From Legacy CRMs to AI Highs: Benioff’s Bold Swing

Holding Salesforce in the portfolio hasn’t been a pleasure over the recent months – but the tides might be turning now. I bought in earlier this year during the “sell-off-all SaaS-companies-because-of-AI contest” that shook up the stock price. Investors, frightened as usual, got rid of their shares, while I continued to add. To me, it was (and is) an obvious buy. Just look at the underlying fundamentals: an FCF margin around 33% that has almost doubled in the last 3 years, phenomenal cash flows, continuous margin expansion, and a strong acquisition. It felt like holding a leader that wasn’t credited for its position. Don’t get me wrong, there are some software companies in deep trouble right now. Adobe, for example, really seems to have a problem. Yes, revenues are sticky and it’s vaguely entrenched but photoshop is already replaced by AI and cheaper competitors.

Salesforce is a completely different story for me, because AI integration with Agentforce is taking place, AI revenues are surging, and the company is so deeply entrenched in customers’ systems that management can safely focus on profitability and margin expansion. The market seems to have come to its senses on this one, after last week’s Dreamforce wrapped up, with a monster of a guidance and an extremely optimistic Marc Benioff. My position flipped green for the first time since entry. Up about 12% in days, and honestly? It feels earned. The stock is still down more than 20% YTD, but there’s still more than 2 months to make it a green year for the company.

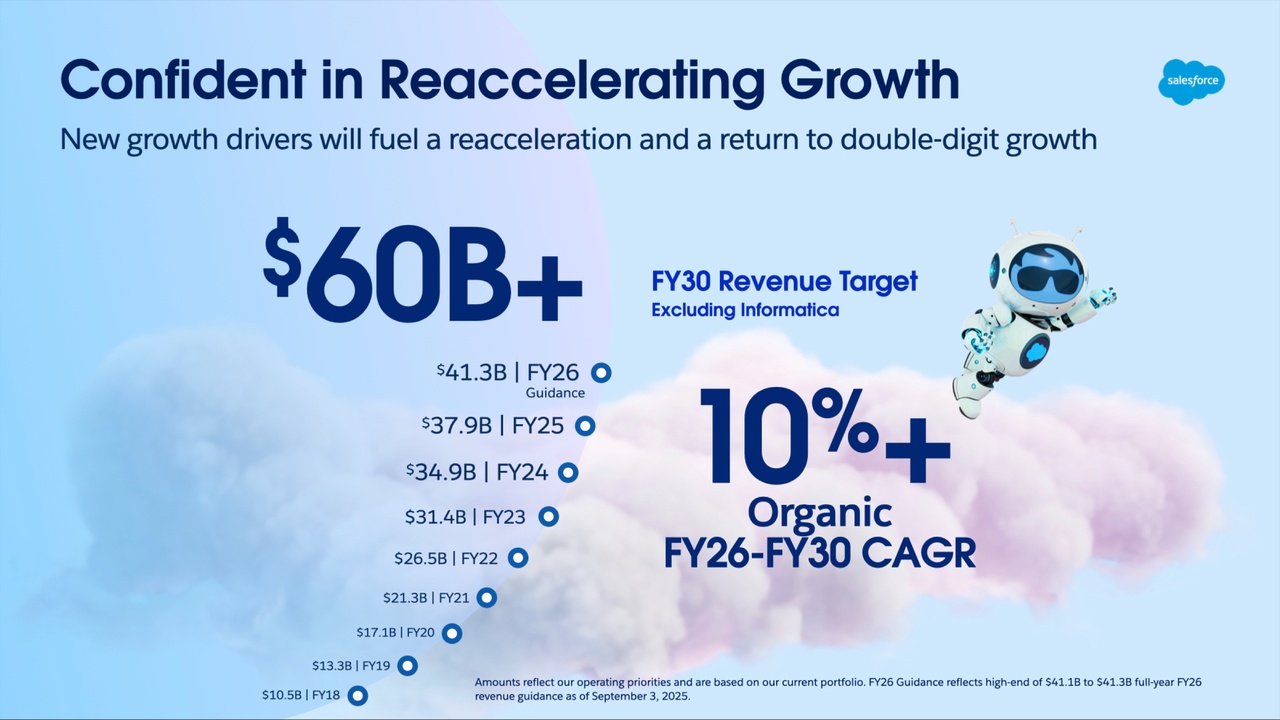

So what was it that finally convinced the market? Let’s break it down. Dreamforce 2025 was Benioff’s stage to remind everyone why Salesforce isn’t just another cloud play; it’s the CRM kingpin evolving into an AI powerhouse. He didn’t hold back on the keynotes — straight talk on Agentforce, their AI agent platform rolling out across services, and how it’s already driving upgrades. But the real fireworks? That $60 billion+ revenue target for 2030, excluding the Informatica revenues. Wall Street’s main concern was sub-10% growth forever, but Benioff basically said, “Watch us hit double-digits again, and compound from there.” Management confidently projecting a reacceleration of growth is always a bullish sign. Salesforce is about to use its scale and AI progress to create a behemoth in the future of CRM.

Benioff’s vibe was pure conviction: no more tiptoeing around the slowdown. And the numbers back it up: recurring revenue sticky as ever, FCF yield pushing 6%, valuation sitting at historic lows after the dip. If they execute on that 2030 runway, we are likely talking about 15-20% EPS growth annualized, even though EPS and cash flow projections were already in the double-digits before Dreamforce. That’s the kind of asymmetric setup I chase — beaten-down giant with a clear path to re-rate. Misunderstood companies with a great balance sheet (but not just a great balance sheet: looking at you, Adobe).

Of course, risks linger, but they are very limited at the current price levels. Execution is key; if Agentforce stumbles or macro tightens further, we could test those lows again. But so what? I’ll just buy more. I am in this thing for the long run and the long run looks very prosperous. Benioff’s not just talking transformation — he’s delivering it, Agentforce and Informatica are just the first step.

I was greedy, when others were fearful and now it’s beginning to pay off.