What is it about?

As I wrote in my last post, the USDEUR exchange rate has broken its upward trend, which has been running since 2007, in the last few days.

Why is this a problem for investors?

A falling USD means capital outflows from the US market, which traditionally goes hand in hand with problems in the US and global economy and thus falling equity indices. In addition, a 30% depreciation of the USD means an additional 30% loss for investors in EUR. Ergo: Understanding the USD cycle is very important for your own investment strategy!

In the following article, I will 1. introduce you to the USD cycle, 2. explain which asset classes perform best in which phase of the cycle, 3. what to expect over the next few years from a cycle perspective and 4. how to profit from it.

The USD cycle

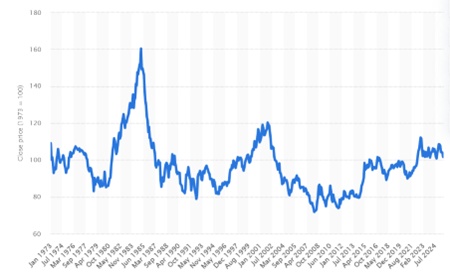

Here is the long-term chart of the USD index since the installation of the current international monetary system (Bretton Woods) in 1971:

A certain cyclicality of the USD is noticeable. It can be roughly summarized as follows:

High approx. 120 USD: 1971

Low approx. 80 USD: 1978-80 -30%

High approx. 160 USD: 1985 +100%

Low approx. 80 USD: 1990-95 -50%

High approx. 120 USD: 2000-02 +50%

Low approx. USD 70: 2007-11 -40%

High approx. 115: 2022-2025 +60%

If you look at the highs in 1969, 1985, 2001 and 2017, you can see a relatively stable 16-year cycle. The next high point would be around 2033. There is also a 16-year cycle for the low points: 1978, 1994, 2010. The next one would be around 2026. Roughly speaking, this results in the following cycle: USD falls for 9 years and then rises for 7 years. On average, the USD appreciates by 70% in an upward cycle and depreciates by 40% in a downward cycle (100 +70% -40% = 102). The economic reason for this cycle is probably to be found in the US election periods and the different economic policies.

Each cycle tells its own story:

1969-1978: Oil crisis and stagflation

1979-1984: Reaganomics

1985-1994: Political turnaround and emerging markets boom

1995-2000: Internet boom and emerging markets bust

2001-2010: Internet bust, financial crisis and emerging markets boom

2011-2016: Zero interest rate policy and US tech boom

2017-2026: AI boom/bust and Trump(?)

What does this mean for the next few years? The current phase did not look like a devaluation phase for a long time. We are still only 10% below the peak of the last appreciation phase 2011-16/17. The current depreciation phase ends in 2026/27. For the cycle of the last 60 years to be maintained, there would have to be a significant USD depreciation of 30-40% in the next 1-2 years.

Ergo: If the cycle remains intact, we are on the verge of a true USD crash! Of course, it will hit everyone unexpectedly, especially our political economists - but not you! You now know the cyclicality. How can you profit from it now?

2. the performance of asset classes in the cycle phases

Here you can see the real return (performance minus inflation) of the most important markets S&P500, emerging markets, gold and commodities in the individual phases of the cycle in USD (I have left out bonds):

S&P 500

Period Real (p.a.)

1969-1978 -0,5 %

1979-1984 4,4 %

1985-1994 10,9 %

1995-2000 17,5 %

2001-2010 0,0 %

2011-2016 10,3 %

2017- 2025 7,5%

MSCI Emerging Markets Index

Period Real (p.a.)

1969-1978 -

1979-1984 -

1985-1994 12,0 %

1995-2000 2,0 %

2001-2010 9,4 %

2011-2016 -3,4 %

2017- 2025 2,1%

Gold (USD per ounce)

Period Real (p.a.)

1969-1978 23,8 %

1979-1984 2,5 %

1985-1994 -4,9 %

1995-2000 -5,5 %

2001-2010 14,7 %

2011-2016 -5,0 %

2017- 2025 9,2%

Commodities (CRB/BBG Commodity Index)

Period Real (p.a.)

1969-1978 5,0 %

1979-1984 -2,1 %

1985-1994 -4,2 %

1995-2000 -0,4 %

2001-2010 5,0 %

2011-2016 -10,4 %

2017- 2025 -0.7%

If we select the top performer for each period, the following picture emerges:

Period 1st place (real return p.a.)

