I announced it and here it is, my stock from Japan. Feel free to read the review in conjunction with my previous posts (https://app.getquin.com/activity/JdjbmMXyKg) to get the full picture.

Itochu Shoji

JP3143600009

Itochu Shoji is a traditional group headquartered in Osaka, with the Itochu Group comprising more than 700 companies in various industries. The Group is a global trading company. From food to textiles to mining machinery, the Japanese are active in a wide range of industries.

In addition, the company has various holdings in other companies. The trading conglomerate can be compared to Warren Buffett's Berkshire Hathaway. Buffett's holding is even invested in Itochu itself. The share is one of the outperformers on the Japanese stock market.

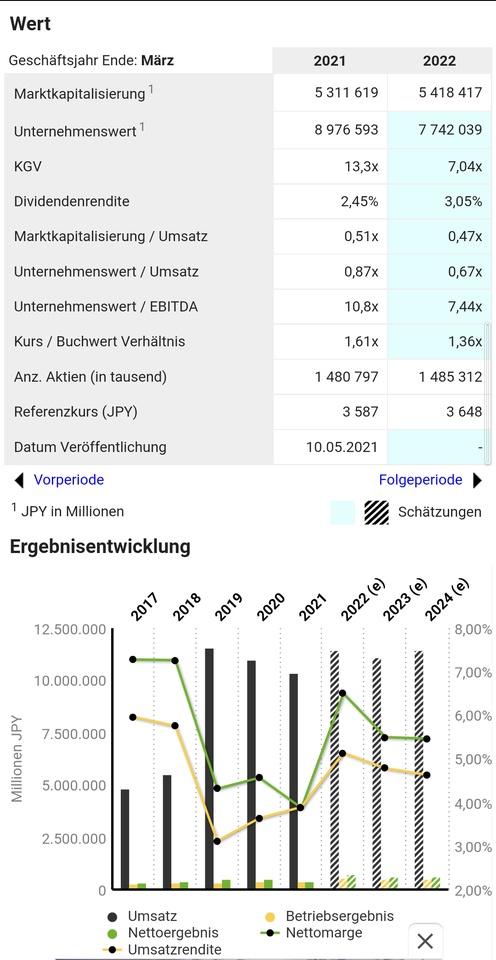

Key figures:

P/E RATIO 2021: 13.3

P/E ratio 2022e: 7.04

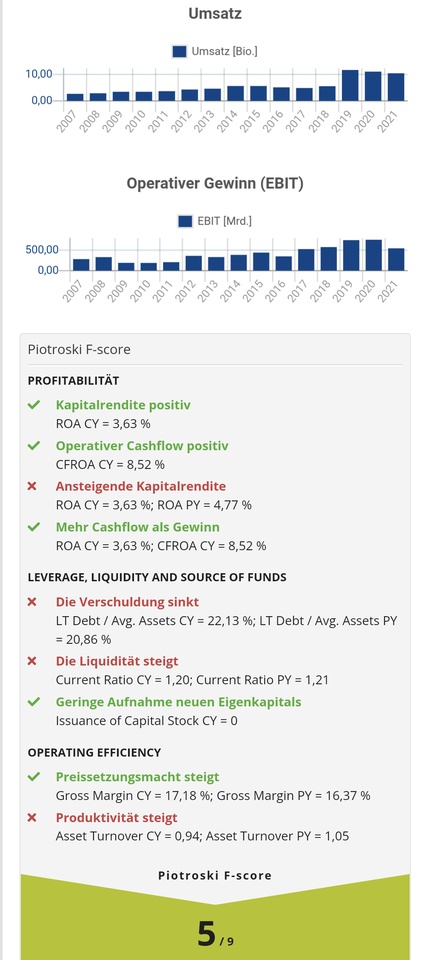

Sales growth 10Y p.a.: 11,64%

Profit growth 10Y p.a.: 12,02%

Net margin: 5.07

Equity ratio: 29.12

Return on equity: 14.63

Itochu follows the philosophy of sampo yoshi, which means "good for the seller, good for the buyer, and good for society." This is a variation of the Hanseatic merchant ethic, which gives the company a good ESG score.

Moat:

Itochu is a classic value stock. The market in which it operates is mature, but in return the company has good standing and strong pricing power. Peter Lynch would probably rank the stock between a low-growth and steady stock. In addition, Itochu is highly diversified, which makes it very resilient to crises. Despite low margins, Itochu has been profitable and crisis-proof in all past crises. Given its long history (founded in 1858), this does mean something.

