Have a nice 3rd Advent:

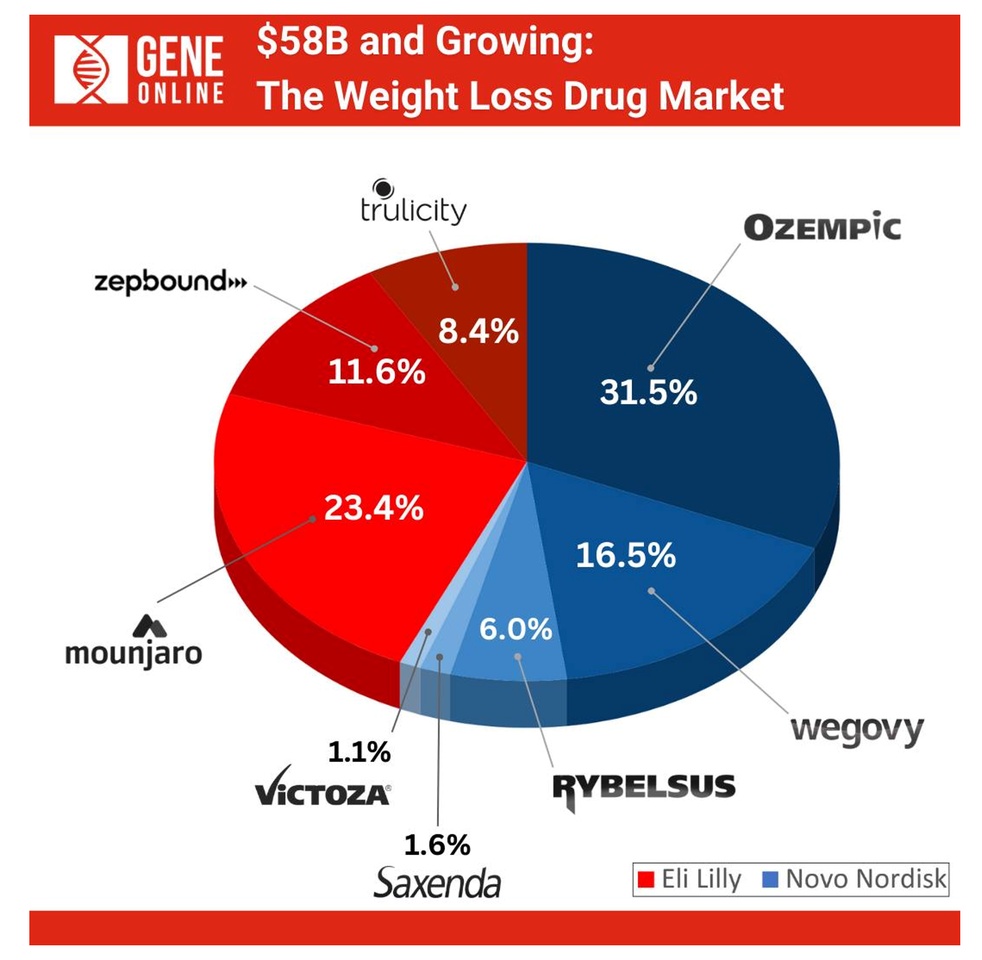

$NOVO B (+0,15%) is currently at -70%, and many are wondering whether Novo is now a buy.

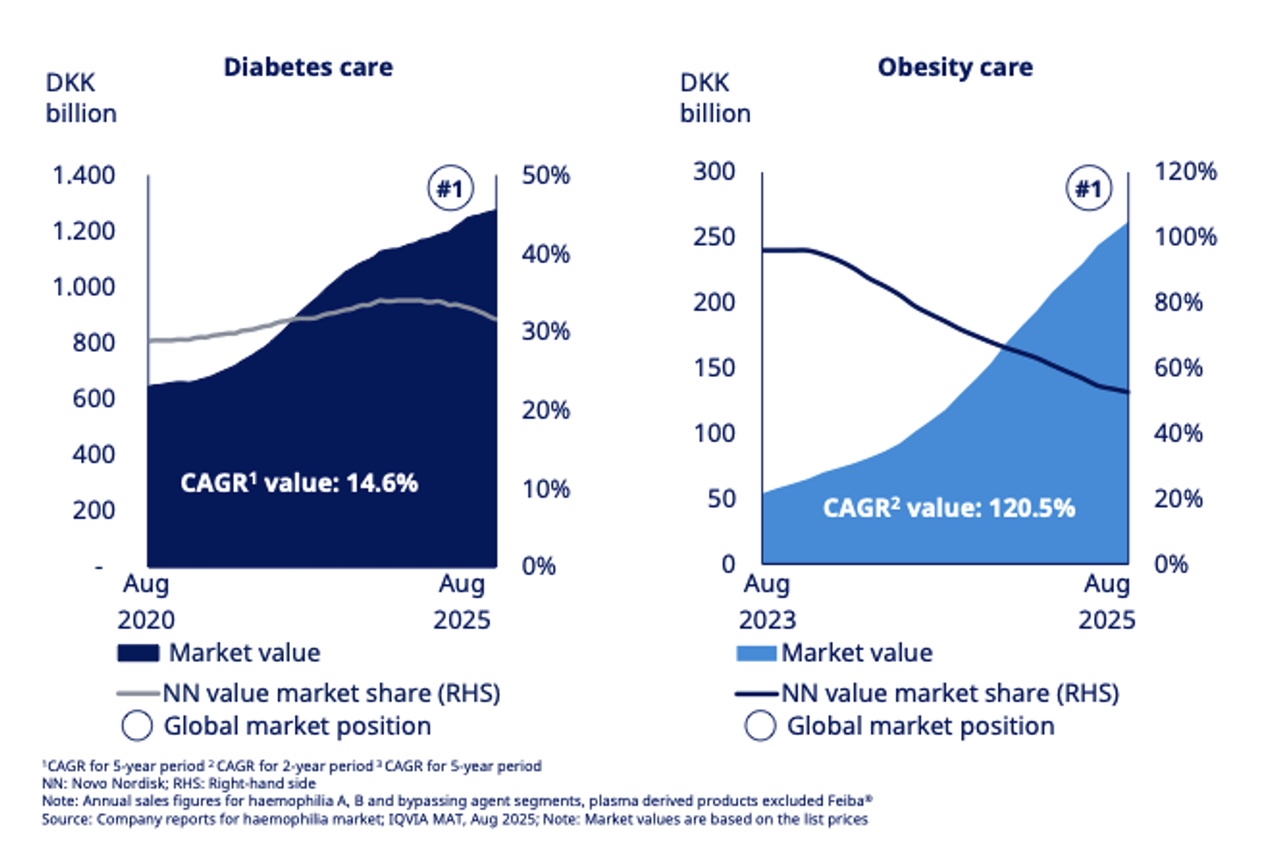

My opinion: If margins continue to fall and market shares are not secured by new products, valuations will rise and EBIT... will fall drastically.

This means that we need new products due to the expiry of patents in Canada in 2026 and GLP-1 in 2030, otherwise margins and sales will be reduced.

You can find out more about this in my new video from Novo, and where my opportunities and risks lie:

https://www.youtube.com/watch?v=cbwE7mDqP2k

Would love some feedback! <3