1969-1978 Gold +23.8 %

1979-1984 S&P 500 +4.4 %

1985-1994 EM +12.0 %

1995-2000 S&P 500 +17.5 %

2001-2010 gold +14.7

2011-2016 S&P 500 +10.3 %

(2017-2025 gold +9.2 %)

The result is quite clear: the S&P 500 performs best in the USD appreciation phases. Gold and, to a lesser extent, emerging markets perform best in depreciation phases. There is also an economic logic to this: when the US economy is booming, international capital flows into the US market, which strengthens the USD and causes prices to rise. Gold is traded in USD and becomes cheaper for ex-US investors when the USD falls and more attractive for US investors when share prices fall. Emerging market companies and governments are often indebted in USD, which lowers the debt burden when the USD falls.

3. cyclical forecast for 2026/27

a) The USD is likely to reach its cyclical low in 2026. As it is still close to the high of the last cycle, it should depreciate by approx. 30-40% over the next 1-2 years.

b) The S&P500 has gained an average of approx. 3.5%pa (real) during the devaluation phases. From a level of 2400 points in 2017, this would be approx. 4500 points at the end of 2026 with approx. 3% inflation, i.e. approx. 15% lower than today (5300 points).

c) Gold has gained an average of approx. 11.2%pa (real) during the devaluation phases. From a level of USD 1300 in 2017, 3% inflation at the end of 2026 results in a gold price of approx. USD 4900, i.e. around 50% higher than today (USD 3300).

d) For euro investors, the depreciation of the USD must also be taken into account. This means that an unhedged S&P500 ETF would be approx. 45-55% lower in 2026 than today according to the cycle and unhedged gold would be approx. 10-20% higher than today.

e) From 2027, the USD should bottom out and then rise again until 2032. This would then also be the performance phase for the S&P500.

4. strategies and investments

a) Passive B&H savings plan investors (S&P500/ MSCI World/ ACWI)

B&H investors remain consistently invested and continue to save in their ETFs. However, they should be prepared for a massive test of their strategy and nerves. The drawdown could be massive (approx. -50%) due to the falling USD and falling equity markets. Those who have added emerging markets should be less affected by a falling USD.

Those who have the opportunity can consider at least hedging the depreciation of the USD. A factor certificate or ETC is most suitable for this. If you reserve 10% of your portfolio volume for a factor 10 short USDEUR, you can at least cushion a good part of the USD depreciation.

- Wisdomtree 5x Short USD EUR ETC, DE000A12Z322

- Vontobel 10x Factor Warrant EUR long USD, DE000VP3NYZ9

An alternative would be to pause the savings plan for the equity ETF and instead invest in a currency-hedged gold ETC or simply a money market ETF.

- WisdomTree Physical Gold - EUR Daily Hedged, JE00B8DFY052

Another option is to switch to currency-hedged ETFs or redirect the savings plan to them. Such ETFs are available cheaply for the S&P500, MSCI World and ACWI.

- Invesco S&P 500 EUR Hedged UCITS ETF IE00BRKWGL70

- iShares Core MSCI World UCITS ETF EUR Hedged (Dist), IE00BKBF6H24

- SPDR MSCI All Country World UCITS ETF EUR Hedged (Acc) IE00BF1B7389

b) Active investors (market timing, trading, stock picking)

Friends of sophisticated, strategic market timing have a few more options.

They can either switch immediately into a currency-hedged gold ETC or wait for a correction and invest in gold near the SMA100 via a factor ETC, for example.

- WisdomTree Physical Gold - EUR Daily Hedged, JE00B8DFY052

- WisdomTree Gold 2x Daily Leveraged JE00B2NFTL95

Or you can bet directly on a falling USD with a low-cost factor ETC/certificate (see above)

In addition to gold mines, equity fans can also target emerging market companies with high USD debt, as these benefit particularly from a falling USD. This can quickly add up to several 100% gains.

Finally, connoisseurs can bet on falling prices on the US markets with inverse index ETFs. However, due to the asymmetrical volatility, a good strategy and disciplined implementation are a must here.

- Amundi MSCI USA Daily (-1x) Inverse UCITS ETF Acc LU1327051279

What other ideas do you have for profiting from a USD devaluation?

5. summary

The USD cycle has been very reliable over the last 60 years. Knowing it helps to better understand the major movements in the financial markets. The current break in the USD trend could be followed by a rapid and sharp depreciation of the USD in the next 1-2 years with serious consequences for the financial markets, especially for German investors with USD investments. Those who know the cycle can protect themselves against it or even profit from it.

I have hereby warned you.

And now on with the business!

Your Epi