Conclusion:

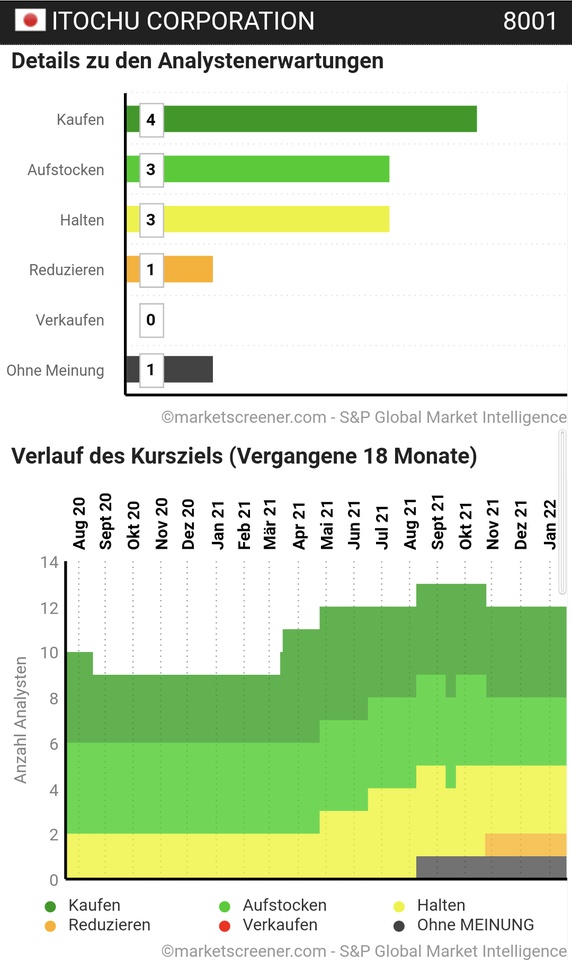

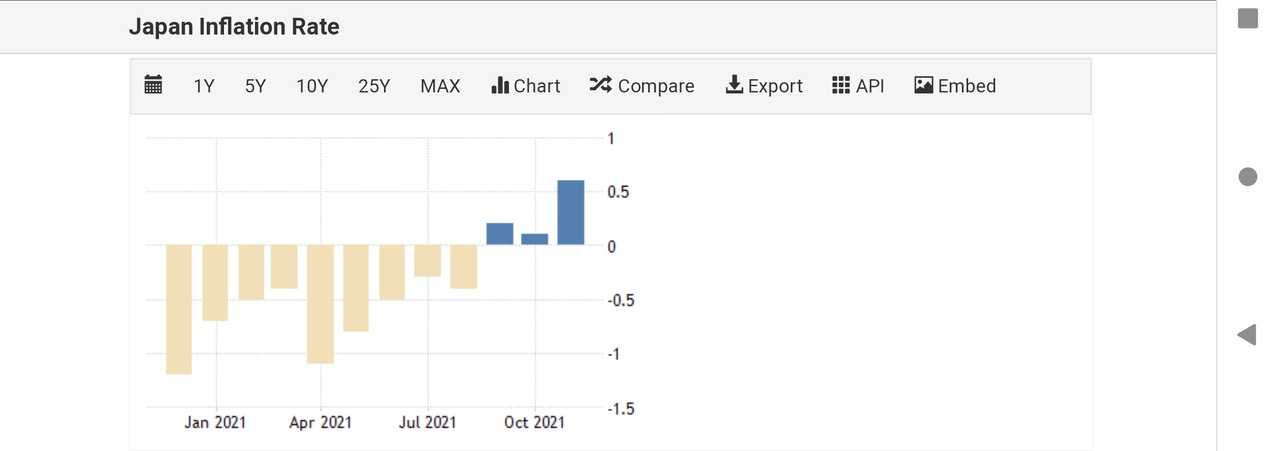

Itochu is still quite cheaply valued. Itochu is certainly a good choice for a broader positioning in the Japanese market. Itochu has outperformed the Nikkei and covers a variety of areas. In addition, I see the Japanese market as interesting again in the long term. While growth stocks are currently being punished, Itochu has even gained in price.

Disclaimer: I am invested myself. No investment advice!

So, and with that I'm done for now with my Japanese series 😅 hope you enjoyed it.