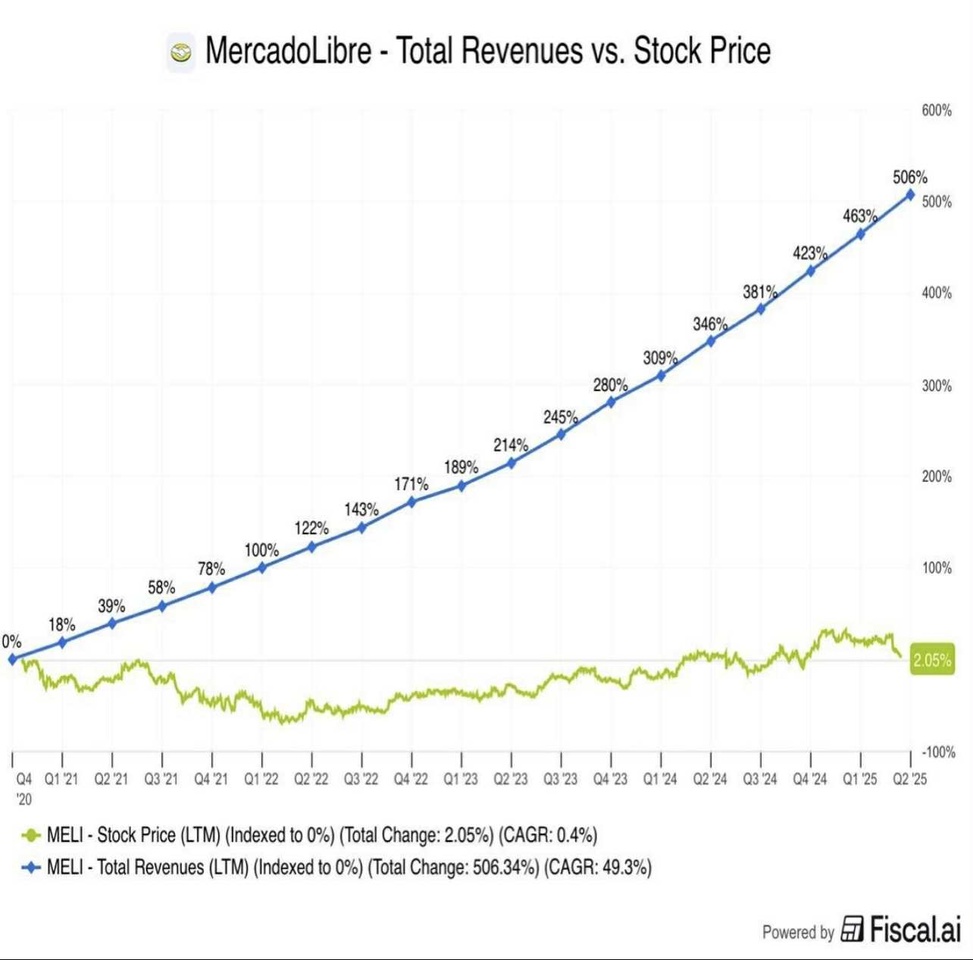

Despite a six-fold surge in revenues and spectacular execution, Mercado Libre $MELI (+2,56%) stock has barely budged since 2021, leading to the paradox of what might be one of the market’s greatest disconnects between company growth and investor sentiment. This article dives deep into the numbers, business segments, and why today’s valuation may signal a historic opportunity.

Business Model: Building an Unassailable Moat

Mercado Libre isn’t just “the Amazon of Latin America.” The company has methodically created its own moat with an e-commerce platform, digital payments, fintech innovations, and robust logistics that span the continent. Its strategic combination of marketplace (Amazon), fintech (PayPal), and merchant enablement (Shopify) is delivering rapid, compound growth across multiple verticals.

