$NOW (-2,85%)

$IGV (+0,04%)

$CSPX (+0,58%)

ServiceNow Bought a Company. SaaS Fell Apart

“The speculation out there is that M&A is the new playbook out of necessity… We have never acquired a single company for revenue alone. We use M&A to expand into an even larger TAM, and it is now beyond $600 billion, based entirely on where our customers need us to go, where we know we can build exciting growth businesses.”

- Bill McDermott, ServiceNow CEO (Q4 Conference Call)

On Wednesday, the enterprise software giant ServiceNow beat analyst estimates for both Revenue and Earnings, but you wouldn’t have known it by looking at the stock price.

Source: ServiceNow on Fiscal.ai

Instead, investors had a different point of focus. Acquisitions.

Throughout ServiceNow’s history, the focus has always been organic growth. There have been many small tuck-in acquisitions over the years, but by and large, the strategy has been to build new products internally, expand the overall product suite, and upsell the new features to existing clients.

That took a turn in 2025.

In March, ServiceNow made its largest acquisition ever by buying agentic AI platform Moveworks for $2.85 billion in cash and stock. Nine months later, they spent another ~$1 billion to acquire the identity management company Veza. And to cap it all off, in late December, they announced their biggest deal by a landslide with their $7.75 billion purchase of cybersecurity platform Armis.

For the first time in their history, ServiceNow went on a buying spree. To the tune of $11 billion.

Naturally, investors have become cautious.

The concern among analysts is not just that these acquisitions might be defensive moves amidst AI disruption threats, but that they’re using acquisitions to mask their slowing organic growth. Analysts estimate that without any acquisitions, ServiceNow would have reported 18.5%-19% revenue growth for the quarter, marking their slowest growth rate on record.

ServiceNow’s stock plummeted as the 4th quarter conference call took place, and CEO Bill McDermott tried his best to quell concerns:

“I want to make it very clear to the investors… we did not, and never have, bought an asset like many others have, and I know that's probably why it's on your mind, because we needed the revenue.”

“I noticed that we lost about $10 billion in market cap on that because of the worry. So now the worry is gone. You can give us back the market cap”

- Bill McDermott, ServiceNow CEO (Q4 Conference Call)

SaaS Shockwaves

ServiceNow’s slowing organic growth sent ripple effects across the software industry.

