T-Mobile US Inc. $TMUS (-1,71%)

$DTE (-1,27%) reported record growth in customer numbers, prompting the company to raise its forecast for several key figures.

Despite these successes, the shares fell by 2.2% in regular trading after the announcement, having already fallen by 0.89% in pre-market trading.

This suggests that investors may have been expecting even stronger results or were concerned about the slight year-on-year decline in net profit.

The telecommunications giant reported earnings per share of USD 2.41, narrowly beating analysts' expectations of USD 2.40.

Turnover reached USD 21.96 billion, which was also above the forecast of USD 21.88 billion.

These results underscore T-Mobile's continued momentum in the competitive wireless market while the company undergoes a leadership transition with CEO-designate Srini Gopalan replacing outgoing CEO Mike Sievert.

》Quarterly performance highlights《

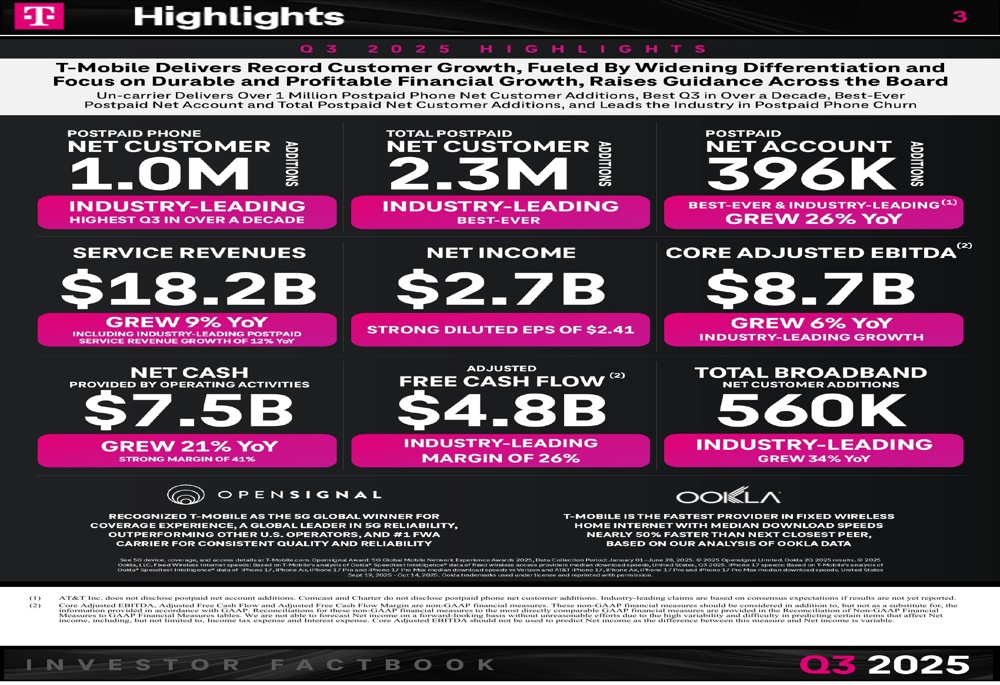

T-Mobile's business performance in the third quarter of 2025 was characterized by exceptional customer growth in several segments. The company recorded 1.0 million net additions in postpaid mobile - the best result for a third quarter in over a decade. Total postpaid net additions reached a record 2.3 million.

Of particular note was the 26% year-on-year increase in postpaid net additions to 396,000 - another record for the company. T-Mobile also continued its strong development in the broadband segment: 560,000 net new customers represent growth of 34% compared to the same period last year.

Customer retention remained strong. The churn rate in the postpaid mobile segment improved slightly from 0.90% in the previous quarter to 0.89%, but was slightly higher than the 0.86% recorded in the third quarter of 2024. This stable churn rate, combined with the strong addition of new customers, underlines T-Mobile's competitive position in the market.

》Outlook and forecast《

Based on the strong third quarter results, T-Mobile has raised its full-year 2025 guidance for several key performance indicators. Most notable is the increase in the forecast for net additions in the postpaid segment from 6.1-6.4 million to 7.2-7.4 million. This corresponds to a significant increase of 1.05 million in the middle of the range.

The forecast for adjusted core EBITDA was raised by USD 300 million to USD 33.7-33.9 billion in the middle of the range, while the forecast for operating cash flow was increased by USD 600 million to USD 27.8-28.0 billion. The company also raised its capital expenditure guidance from approximately USD 9.5 billion to approximately USD 10.0 billion, reflecting increased investment to support its growing customer base and network expansion.