---𝐀𝐤𝐭𝐢𝐞𝐧𝐯𝐨𝐫𝐬𝐭𝐞𝐥𝐥𝐮𝐧𝐠---

Mitek Systems Inc.

US6067102003

The stock between cyber security and fintech! Value in the small cap sector?

Mitek Systems Inc. is a software as a service (SaaS) provider offering mobile capture and identity verification software solutions for businesses. The company is a computer vision, artificial intelligence and machine learning software development company. It serves more than 7,500 financial services companies and leading market and financial technology brands around the world. Mitek's Mobile Deposit solution is used by consumers for mobile check deposit. The company's Mobile Verify solution verifies a user's identity online and enables businesses to build more secure digital communities, while CheckReader enables financial institutions to automatically extract data from a check image received through any deposit channel - branch, ATM, RDC and mobile. [1] MarketsAndMarkets currently estimates that the global identity verification market is expected to double by 2025 (from over $7.6 billion in 2020 to $15.8 billion in 2025).

"About us" as per homepage:

"Mitek brings the future to business with patented solutions and intuitive technologies that bridge the physical and digital worlds. Our leadership in identity verification, including facial biometrics, image capture technology and ID card verification enables customers to confidently onboard users, verify identities within seconds and strengthen security against cybercrimes. Mitek products power and protect millions of identity evaluations as well as mobile deposits every day, around the world." [2]

Key figures:

-EBIT growth 10 years: 46.54% p.a. [3]

-Sales growth 10 years: 27.85% p.a. [3]

-KGV 2022: 41.8 [4]

-KGV 2023e: 31.5 [4]

-PEG 2022 (P/E/growth rate): 41.8/30% = 1.39 (rule of thumb: < 1 = very favorable)

-PEG 2023: 31,5/30% = 1,05

-->conservative estimate of 30% growth!

-Goodwill: 32.8% of equity; 15% of total assets; 7.9x earnings 2021 [5]

Goodwill Contribution: https://app.getquin.com/activity/ymidZwhlTk

Rubric - What would Buffet say (data from Annual Report 2021 [5]):

Criteria to be read in detail: https://app.getquin.com/activity/XcuRrJwmyP

Income Statement:

-Research and development: 26.8% of gross profit (2021)-->positive! (Buffet's target: max 30-40% of gross profit)

-Sales/Administrative. and other overhead: 18.9% of sales / 21.5% of gross profit (2021)-->positive!

-Gross margin: 87.86% -->positive! (Buffet's target: at least 40%)

-Net margin 2021: 6.7% -->ok! (Buffet's target: >20%)

-Net margin 2022e: 14.4%

-Interest expense: 4.9% of operating profit-->positive (Buffet's target: <15%)

Vermerk: Momentan wird noch viel in Marketingaufwand gesteckt: 26,9% des Umsatzes-->I would expect this to reduce somewhat in the medium term.

Balance Sheet:

-Treasury Shares: 7,773 shares available -->minimal! -->neutral

-Debt < 4xEBIT: (-) -->negative -->where 53% of debt is convertible bonds.

Convertible bonds are bonds with an option. The option gives the purchaser the right to exchange his bond for shares in the issuing company at a fixed price. If the investor does not exercise the option, the bond is repaid at par at the end of the term. [6] If exercised, there is also a risk that this will lead to a dilution in the share price (more shares outstanding lead to dilution).

Peer Group/Competition:

Immersion

-KGV: 14.09

-PEG: 14.09 / 10% = 1.4 -->Growth very difficult to assess, as very inconstant!

Veriff (Private)

ID Now (Private)

Jumio (Private)

ABBYY (Private)

Conclusion:

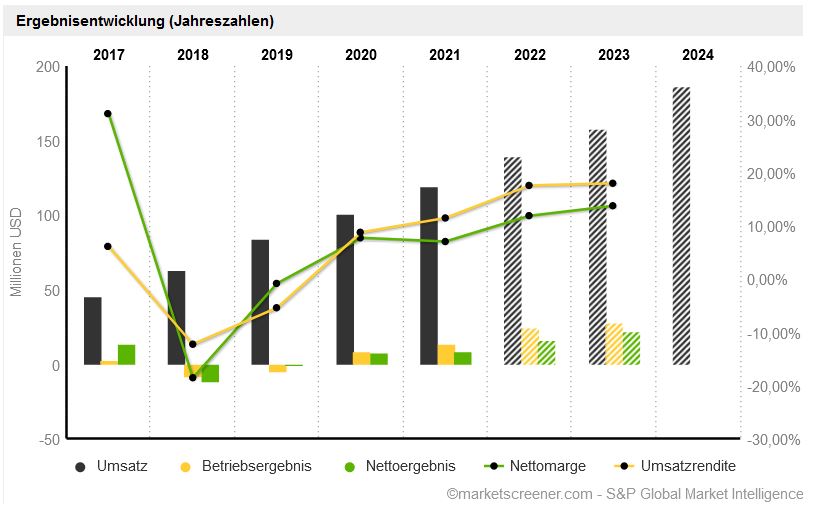

I find Mitek Systems very interesting and have therefore had it on my WL for some time. Even if the key figures suggest it, Mitek is far from being a value company. Revenue in 2021 was just $119 million with a profit of $7.98 million. Over the past few years, however, sales have increased steadily, although 2019 and 2018 still ended with a loss (2017, 2016 and 2015 with a profit). If the forecasts are correct, we see very good growth with consistent profit in the future. Therefore, a P/E ratio in the 30/40 range is anything but expensive. In fact, for a growth company, this seems relatively cheap. Similar to Jack Henry & Accociates.

(Imagination JH: https://app.getquin.com/activity/ClBzvdYgVZ) they could benefit from rising interest rates and loose money at banks. So you don't always have to invest directly with banks to benefit from certain developments. Nevertheless, one should keep an eye on convertible bonds, which could lead to a slight price dilution. I am curious to see how Mitek will develop. Perhaps I will also become weak here at some point. A certain risk in the small-cap area (market cap 2021 approx. 654 million USD) is of course still present.

No investment advice!

Sources:

[1] https://de.extraetf.com/stock-profile/US6067102003

[2] https://www.miteksystems.com/about

[3] https://aktie.traderfox.com/visualizations/US6067102003/DI/mitek-systems

[4] https://de.marketscreener.com/kurs/aktie/MITEK-SYSTEMS-INC-40449463/fundamentals/

[5] https://investors.miteksystems.com/static-files/bf0fc411-dce0-4fb6-a349-03c75c47d20c

[6] https://www.finanztip.de/anleihen/wandelanleihen/

Sources Graphs:

Sales development: https://de.marketscreener.com/kurs/aktie/MITEK-SYSTEMS-INC-40449463/fundamentals/

Company homepage: