...at the request of @DonkeyInvestor a few words about my money management. Perhaps it will help you to limit one or two losses in 2023! It all starts again tomorrow - may the bull market be with you!

1. introduction to money management / risk management

- What are risks?

- Why money management?

- The 3 levers for risk management

2. money management in theory

3. money management in practice

1. introduction to money management and risk management

I'll start with a quote (allegedly from William O'Neil - founder of Investment Business Daily): "The whole secret of stock market success is to lose as little as possible when you're wrong."

Warren Buffett also once said:

Rule number 1: Don't lose money.

Rule number 2: Never forget rule number 1.

...but now I'll leave it at that with the old, hackneyed quotes, even if these two quotes actually describe the essentials of risk and money management!

What are risks?

In principle, risks can be divided into 2 areas:

1. risks that we cannot influence, such as the general market environment, political events such as the Ukraine war, or the interest rate policy of national banks such as the FED or ECB.

2. risks that we can influence, such as "no" diversification, "no" knowledge or simply "no" risk management.

Money management is also an area that we can influence. Alongside diversification, it is the most important risk management for me.

Why should we practice money management?

It is difficult to recover losses!

Using the example of Tesla with a performance of -70%, we can see how difficult it is to recover this loss. Tesla would need an incredible performance of +233% to get back to the old price level. How realistic is such a recovery of +233%? Better not let it get that far. Buy&Hold is good, but not until the bitter low...

It is important to note the differences between short/medium-term traders and long-term investors. For traders, the focus is on money management and risk management in the form of stop prices derived from opportunities and risks. For long-term investors, diversification is the means of choice; money management is more or less already done when the savings plans or the investment amount are determined.

However, I also recommend that the buy-and-hold investors among you think about money management. In reality, it is not so easy to distinguish between the two, the transitions are blurred. What short-term traders need to keep an eye on at all times, long-term investors should also do from time to time. Check your position sizes and think about exit prices, i.e. adjust any stops.

The 3 levers for your risk management are as follows:

1. diversification

2. correct use of capital (=money management)

3. loss limitation by means of stop prices*

*I know that many here are not fans of stop prices, but it also makes sense for buy & hold investors. An example from my practice are "stocks for eternity" such as Apple and Amazon. By consistently tightening the stops, I was able to secure the profits; in addition to a few other stocks, these shares were stopped out / sold near the high in mid-August. I was spared the massive slumps in September and October. As I still believe in these companies, I have now started to collect these shares again at much lower prices.

2. money management

What is money management?

Money management determines the capital investment and the position size based on the maximum loss to be accepted!

Since capital loss can only be offset by a correspondingly higher profit, good money management is essential!

Here are a few values to get a feeling for losses:

A loss of -20% needs +25% recovery to get back to the old price level.

A loss of -40% requires +67% recovery to get back to the old price level.

A loss of -50% requires +100% recovery to get back to the old price level.

(see also the Tesla -70% example requires +233% performance).

If one risks only 1% of the available capital per position, then even after 10 wrongly assessed trades approx. 90% of the capital would still be available. If you were to risk 4% of the available capital per position, you would have already lost 40% of your capital after 10 incorrectly estimated trades, i.e. you would need +67% performance on the remaining capital in order to only regain the initial capital.

An established guideline for money management is - never risk more than 0.5 to 2 percent of your capital on a single position.

Money management is primarily concerned with how much money you should invest and risk per position! It is about determining the optimal position size.

To make what is described here a little more tangible, here is an example of how to calculate a position size.

Your free capital for investments: €10,000

Your maximum loss limit per position: 1% (= €100)

You want to build up a position with a current purchase price of €20 per share

Your determined stop price is €18 (= max. loss of €2 per share)

The optimum position size is now calculated by dividing the maximum loss by the difference between the buy price and the stop price.

