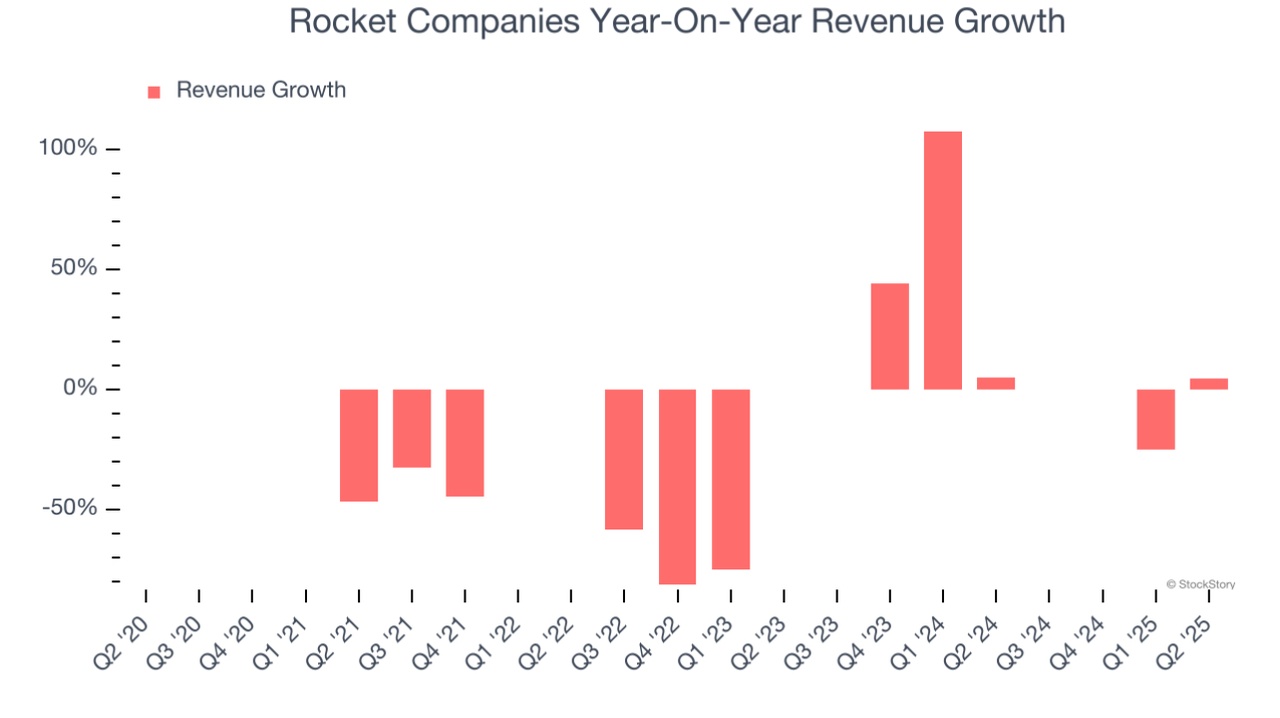

$RKT is a Detroit-based fintech platform company specializing in mortgage, real estate, title, and personal finance services. In 2025, the company demonstrated solid financial performance, particularly in the second quarter, showcasing its ability to grow amid a competitive and evolving market. Rocket Companies generated total net revenue of approximately $1.36 billion in Q2 2025, reflecting a 9% year-over-year increase compared to the previous year. This revenue exceeded analyst expectations, with an adjusted revenue figure of $1.34 billion, which surpassed the high end of the company’s guidance range.

