The 1x1 of the hydrogen industry on the stock exchange.

Hello dear community,

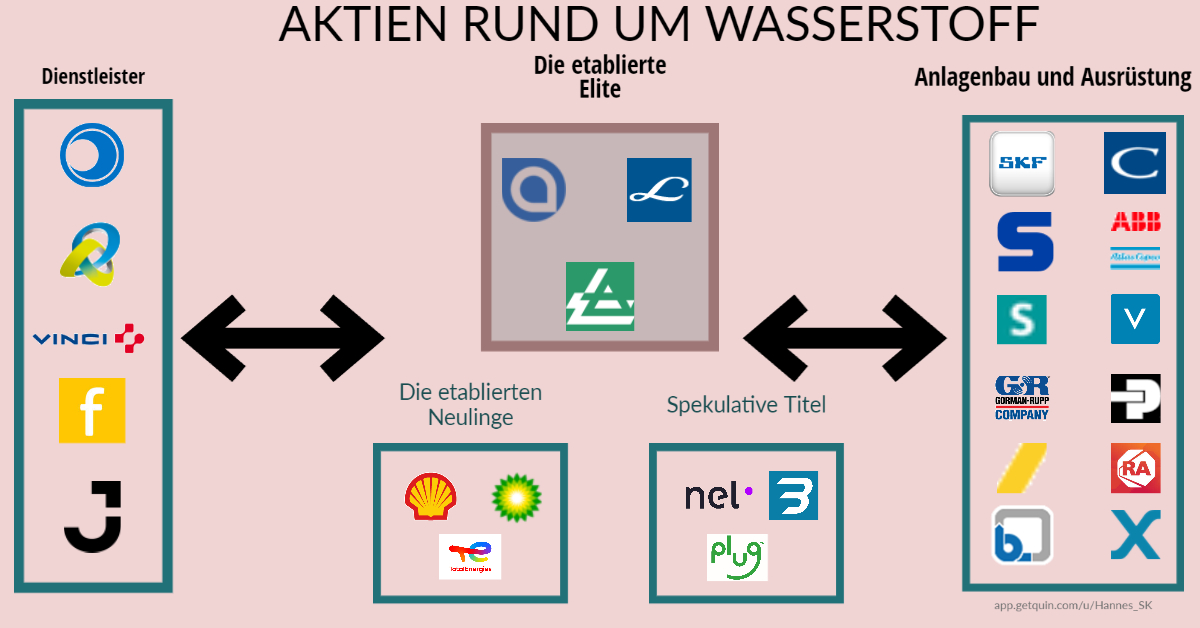

Considering the fact that there are a lot of newcomers on the platform, I have created a, for social media typical, dumb graphic to give you an overview of stocks, which may not be on everyone's radar. After all, it goes without saying that you can't know your way around every industry. But we have come together here in the community for a solid exchange.

But since we're here on Getquin and not on Instagram, here's some input for the inquisitive.

What do the companies do anyway?

Service provider:

On the service provider side, you'll find rather atypical companies for the sector.

Here I have Friedrich Vorwerk $VH2 , Vinci $DG , Ferrovial $FER , Bilfinger $GBF and Jacobs Solutions $J listed.

Their main focus is background work on the objects themselves. They support the companies in planning, realization, construction and maintenance. They work decentralized in regional working groups to cover the breadth of the industry. They provide almost any service for an industrial company.

The established elite

If you want to invest in the hydrogen sector, all roads lead to the giants Linde $LIN , Air Products $APD and Air Liquide $AI . Their market power in the field of industrial gases and in today's market environment of commercial hydrogen production seems indisputable. Their know-how in the gaseous materials production segment has been proven over decades and their processes are almost perfectly optimized. Each company also has its own engineering divisions that position them perfectly for the future in electrolyzer development.

The established newcomers

With plenty of money in their satchels, the oil companies Shell $SHEL , Total $TTE and BP $BP. are entering the segment. Oil is finite, but the business should not be. These companies are also experienced in dealing with hydrogen. In the refinery process, hydrogen is an indispensable component. In order to become less dependent on the big 3, they are also entering new market fields. Will they be able to prove themselves there?

Speculative titles

Nothing but expenses. Years of hype and yet a harsh reality hit the small fish in the shark tank around the segment. Nel $NEL , Plug Power $PLUG and Ballard $BLDP are long-suffering. They have never managed to deliver even remotely profitable figures. On the contrary, quarter after quarter, things seem to be getting worse. Only sales are increasing. Can this ever work?

Plant engineering and equipment

Of course, in a globalized world, one no longer takes care of the entire value chain from A-Z. Each company is specialized in its own segment. Permanent beneficiaries of the industry are therefore the equipment suppliers, because they have to technically develop the cornerstones for every innovation in order to survive in the vastness of globalization.

The equipment suppliers

They manufacture the physical parts for the process plants.

Examples of this are Voestalpine $VOE , Atlas Copco $ATCO B or Sulzer $SUNE .

The equipment suppliers

In addition, the transport of substances is also part of the process. Mass transfer in industry, but also at home, for example in water pipes, is ensured by pumps (for liquids) or by compressors (for gases). Established brands here are KSB $KSB , Xylem $XYL , Gorrman-Rupp $GRC but also as total supplier Chart Industries $GTLS or SKF $SKF B or for specialized tools Stanley B&D $SWK .

Furthermore, process control is indispensable. Here, brands such as Siemens $SIE , ABB $ABBN or also Rockwell $ROK and Parker $PH have established themselves. They not only supply the electronic equipment for the process plants. They also offer their software services as safety services, so that safety in process control can always be guaranteed.

I hope to have given you a little insight into the industry and would be very happy to receive constructive feedback.