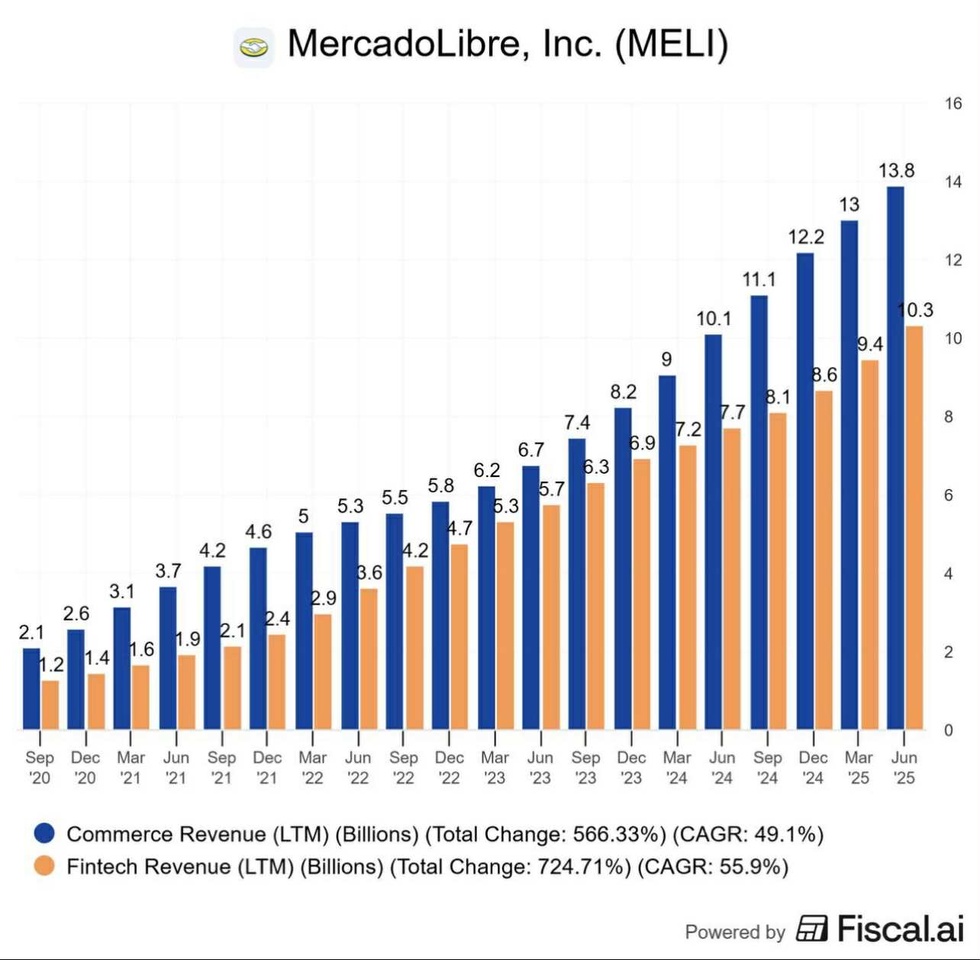

- E-commerce revenue has grown at a CAGR of 49.1%, hitting $13.8B by mid-2025.

- Fintech, the company’s second engine, exploded with a CAGR of 55.9%, reaching $10.3B over the same period.

- Commerce and fintech together compound the competitive advantages, driving adoption and recurring user engagement at scale.