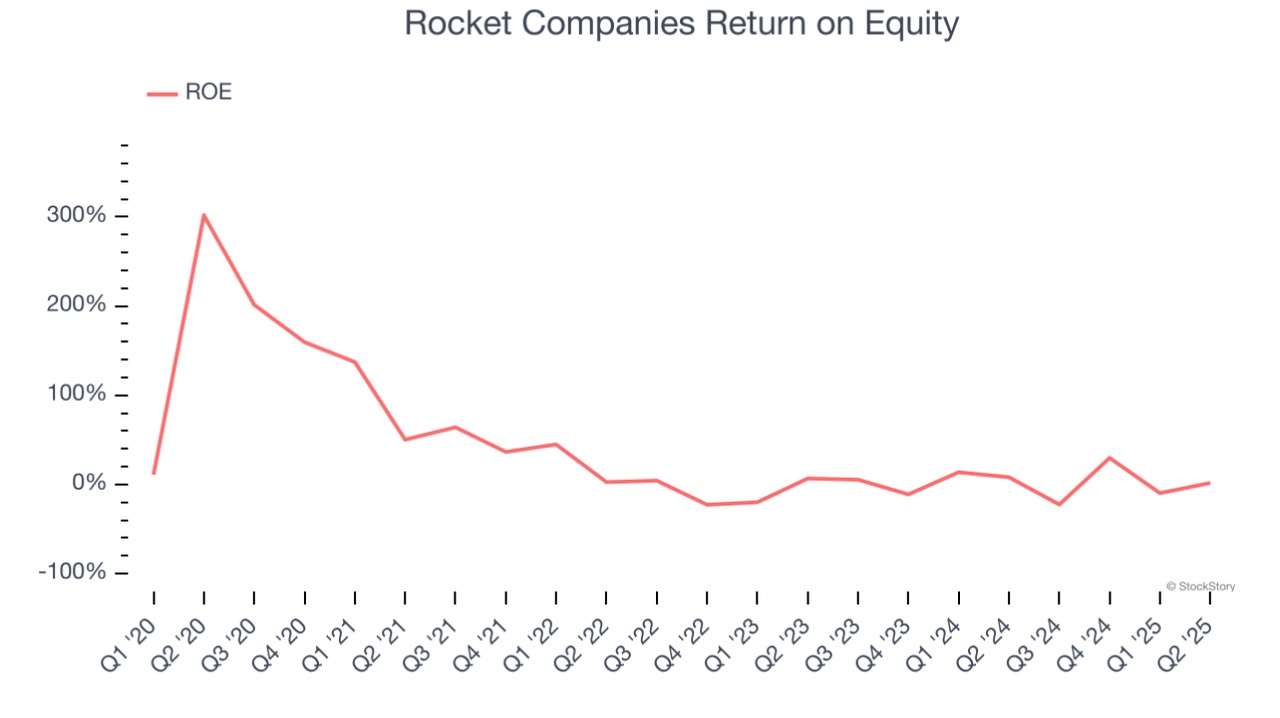

The company’s net income on a generally accepted accounting principles (GAAP) basis was $34 million for the quarter, with an adjusted net income of $75 million, indicating strong operational efficiency. Earnings per share (EPS) also beat forecasts, coming in at $0.04 versus the expected $0.03, a positive surprise that lifted investor sentiment and the stock price in aftermarket trading. Rocket Mortgage, the company’s flagship mortgage lending platform, contributed substantially by generating a closed loan origination volume of $29.1 billion, an 18% increase year over year. Moreover, net rate lock volume increased by 13% to $28.4 billion, signaling strong customer demand in the mortgage market.

Rocket Companies has been enhancing its digital mortgage experience, with clients now able to complete refinancing applications digitally within 30 minutes, reflecting the company’s commitment to seamless, technology-driven services. The firm has also successfully completed its acquisition of Redfin, a leading real estate brokerage, which has begun to drive higher conversion rates and an expanded purchase funnel, further integrating the home buying and financing process for customers.

Financially, Rocket Companies holds a robust liquidity position, with total liquidity reported at $9.1 billion as of June 30, 2025. This includes significant cash balances and undrawn credit facilities that position the company well for continued growth and market fluctuations. The servicing portfolio managed by Rocket amounts to an unpaid principal balance of $609 billion, servicing about 2.8 million loans, generating around $1.6 billion in annual servicing fee income.

