Hello everyone, the last few days have once again been about the old topic.

It was about an investment horizon of 20 years and more.

And as I can often see here again and again. A lot of young people here also start with a rather conservative dividend strategy.

Every time I ask myself the question "Does that make sense? ".

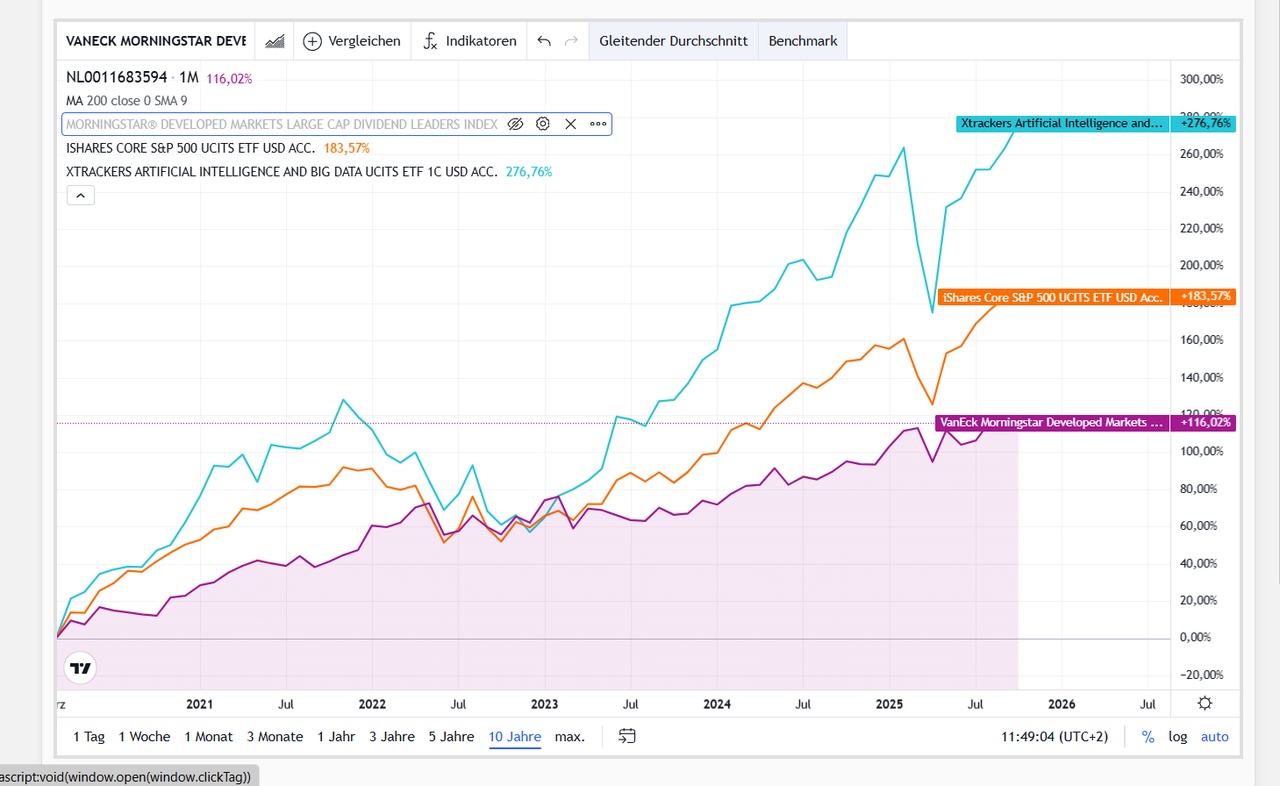

To symbolize the strategies in history a little, I have compared three ETFs over an investment horizon of 10 years.

Performance 10 years

$TDIV (+0,23%) 58.50 % (dividend strategy)

$CSPX (+0,58%) 139.26 % ( Conservative)

$XAIX (+1%) 201.61 % (Growth Strategy)

Chart from love @TomTurboInvest since 2019 (@TechNav ) (@Dividendenopi )

$TDIV (+0,23%) 122,01 %

$CSPX (+0,58%) 160,03 %

$XAIX (+1%) 228,53 %

With a big thank you to @TomTurboInvest 😘

I was amazed at how quickly the Growth ETF recovered after the bear market in 2020. And also from the 🍊 mini crash in April. But of course, this volatility is not for everyone.

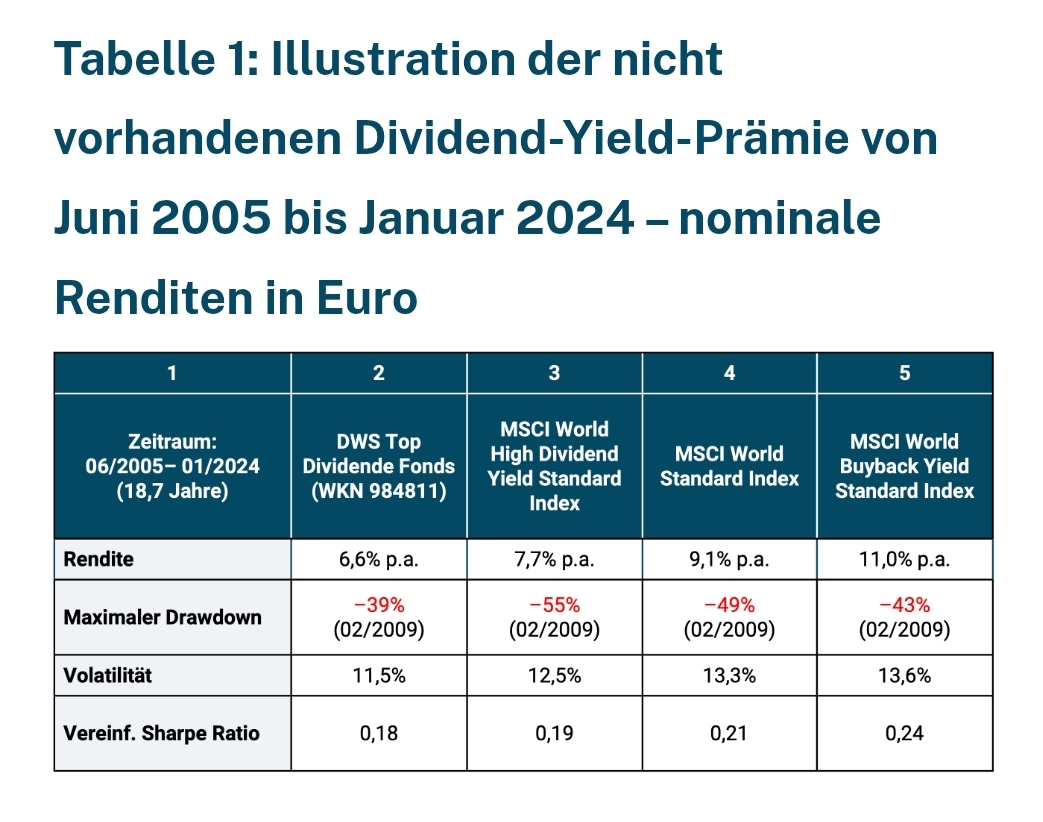

Here is an interesting article from

from Gerd Kommer and Alexander Weis

I have only included the conclusion here.

( @All-in-or-nothing It is also mentioned here that the dividend payout is almost always at the expense of performance. And is therefore not really a gift. It also mentions that a dividend strategy has not been more successful over 20 years or more).

Conclusion

Historically, dividend investing has tended to produce poorer returns than comparable investing without a dividend focus. Dividend stocks also offer a significant advantage in terms of risk.

Science and logic see more disadvantages than advantages in dividend-oriented investing.

However, the lack of systematic benefits of dividend investing will not prevent the financial industry, the financial media and an army of financiers from continuing to encourage private investors in the false belief that dividend investing has real, objective, lasting benefits in order to sell expensive products or increase circulation and click-through rates.

If you want to understand the facts in detail in the scientific literature, we recommend the study by Hartzmark/Solomon (2019).

Full article ⬇️

https://gerd-kommer.de/blog/dividendenstrategien-fakten-und-fantasien/

My dears let's go into dialog, I'm looking forward to it.

@Epi

@Iwamoto

@Max095

@Dividendenopi and everyone else.

My dear friend @TomTurboInvest can you perhaps make us another chart over a longer horizon?

You are the professional with the best tools