Not a good day for LVMH $MC (-1,68%).

The champagne has been left in the fridge again (didn't expect to get it out either)

LVMH currently 5th largest position in my portfolio, according to the getquin Deepdive -> 3.8% portfolio share.

-40% from the all-time high and the benchmarks don't look good. I'm convinced in the long term and want to hold the position, but I'm still wondering whether it wouldn't make more sense to reallocate and enter later. Should I stay in the luxury sector or is the alternative a basic investment? I don't need the money at the moment and am thinking of holding on to it.

I'll answer this question for myself at the end of the post.

For now, here is an overview of the figures and classification. Sources: Earnings call and report presentation

(I know, dozens of others have already posted today, perhaps the classification and explanation will provide more clarity).

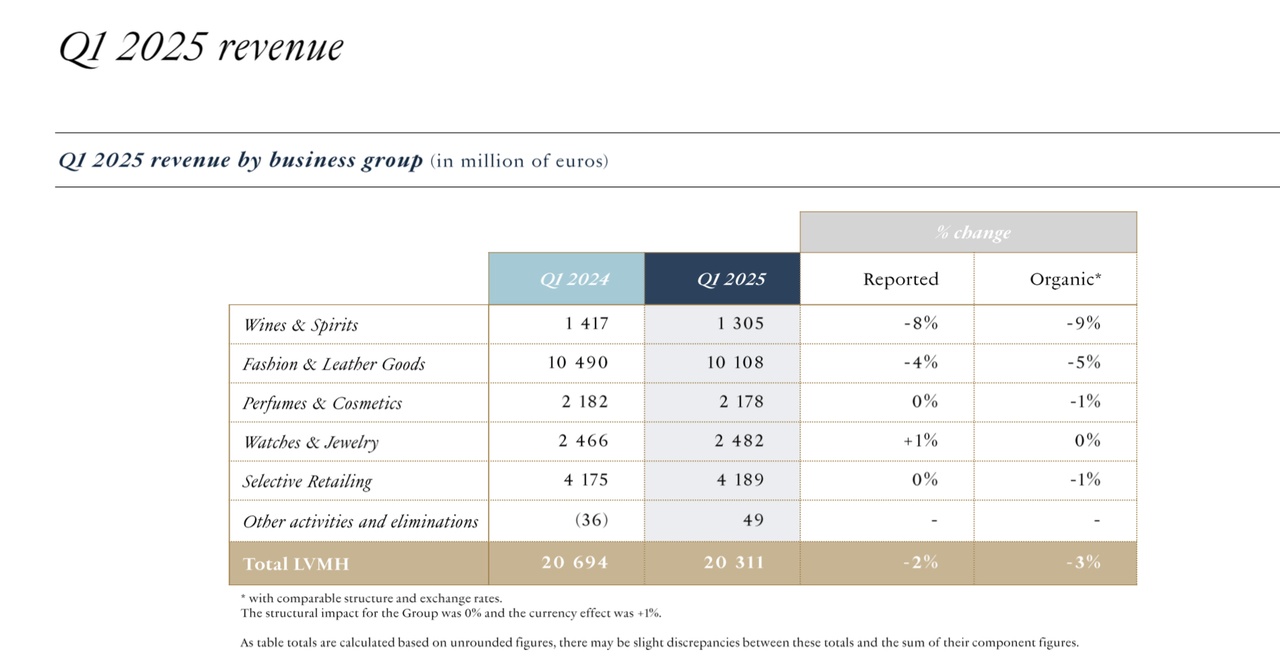

Overall view: Solid, but the shine is fading slightly

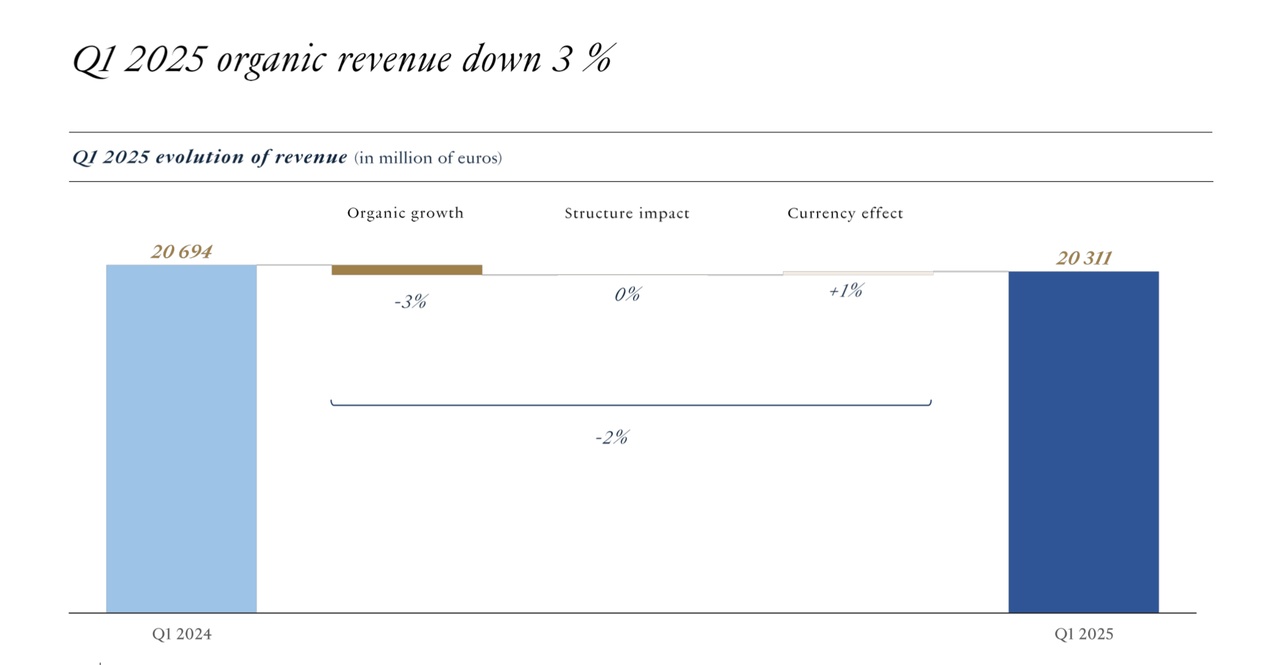

Turnover20.31 billion €

- -2 % reported (= incl. currency & portfolio effects)

- -3% organic (= real business development, adjusted)

Explanation:

Weak euro at the beginning of the year lifted US sales, weak yen depressed Japan, but overall it was enough for a better reporting result. Summarized at the end of the post for those interested.