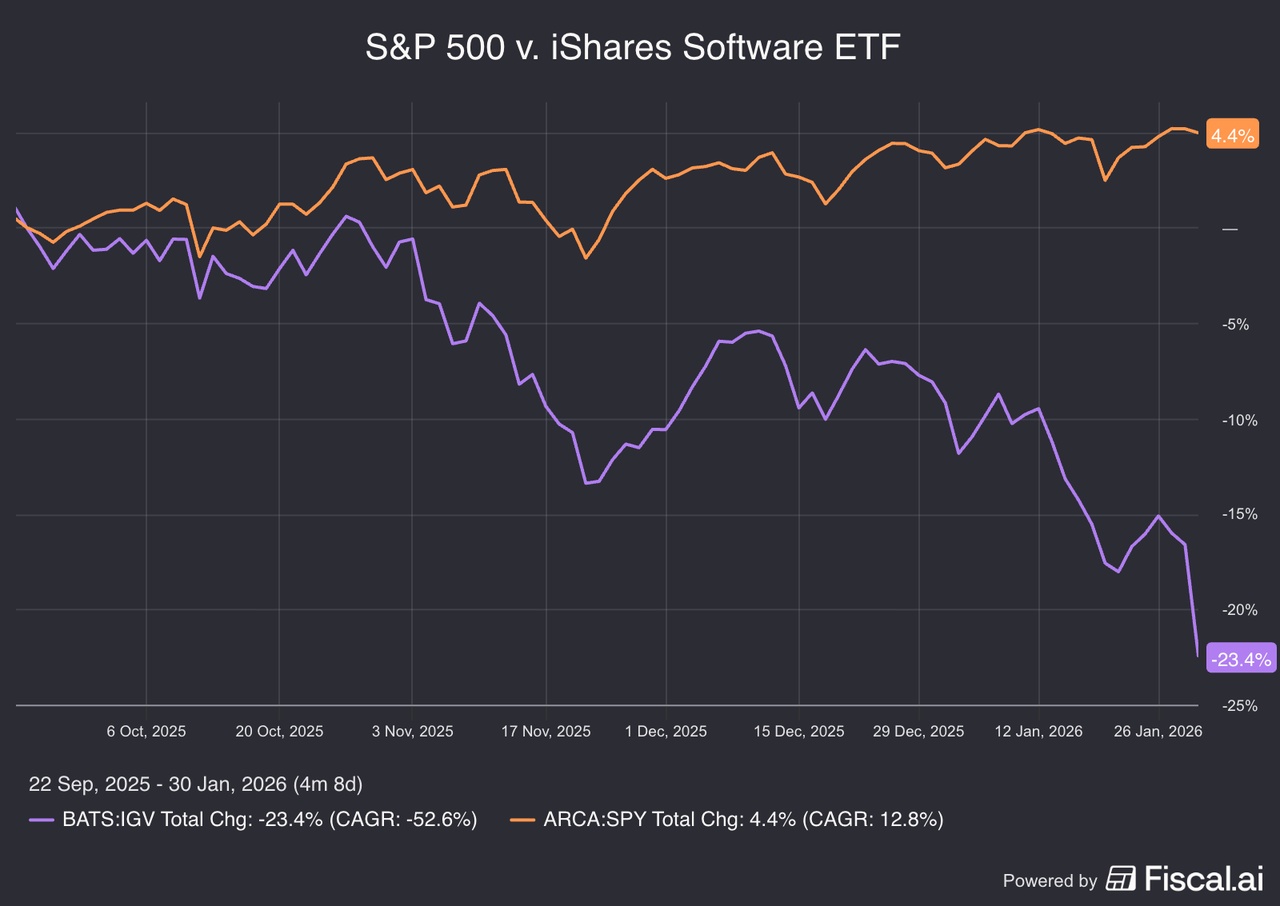

Here’s a look at the iShares Tech-Software Sector ETF v. the S&P 500 over the last ~4 months:

Source: iShares Software ETF on Fiscal.ai

While that gives some visibility into the struggles of the software sector broadly, the iShares Software ETF is actually still being lifted by two of its larger constituents, Microsoft & Palantir.

Underneath the hood, many companies are experiencing far more severe drawdowns.

Source: Dashboard on Fiscal.ai

Is the Sell-Off Warranted?

The sector-wide correlation with ServiceNow shouldn’t come as much of a surprise.