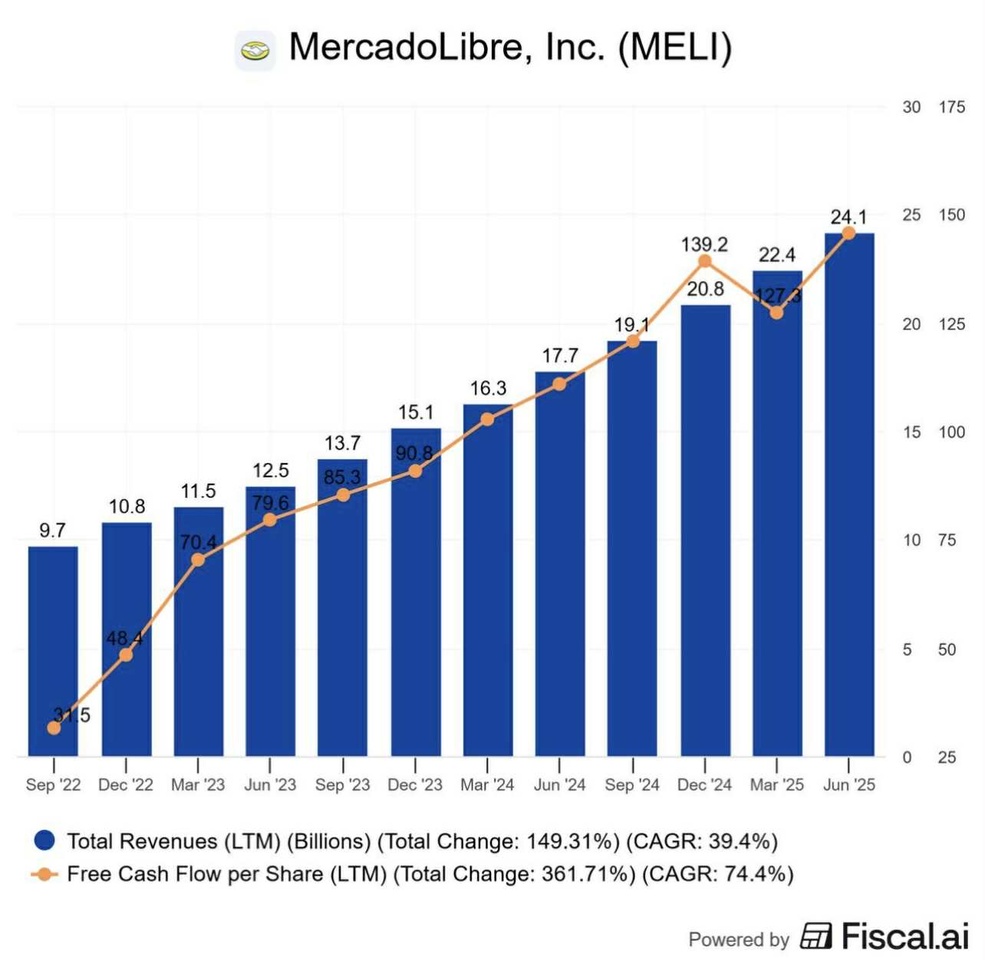

Explosive Financial Growth: Revenue and Free Cash Flow

The topline story is almost hard to believe: since 2021, total revenues have skyrocketed over 500%, from less than $2B to above $14B. The company’s “flywheel” dynamic is obvious; user growth, merchant growth, and platform engagement are all translating into higher transaction volumes and revenue.

- Total revenues reached $24.1B LTM in June 2025, with a CAGR of nearly 40% since 2022.

- Free cash flow per share, a critical profitability metric, surged 361% (CAGR: 74%) in the same period, signaling Mercado Libre’s ability to turn top-line expansion into bottom-line results.

- The company’s strong financial discipline means reinvestment into new product launches while maintaining robust margins.

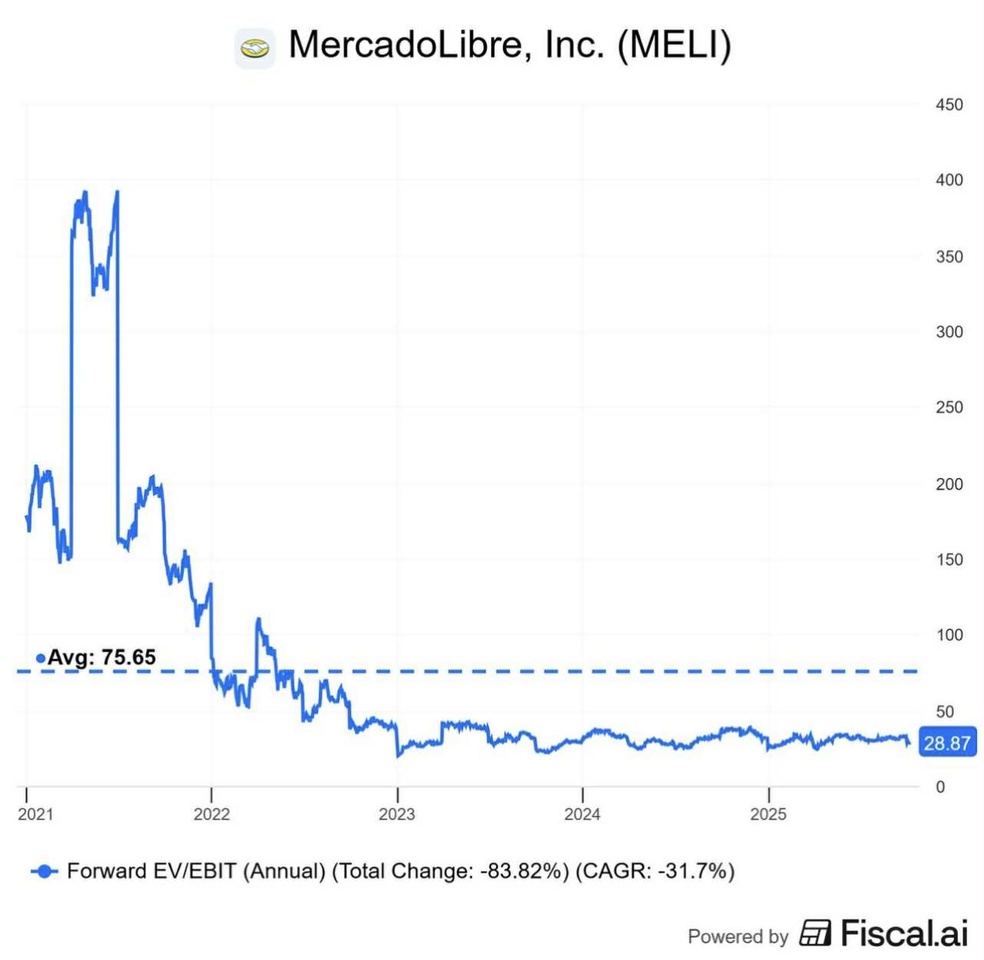

Valuation Paradox: Is Mercado Libre Critically Undervalued?

Yet the share price tells a different story. Since 2021, MELI stock is essentially flat (+2%), even as fundamentals have soared. This mismatch is starkly visible in forward EV/EBIT multiples:

- The forward EV/EBIT ratio collapsed by 83.8%, from peaks above 300x to just 28.9x in 2025 (CAGR: -31.7%), a multiple near historic lows for the company.

- Such a drastic contraction rarely persists when the company’s growth trajectory is this strong, especially in light of sector leadership and margin expansion.

- This signals that investor sentiment, not fundamentals, is driving the current share price. Historically, companies that build a strong moat and deliver outsized growth tend to dramatically outperform from such valuation troughs.

Segment Dynamics: Commerce, Fintech, and Logistics

Both e-commerce and fintech revenues are compounding quickly. The company’s investments in logistics, payment processing, and omnichannel capabilities are extending its competitive lead:

- Commerce revenue LTM reached $13.8B in June 2025, showing scale but also resilience against local competitors.

- Fintech revenue, under the MercadoPago and credit segments, advanced even faster, perhaps reflecting the growing importance of digital finance in Latin America’s fast digitizing economies.

Outlook: Why Now May Be the Turning Point

The convergence of explosive growth, robust cash flow, and deepening competitive advantages positions Mercado Libre for future market leadership. With valuation metrics at multiyear lows and continuous moat expansion, investors may be staring at a rare opportunity:

- Margin expansion continues with cost controls and scale, improving profitability quarter after quarter.

- The absence of significant stock price appreciation in the face of fundamental strength could catalyze a powerful re-rating if sentiment shifts.

Conclusion: Hidden Giant, Contrarian Play

Mercado Libre’s fundamentals paint a picture of an unstoppable Latin American digital titan, yet its valuation is stuck in the doldrums. Historically, such disconnects resolve with outperformance as the market aligns with the real business story. For disciplined investors, Mercado Libre presents not just growth but deep value—an opportunity that arises only when capital markets lose sight of fundamentals.