾𝗍 𝗌𝖺𝗀𝖾𝗇 (data from Annual Report 2021 [1]):

Criteria to be read in detail:

https://app.getquin.com/activity/XcuRrJwmyP

Income Statement:

-Net Margin: 2021: 2.6% 2022: 1.96%; 2023: 6.93%; 2024: 11.0% [2] -->negative! (Buffet's target: >20%) -But not unusual for asset-intensive companies.

-Gross margin: 2021: 44.4% [3] --> positive! (Buffet's target: min. 40%)

-Sales/administrative. and other overhead: 20.8% of sales -->positive! (Buffet's target: max. 30-40%)

-Interest expense: 85.8% of operating profit -->negative! (Buffet's target: <15%) -->but declining sharply since 2019 (positive signal).

Also: in interest expense above $151m, $141m is "long term debt". I see this more positively than short-term debt, since long-term debt does not lead to short-term upheavals due to variable rising interest rates or similar.

Balance Sheet:

-Treasury Shares: Yes! [6] -->positive!

-Debt < 4xEBIT: 2,22 Mrd. USD; EBIT = 0,17 Mrd. USD -->negative!

-Current liabilities to current assets: 1.19 (current liabilities exceed current assets by 19%) -->negative! Development but positive.

-EK ratio: 32.5% (2021), 20.8% (2020)

-Goodwill: 36.17% of total assets and 111% of equity -->negative!

-->Maxar has very high goodwill. As soon as investments get into difficulties, unscheduled write-downs could be made. - negative due to risk potential!

Goodwill contribution to further understanding: https://app.getquin.com/activity/ymidZwhlTk

Key Note: 67.94% of debt is long term debt and therefore designed for the long term. This gives planning security, even if the debt is quite high.

Cash flow statement:

Investments: exceed 5x net profit (Buffet's target: <50%) -->negative!

Free cash flows:

2021: USD 60m

2020: 506 million USD (where 723 million USD from one-time effect - one-time. Sale - discontinued operations)

2019: USD 304 million (of which USD 280 million from one-time effect - sale of assets)

𝖪𝖾𝗒 𝖭𝗈𝗍𝖾:

Even if Maxar is a very capital-intensive company and one could therefore use key figures such as turnover frequency to assess productivity, it seems to me that it would be more appropriate here to take a closer look at the debt situation:

Total Liabilities 2021: 3.035 Mio USD (67% of total assets)

Total liabilities 2020: 3,547 million USD (79% of total assets)

Total Liabilities 2019: 4.395 Mio USD (85% of total assets)

-->Development positive!

Long Term Debt 2021: 2.062 Mio USD (67% of total liabilities)

Long Term Debt 2020: 2.414 Mio USD (68% of total liabilities)

Long-term debt 2019: USD 2,915 million (66% of total liabilities)

-->high share of long term debt positive (gives better planning security)

Ratio of current liabilities to current assets 2021: 1.19 (ideally < 1)

Ratio of current liabilities to current assets 2020: 1.41 (ideally < 1)

Ratio of current liabilities to current assets 2019: 0.78, with a large portion resulting from one-off asset sales - adjusted: 1.95 (ideally < 1)

-->Development positive! The lower the ratio, the better you can pay short-term debts with your short-term assets!

Total Assets 2021: 4.498 Mio USD

Total Assets 2020: 4.483 Mio USD

Total Assets 2019: 5.157 Mio USD

𝖴𝗇𝗍𝖾𝗋𝗇𝖾𝗁𝗆𝖾𝗇𝗌𝖾𝗂𝗇𝗈𝗋𝖽𝗇𝗎𝗇𝗀 𝗇𝖺𝖼𝗁 𝖯𝖾𝗍𝖾𝗋 𝖫𝗒𝗇𝖼𝗁 [𝟧]:

Cyclical

-->Depending on demand and influenced by general economic situation/investment needs.

𝖯𝖾𝖾𝗋 𝖦𝗋𝗈𝗎𝗉/𝖪𝗈𝗇𝗄𝗎𝗋𝗋𝖾𝗇𝗓:

Airbus (FR) -->Provides similar satellite service, among others.

-KGV 2022e: 18.1

-KGV 2023e: 13.9

Satellite Imagine Corporation (USA)

Planet (USA)

Cloudeo (DE)

SkyWatch (CA)

𝖥𝖺𝗓𝗂𝗍:

I find the topic of aerospace very exciting. Likewise, Maxar is an extremely exciting company with exciting future prospects, for which the company is investing heavily. However, the high investments, which are financed with a lot of debt, also bring me to the negative aspect of a possible investment. For my taste, there is still too much debt capital in the company. On the positive side, however, the interest burden is falling due to the steady repayment of current loans and the focus on long-term loans (see key notes). It seems to me that the company wants to steadily reduce the burden, which is a positive signal. The financial situation is therefore not optimal for me, but not too worrying either. Nevertheless, the goodwill is also too high for me, which adds to the risk. Due to all these aspects, Maxar belongs to a risk investment for me, which can definitely pay off. However, you definitely have to be willing to take certain risks. Therefore, I personally would not weight Maxar too high in the portfolio.

Relevant news of the last days and weeks based on the satellite images of Maxar:

As always, you can find my collected analyses here:

https://app.getquin.com/activity/YyIXcpDduz

No investment advice!

Sources:

[1] https://www.maxar.com/about

[2]

https://de.marketscreener.com/kurs/aktie/MAXAR-TECHNOLOGIES-INC-50060908/fundamentals/

[3]

https://s22.q4cdn.com/683266634/files/doc_financials/2021/ar/Maxar-2021-Annual-Report.pdf

[4]

https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datacurrent.html

[5]

https://diyinvestor.de/peter-lynch-6-kategorien-fuer-die-einordnung-von-unternehmen/

[6]

Sources images:

https://www.onda-dias.eu/cms/de/data/catalogue/maxar-constellation/

Maxar products (satellites):

https://s22.q4cdn.com/683266634/files/doc_financials/2021/ar/Maxar-2021-Annual-Report.pdf

Company homepage: