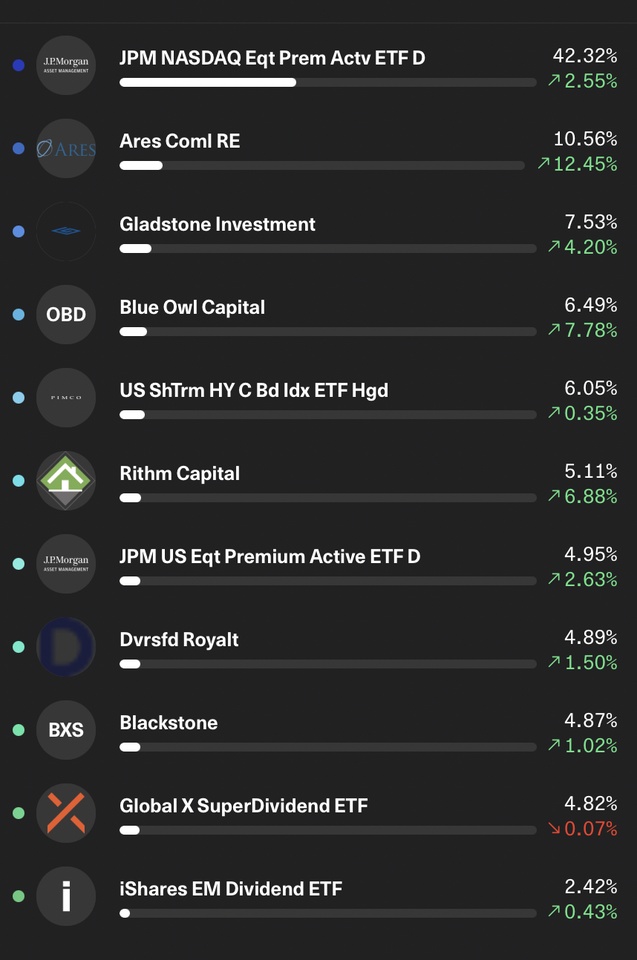

Update High Yield Income Portfolio

There were a few changes to the portfolio in December.

New additions:

- $BXSL (+0,09%) I like the portfolio, very nice NAV growth

- $SDIP (+0%) is in my opinion an interesting diversification for the portfolio, but is rather experimental

Exchanged for:

- $QYLE (-1,06%) against $IE000U9J8HX9 (-0,68%)

$JEGP (+0%) against $IE000U5MJOZ6 (-0,51%)

I want to keep my div/dist yield at around 8-10% in the long term.

$IE000U9J8HX9 (-0,68%) I will only be saving with the distributions from the portfolio, so the weighting should slowly decrease for the time being, while I continue to save the other positions regularly.

Have you found any interesting stocks in the last month?