Looking ahead, Rocket Companies plans to announce its third-quarter earnings on October 30, 2025. The company has provided optimistic revenue guidance for the upcoming quarter, estimating between $1.6 billion and $1.75 billion in total revenue. It also expects to complete its acquisition of Mr. Cooper in Q4, a move anticipated to strengthen its market leadership further. These strategic expansions, combined with ongoing investments in AI-driven fintech innovations, underpin Rocket’s future growth prospects despite ongoing volatility in the housing market.

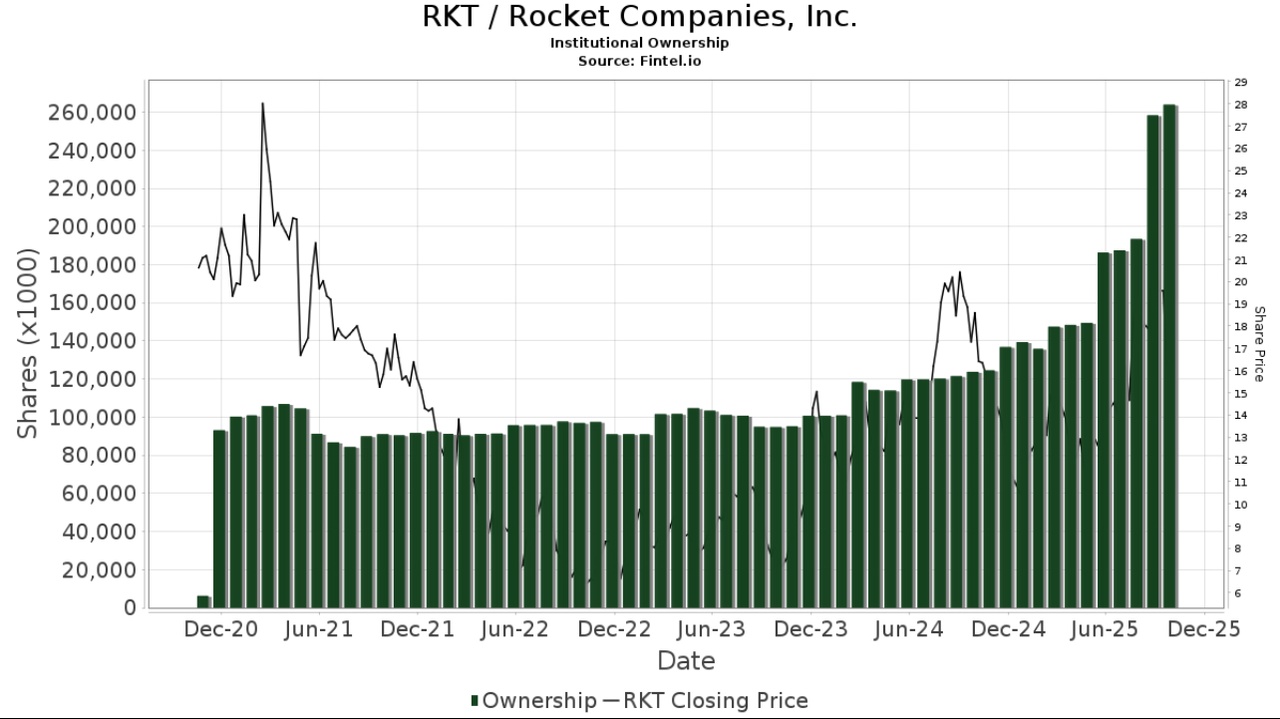

From a market perspective, Rocket Companies’ stock has shown resilience, with a 52-week trading range between $10.06 and $22.56, and a market capitalization near $48.6 billion as of mid-October 2025. Although the price-to-earnings ratio is currently negative due to accounting factors, analysts continue to regard the stock as having strong upside potential given its solid earnings beat, expanding digital platform, and growth strategy. The company maintains a dividend yield of about 4.8%, adding to its appeal for income-focused investors.

In summary, Rocket Companies in 2025 remains a formidable fintech player, capitalizing on mortgage market growth, technology integration, and strategic acquisitions. The company’s emphasis on digital transformation and comprehensive home financing solutions positions it well to thrive in a competitive environment, promising sustainable financial returns for stakeholders in the near future.