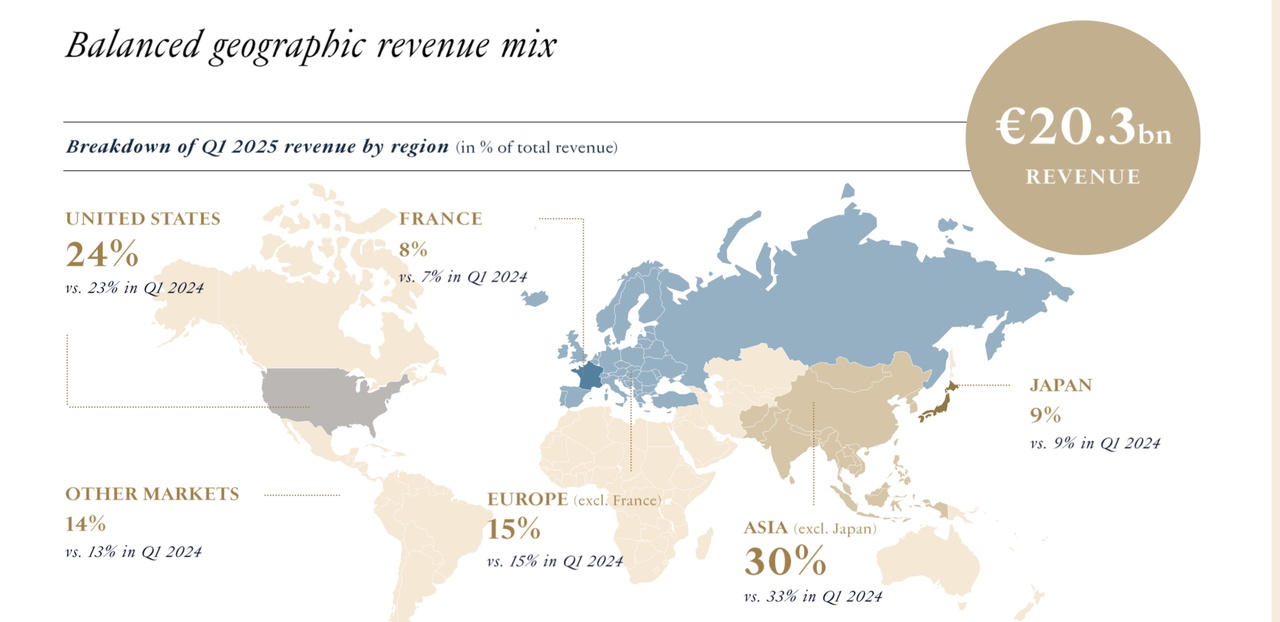

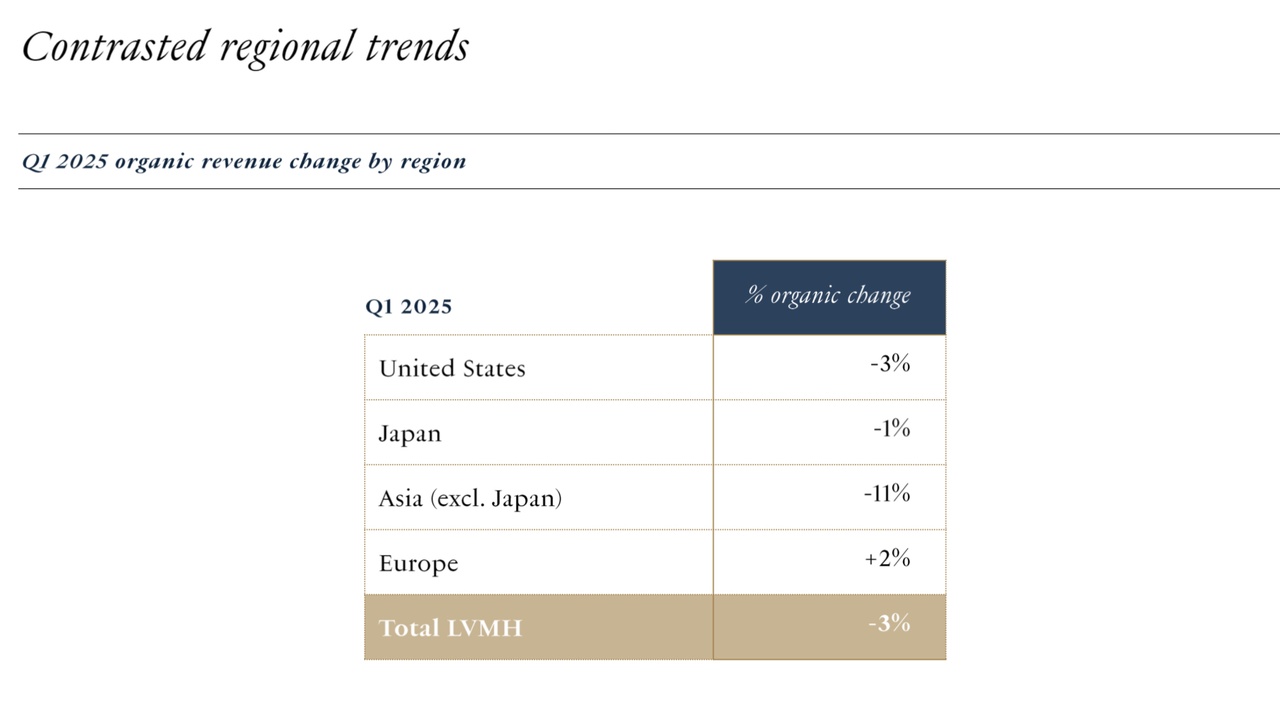

Regional trends:

- Europe: +2 %

- USA: -3 % (despite good fashion performance, beauty weak)

- Asia excl. Japan: -11 %

- Japan: -1 % (base effect after +32 % in the previous year)

Explanation:

The decline in Asia is partly due to a "base effect": 2024 was extremely strong (especially in Japan due to Chinese tourists). This strong basis for comparison makes 2025 look much weaker, although the absolute level remains high.

2nd segment analysis: strengths and weaknesses at a glance

Fashion & Leather Goods (cash cow)

Turnover10.10 billion € (-5% organic)

Highlights:

- Louis Vuitton with successful Murakami collaboration (premium prices, sold out)

- New collections, change of creative directors (e.g. Givenchy, Loewe, Celine)

- Focus on "mix" strategy: sale of more expensive items instead of price increases

Classification:

Mix = higher-quality product mix, e.g. selling more €4,000 bags instead of €1,500 bags -> more sales per item and supports the margin without using official price increases.

Wines & Spirits (problem child)

Turnover1.30 billion € (-9 % organic)

- Cognac declining sharply (-17%) in USA & China

- Turnaround plan over 2 years announced, no details given, but focus is probably on stabilization & new brand activation

Watches & Jewelry

Turnover2.48 bn € (0% organic, sales stable)

- Tiffany: strong demand (Tiffany T, Tiffany Lock, Tiffany Knot, new flagship stores)

- Bvlgari, Chaumet, Fred: new collections & solid growth

Perfumes & Cosmetics

Turnover2.17 billion € (-1% organic)

- Dior: success with J'adore & high-end series "La Collection Privée"

- Guerlain, Givenchy, Aqua di Parma: new fragrances & ambassadors

Selective Retailing (Sephora, DFS, Le Bon Marché)

Turnover4.18 billion € (-1 % organic)

- Sephora: further growth in stationary retail (Brick & Mortar)

- Weakness in e-commerce, Amazon aggressive with prices... is Amazon a competitor?

