💧 Balance sheet analysis Big Bath Accounting 💧

As already announced, I would like to introduce you to other balance sheet topics. The following is therefore my second presentation from the series "Excursus Balance Sheet Analysis":

BIG BATH ACCOUNTING

No, this is not about relaxing baths with calculators or about the world's biggest bathtub. Big Bath Accouting is a common topic for "balance sheet embellishment" or even "legal" (gray area) balance sheet manipulation.

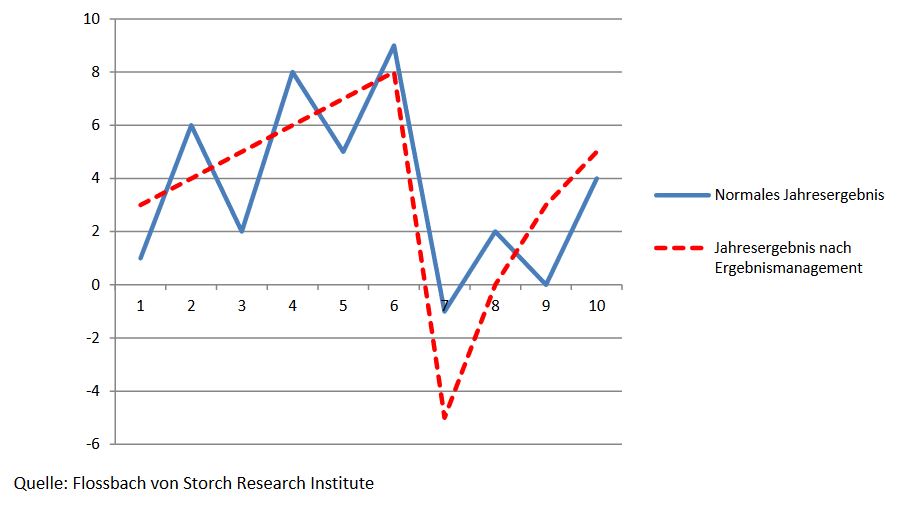

"A big bath is an accounting term that is defined by a company's management team knowingly manipulating its income statement to make poor results look even worse in order to make future results appear better. It is often implemented in a relatively bad year so that a company can enhance the next year's earnings in an artificial manner." [1]

In German, Big Bath Accounting is used in the context of earnings management [2]. This is also where Corona comes into play. If a bad result is knowingly/unavoidably generated in a fiscal year, the management deliberately tries to shift costs to the corresponding year in order to be in a better position in future years.

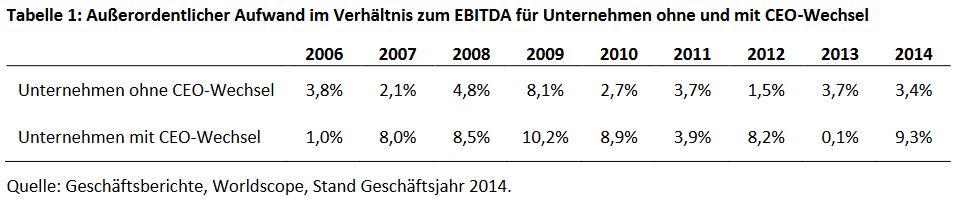

Also in the context of changes in management, the new management often deliberately tries to make the company look worse in the year of the takeover so that it can shine with splendid results in the coming years. In external communication, this is often referred to as "cleaning up". In other words, the mismanagement of the previous management is eliminated in order to start anew. The motto here is:

"If you want to aim high, you only have to start low enough".

Examples of big bath accounting in the balance sheet [2]:

-Consciously higher provisions (adjustment basis of estimation for their amount).

-Targeted planning of restructuring, which also results in provisions (provision = expense in the income statement and thus reduces profits).

-Value adjustments for investments, goodwill, etc. -->see also Goodwill presentation: https://app.getquin.com/activity/ymidZwhlTk

-General use of extraordinary depreciation of assets no longer required.

-Consciously bring forward costs/investments.

-Postponement of revenues into the future (e.g. delayed invoicing-->conditionally possible depending on the accounting standard-->e.g. IFRS 15 topic).

Such an accounting procedure is also enormously difficult to prove for auditors, since the valuation of provisions and allowances is related to judgment and estimation processes. Big bath accounting is therefore not really an illegal manipulation. One moves partly in gray areas, but also legitimate areas, within the accounting standards. I am also speaking here from my own experience in auditing.

In summary, examples of when Big Bath Accounting occurs in particular [2]:

-Management Change

-Economic crisis periods (Corona)

-Mergers/company takeovers

Well-known example from the past [3]:

When Deutsche Bank's new CEO John Cryan (replaced again in 2018) recently commented on the preliminary consolidated results for fiscal 2015, he let capital providers know that the Group would continue to work hard to "clean up legacy issues." The clean-up of these legacy issues would require the massive recognition of provisions, mainly for litigation, restructuring and severance payments, totaling €6.2 billion. In addition, goodwill (again reference to my presentation on goodwill: https://app.getquin.com/activity/ymidZwhlTk) 5.8 billion from previous acquisitions would have to be written off.

There are studies showing that this phenomenon occurs particularly in the 4th quarter, because the capital market then no longer punishes this news so clearly with a reaction compared with other quarters. [2]

What does this mean for us as shareholders? Quite simply, don't just look at the bottom line and don't panic if the market classifies the result as poor/below expectations. Maybe there are reasons for the poorer result? Was there a change at the management level? Corona or similar? Get a picture of the overall situation and try to classify the earnings report accordingly.

I hope you enjoyed the presentation. I try not to inflate the topics too much and to make them clear. Please feel free to give me feedback or if you want me to go into more detail. Maybe you also have good examples on the topic from the past that you would like to share. That would also interest me very much.

Sources (partly drawing on my own experience):

[1] https://www.investopedia.com/terms/b/bigbath.asp

[3] + attached graphics: https://www.flossbachvonstorch-researchinstitute.com/fileadmin/user_upload/RI/Studien/files/studie-160217-der-grosse-kehraus.pdf