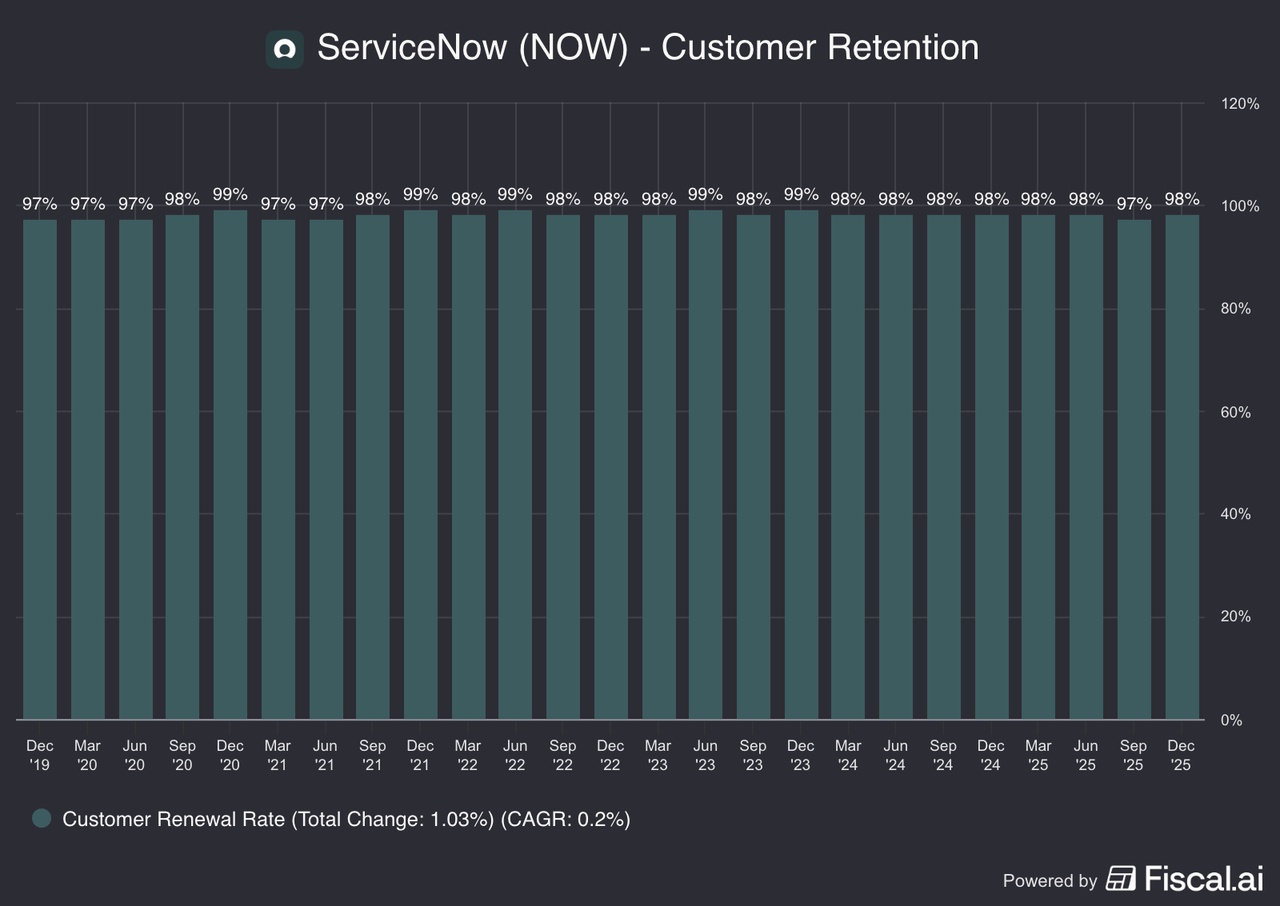

The implication is clear: If a business like ServiceNow (which is one of the most embedded databases and systems of record in the enterprise world) is seeing slowing growth, then it could be far worse for other companies.

After all, there are few businesses on earth with customer retention rates like ServiceNow:

Source: ServiceNow Segments & KPIs on Fiscal.ai

AI is still the “boogeyman” for software investors.

The concern appears to be two-fold. One, AI will replace jobs and therefore reduce the number of seats subscribed to enterprise software products. And two, companies will begin building systems internally instead of relying on outside vendors.

Will these worries materialize?

Let’s take a look at the short history of AI coding assistants/agents.

- June 2022: Amazon launched CodeWhisperer

- June 2022: Microsoft launched GitHub Copilot

- 2023: Cursor is launched

- Feb. 2025: Anthropic launched Claude Code

- May 2025: OpenAI launched Codex

I’m probably missing something in there, but you get the point. AI coding assistants/agents have existed in some capacity for nearly 4 years.

