I became aware of the company here in the forum $MTM (-1,25%) here in the forum, as some people have made positive comments about the company and have invested in it. The story initially sounded like an exciting investment opportunity. However, after doing some research, a questionable picture emerged.

The story that $MTM (-1,25%) spread:

Chemist Doctor James Tour and his research team at Rice University have developed a process called Flash Joule Heating. Using short pulses of electricity, the pulverized material to be recycled is heated to temperatures of over 3000 degrees Celsius. Materials such as:

- Rare earths (e.g. neodymium) with recovery rates of 80-90%

- Metals (e.g. cobalt) with recovery rates of over 90%

- Precious and industrial metals (e.g. gold or palladium) with recovery rates of 60-85%

with relatively little effort. The promising aspects of this approach are the energy efficiency, the speed of the process and the small space requirement.

The results achieved in the laboratory $MTM (-1,25%) now wants to commercialize these laboratory results and has secured the licenses for the Flash Joule Heating technology.

A first system is currently being developed in Texas and, following successful implementation, further systems are to follow at other locations in the USA.

The company is also carrying out exploration in Australia.

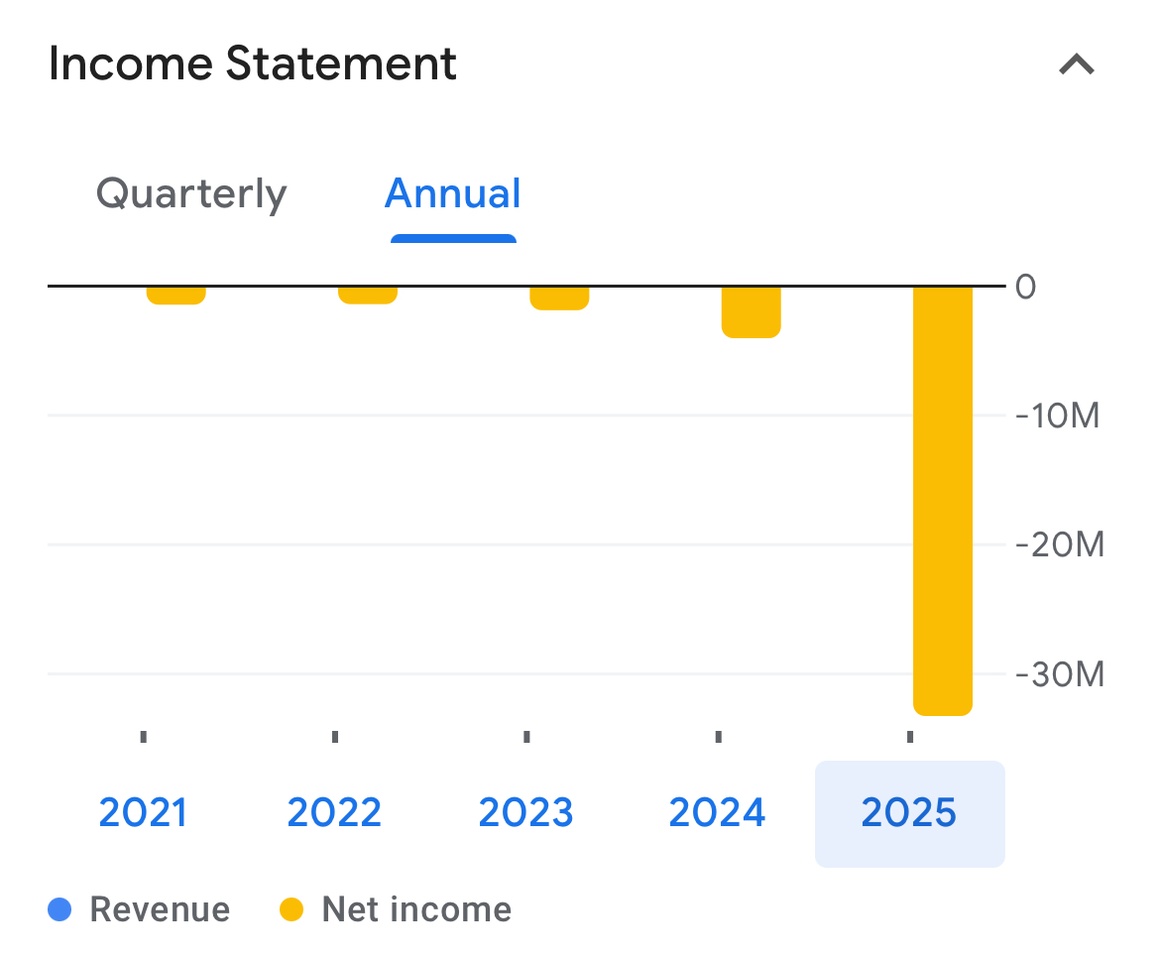

So far so good. Now let's take a look at the figures:

The currency is the Australian dollar (AUD), which is currently quoted at EUR 0.57.

We see a sharp rise in expenditure for the last financial year.

This expenditure of AUD 33 million was probably spent on the development of the plant in Texas and on research and development of the Flash Joule Heating technology, right?

The Annual Report gives us some information:

AUD 17 million went into the pocket of CEO Michael Walshe and a further AUD 6 million into that of Steve Ragiel (President of subsidiary Flash Metals). The payment was made in the form of shares and both sold a large part directly. It is also interesting that the legitimization for the bonuses was the achievement of milestones such as 1-year-employed or share-price-trading-above-price-x. That says a lot about the ambitions of the management...

Also, just under half of the AUD 2 million in annual salaries goes to Michael Walshe and Steve Ragiel.

Expenditure on research and development, on the other hand, only amounts to AUD 800,000. That is less than the combined expenditure on travel and marketing.

Expenditure on property, plant and equipment was even less than AUD 400,000. Nevertheless, according to the company, intangible assets amounting to AUD 7 million were created. How reassuring ...

The report is consolidated. This means that it includes all activities of the subsidiaries.

Development or investment expenditure cannot therefore be "outsourced" or booked separately - they are already included in the overall result.

To summarize:

- There is as yet no evidence that Flash Joule Heating can be profitably implemented on an industrial scale

- The management remunerates itself extremely generously although hardly anything has been achieved so far

- Expenditure on research and development and on property, plant and equipment is virtually non-existent

- The technology was developed outside the company and merely licensed

This contrasts with a valuation of AUD 480 million (= EUR 270 million)

Everyone has to decide for themselves whether this sounds like a fair valuation...

Personally, I wouldn't trust this company and its management in particular with a single cent.