Stock exchange operators profit directly from the trading volume on the financial markets. They earn from every transaction, regardless of whether the markets rise or fall, which gives them a certain crisis resistance. They also offer stable income through trading fees, data licenses and index products.

During my research for the $SPGI (+0,12%) stock presentation, I came across London Stock Exchange when I wanted to know who was actually behind the FTSE indices.

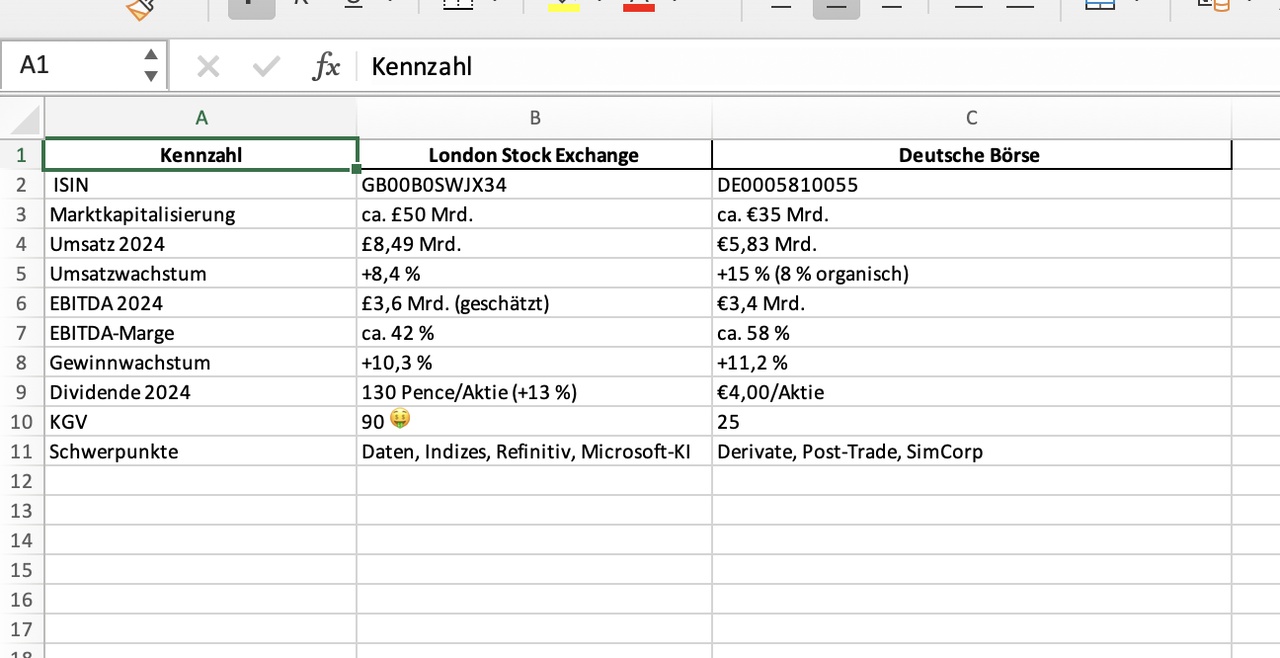

I immediately imagined a fantastic narrative about LSEG, but after a superficial analysis and comparison with Deutsche Börse, I was disillusioned.

In summary, there is a lot to be said for $DB1 (+0,73%)a solid business model, high profitability, attractive margins, strong market position in the EU and continuous growth, a real quality company.

What do you think?