Ladies and gentlemen, after pointing out the risks of value stocks in my last post.

I would now like to present you with a value stock in which I also see opportunities.

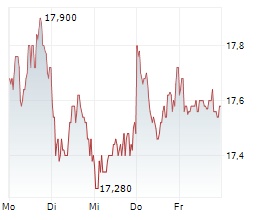

(This is not an investment recommendation, I am invested myself).

?? He was the first to expose Wirecard - now he reveals his top stocks! The GFT Technologies share has had a turbulent few months. Following a profit warning in July, the share price slumped significantly and caused uncertainty on the market. However, analysts now see signs of a bottoming out. In his new video, Tobias Bosler, editor-in-chief of Bosler Börse, shows why this bottom could now become the launch pad for the next rally. The Stuttgart-based software and consulting company operates globally, with strong footholds in Brazil, Germany, Spain and the UK. GFT advises banks, insurance companies and industrial groups on the modernization of their IT systems and drives the digitalization of business processes. Despite the decline in earnings in the first half of the year, the picture is more stable at second glance, as a one-off special effect from 2024 had distorted the basis for comparison. Conclusion: After the "bad bath" effect of the profit warning, GFT could be on the verge of a new start. Those who are betting on solid technology and digitalization trends will find a potential turnaround opportunity here - with an additional boost from the buybacks. Bosler usually invests himself. With a dual strategy & "value with turbo", he demonstrably achieves the following top profits: - +2,300?% with a Rheinmetall warrant - Once +1,071?% and once +737?% with Tesla puts - +36?% with PORR shares - +27?% with Nvidia shares - +210?% with a Raiffeisen turbo - and many more!