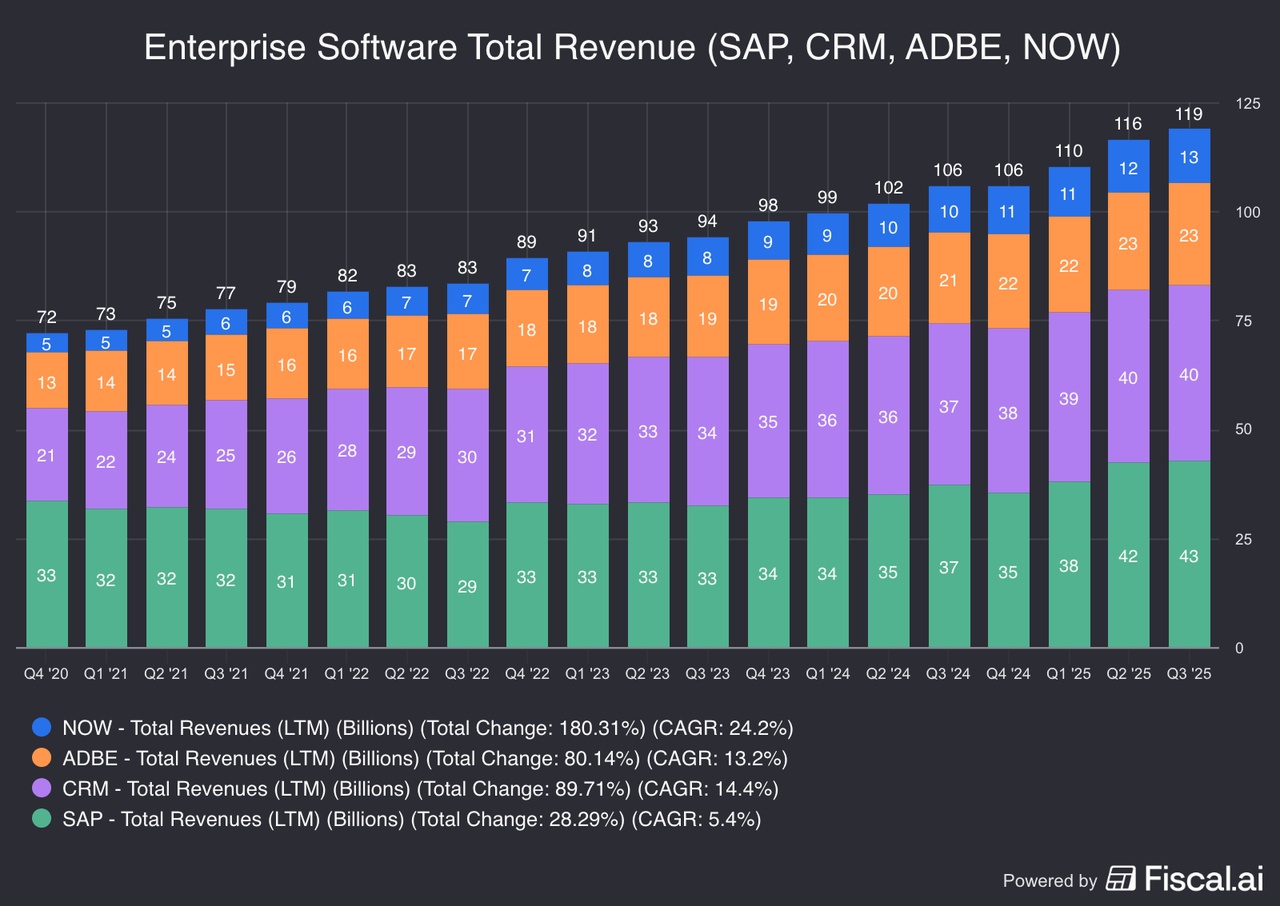

Over that time, many of the large enterprise software companies have grown their customers, revenue per customer, and earnings.

Here’s a glimpse of the combined revenue for a few of the larger players:

If AI has displaced the need for software vendors, it hasn’t shown up in the numbers yet.

Of course there’s the risk these software companies are actually mortgaging their moat by raising prices in the face of increasing competition, but again, most of these companies are reporting increasing customers as well, so that doesn’t appear to be the case.

Long story short, the AI impact remains unclear.

What is clear, however, is that for what feels like the first time in two decades, it is now contrarian to be bullish enterprise software.

Quelle

fiscal.ai