Optimal position size = 100€ / (20€ - 18€) = 50 shares

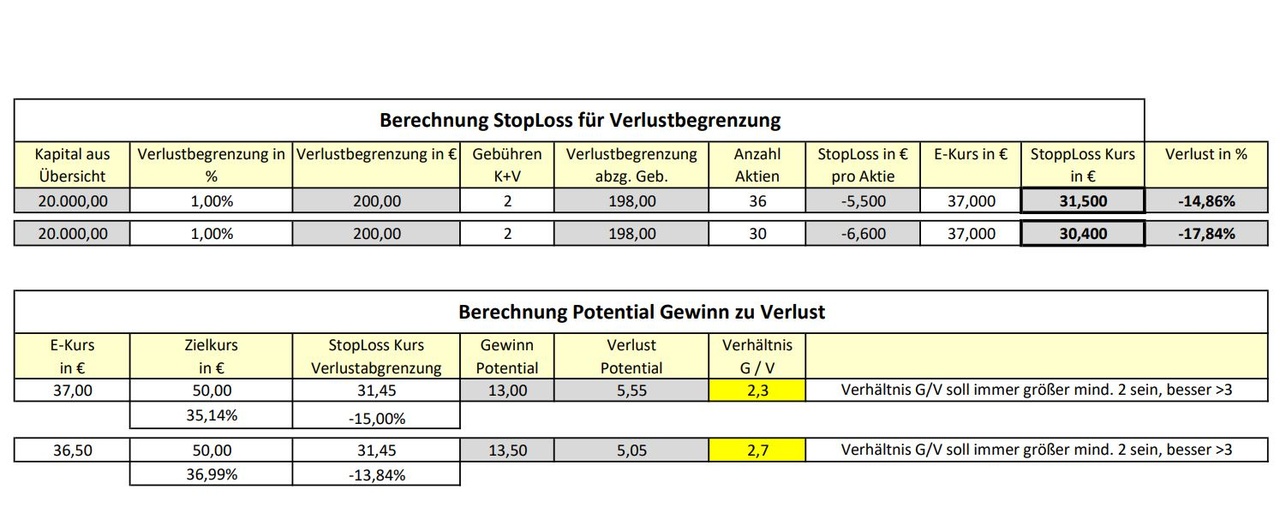

See also Fig. 2 - My template for calculating the lot size or SL

For you, this means that with a position size of 50 shares and a stop price of €18, you remain within the maximum 1% loss according to your money management. Now you just need to remain disciplined and consistently not deviate from the strategy.

Sounds simple, but it's not - that's where it usually fails in practice 😉

Conclusion:

With consistent risk management using diversification and defined exit points, combined with money management, you can consciously limit your losses. In the stock market you can't really influence most factors, the only thing you can really control is your entry and exit price combined with the optimal position size.

PS: As this is my first knowledge post on GQ, please be gracious! Remember, I am not a FinFluencer, constructive criticism is welcome! This is not investment advice, I'm just sharing my personal approach!

For those interested, there is a practical example in the 3rd section.

3. money management in practice

I will not go into the selection of the company any further here, as there are already some great articles on key figures, fundamental analyses and TA technical analyses. For short/medium-term trades, the CRV (risk/reward ratio) is always an important decision criterion for me.

With regard to free capital, the following goal has crystallized for me in the course of the first months of 2022: Due to the ongoing bear market, no more than €20,000 should be invested in my portfolio in 2022. Part of the monthly available capital will be gradually saved as a "free cash reserve for 2023". Quasi self-protection against FOMO (buy the dip from the dip from the dip...)

Company: OMV

As an Austrian and especially in the wake of the current discussions about energy prices and excess profits, I have had my eye on OMV all year. At <€37, the price was in the range that was interesting for me for a trade. I defined the price level of 50+ as my target price / exit point, as OMV has rarely stayed above this price level for longer in recent years (see also Figure3 - 5 year chart OMV).

Money Management - Calculation of the optimal position size:

Free capital for my investments in 2022: 20.000€

1% max. loss per position: 200€

Buy price / entry price <37€ / Stop loss -15% (31,45€) =

5.55€ max. loss per share

The optimum position size is as follows: 200€ / 5.55€ = 36 shares max. position size

(Please note: if you have relevant additional buy/sell costs, these costs must also be taken into account)

To minimize the risk even further, I often enter with 2 or more tranches. If the price runs away from me, then the trade runs with a smaller volume.

Buy1 15 shares on 23.09. a' 36,15€

Buy2 15 shares on 12.10. a' 36,86€

Sell 30 shares on 9.11. a' 48,57€

SL was set quite close at -3.5% when entering the area above €50.

If the price had fallen below €31.45, I would have sold the position with the defined loss. According to my money management, the maximum loss would have been limited to less than 1% / €200. In this case, the somewhat smaller position size meant that the maximum risk of loss was not exhausted (30*5.55€=166€)

Conclusion: Realized return of 33% with limited loss potential of maximum -15%. Since not every position can be closed with a profit, the whole thing only works with the appropriate discipline and consistency.

Source references: Well, I'm having a bit of a hard time with that, I've read up on the subject from various sources over the last few years, mostly from the internet, blogs or YouTube. You can find many knowledge articles of this kind in the knowledge databases of your brokers. Just search for money management. Here are some links where I found something on this topic today.

Risk- und Money-Management Analyse : Wiener Börse (wienerborse.at)

Risiko- und Money-Management | comdirect Magazin

Gutes Money Management: 4-Schritte-Anleitung - Sofort-Start? (aktien-lernen.de)

Moneymanagement - die Grundlagen! (Teil1) | stock3