- .. Yes, Amazon is a direct competitor, especially in the online beauty business

- -> Amazon is putting Sephora under pressure with aggressive prices. LVMH does not want to go along with this in order to preserve the brand value.

- DFS (duty-free stores, i.e. luxury stores in airports / tourist centers): few tourists in Hong Kong / Macau = pressure, weak figures

3. challenges in the market environment

Geopolitics & economy

- -> "In the case of tariffs, price is a lever that we are going to consider."

- "It will not be one size fits all... it can be very different depending on the brands, categories, pricing power."

- -> LV has three production facilities in the U.S., but it's rather around one third of local needs."

- "There is still capacity... we are looking at that obviously. It's something we can contemplate in a reasonable timeframe."

Interpretation:

- LVMH is not planning across-the-board price increases, but is considering them on a brand-specific basis in case tariffs come.

- LVMH is examining whether it can produce more in the USA if necessary, e.g. to avoid possible tariffs - but no immediate relocation.

- Asia: Weak demand development, but structurally intact (long-term growth of the middle class)

Buyer behavior

- "Aspirational buyers" (status-oriented middle class buyers) show restraint

- -> Demand currently weaker due to sentiment, not due to income

- -> Early indicator for cyclical decline in the luxury market

4. LVMH strategy & positioning

+ Strengths:

- Market leader with a broad brand portfolio (LV, Dior, Tiffany, etc.)

- Long-term increase in value through consistent investment in brand, stores, creativity

- Strong innovative strength in products & cooperations

- Weaknesses / risks:

- Profit growth is slowing down

- Luxury market as a whole in a "normalization phase"

5. bottom line, stay invested or reallocate?

LVMH remains a giant that invests selectively in weak cycles instead of cutting back.

Those who take a long-term view will benefit from the structural brand value.

In the short term, the share has no clear price driver in an environment of high interest rates, geopolitical uncertainty and weakening demand in Asia and the USA.

My conclusion: (not investment advice, of course 👀)

>>> Hold position. <<<

______________

What can investors who want to get in on LVMH do?

Stay patient, buy in tranches if necessary

Why?

- The company remains fundamentally strong, but is currently facing challenges (tariffs, China weakness, US risk)

- The P/E ratio is below the 5-year average (~21 instead of 31 depending on the source) -> valuation is more attractive

- The market is already pricing in many uncertainties, but a real upward trigger is currently missing

- LVMH is qualitatively first-class in the long term, but dependent on the economy and geopolitics in the short term

Strategy tip:

Enter in partial tranches (e.g. x% now, x% on setbacks) + watch out for signals (e.g. stabilization in Asia, tariffs specified, Q2 sales trend)

What should investors who are currently in the red do?

Do not sell out of panic

Why?

- The operating basis is intact, LVMH is not cutting back but investing anti-cyclically

- The valuation is no longer excessive compared to recent years

- Luxury demand is cyclical, but structurally intact

- Declines in "aspirational buyers" are sentiment problems, not structural problems

What to do instead of selling?

- Consider adding to the position to improve the entry level (if there is still conviction)

- Or simply hold and wait for the next upward phase

- Alternatives: Possibly reallocate to Hermès $RMS (-1,26%) (premium exposure) in case of returnees or Richemont $CFR (-1,08%) (adequately valued, less US risk) if you want to stay in the luxury segment. Otherwise, for example, switch to Basis Investment.

______________

Exchange rate effect explains why -2 % instead of -3 %?

In the first quarter of 2025, LVMH reported organic sales growth of -3%, but the reported growth was only -2%. The difference is due to positive exchange rate effects, mainly from the US dollar.

At the beginning of the year, the euro was weak against the US dollar, which means

Sales in the USA (e.g. with Louis Vuitton or Sephora) were converted into euros at a more advantageous exchange rate -> this lifts reported sales.

At the same time, the Japanese yen was significantly weaker against the euro. Sales in Japan (e.g. with Dior or Bvlgari) bring in fewer euros when converted, although sales in yen have not changed → this has a negative effect.

Bottom line:

The positive effect from the weak euro against the dollar was stronger than the negative effect from the weak yen. This is why the reported growth of -2% is better than the operating loss of -3%.

______________

Thanks for reading! 🤝

______________

Sources:

Audio Webcast Q1 2025 Revenue:

https://voda.akamaized.net/lvmh/2083769_67e55782ce10a/

Presentation:

https://lvmh-com.cdn.prismic.io/lvmh-com/Z_0pc-vxEdbNPBim_LVMHQ12025.pdf