After the introduction of the one-way bottle deposit in Austria, I did some research into the circular economy. I came across Tomra Systems ASA, a Norwegian company that is the world leader in reverse vending machines.

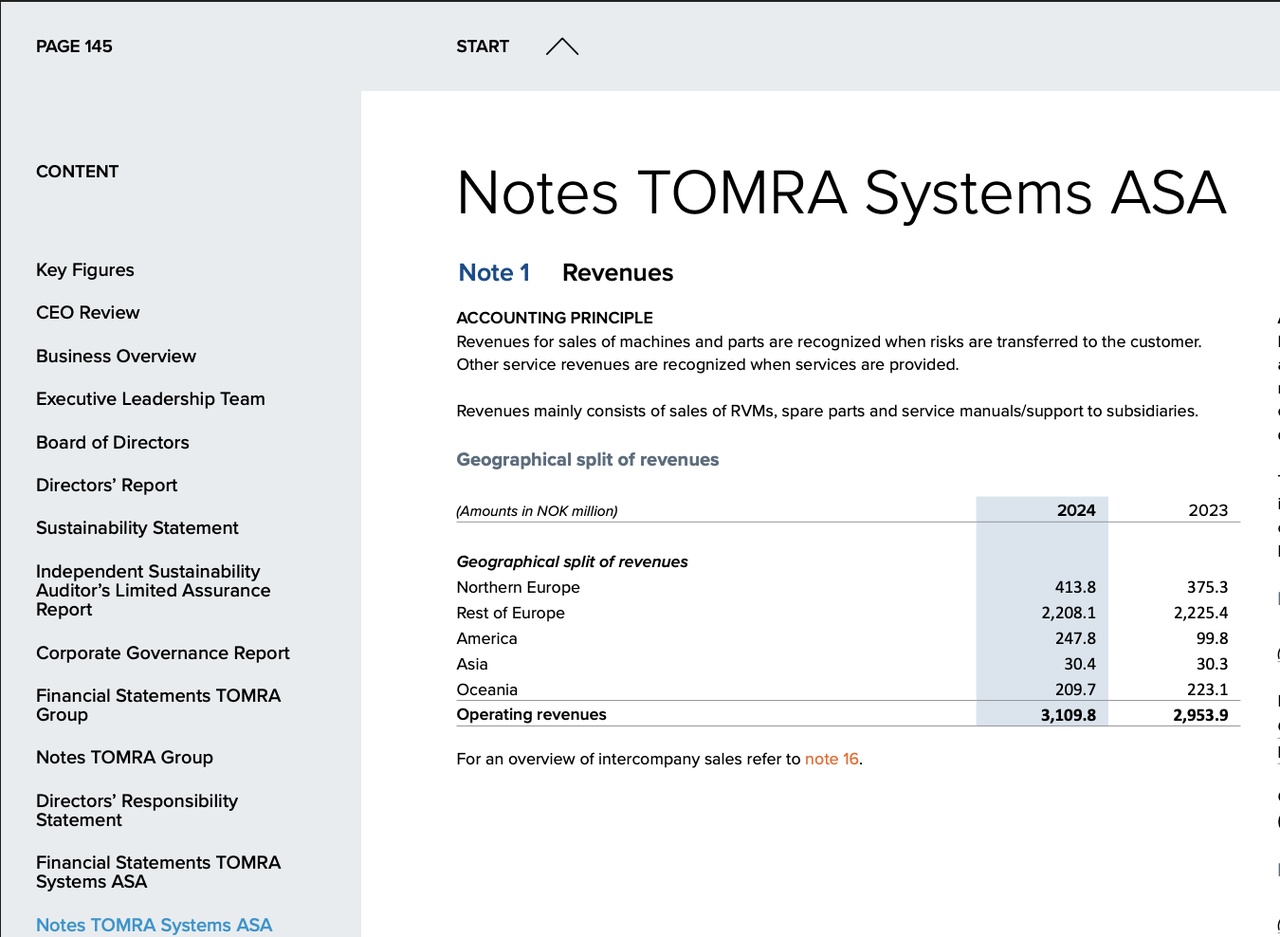

Tomra develops collection and sorting systems for recycling (especially beverage packaging) as well as for the food industry, for example for camera-supported sorting of fruit, vegetables or nuts.

Why might Tomra be an interesting investment?

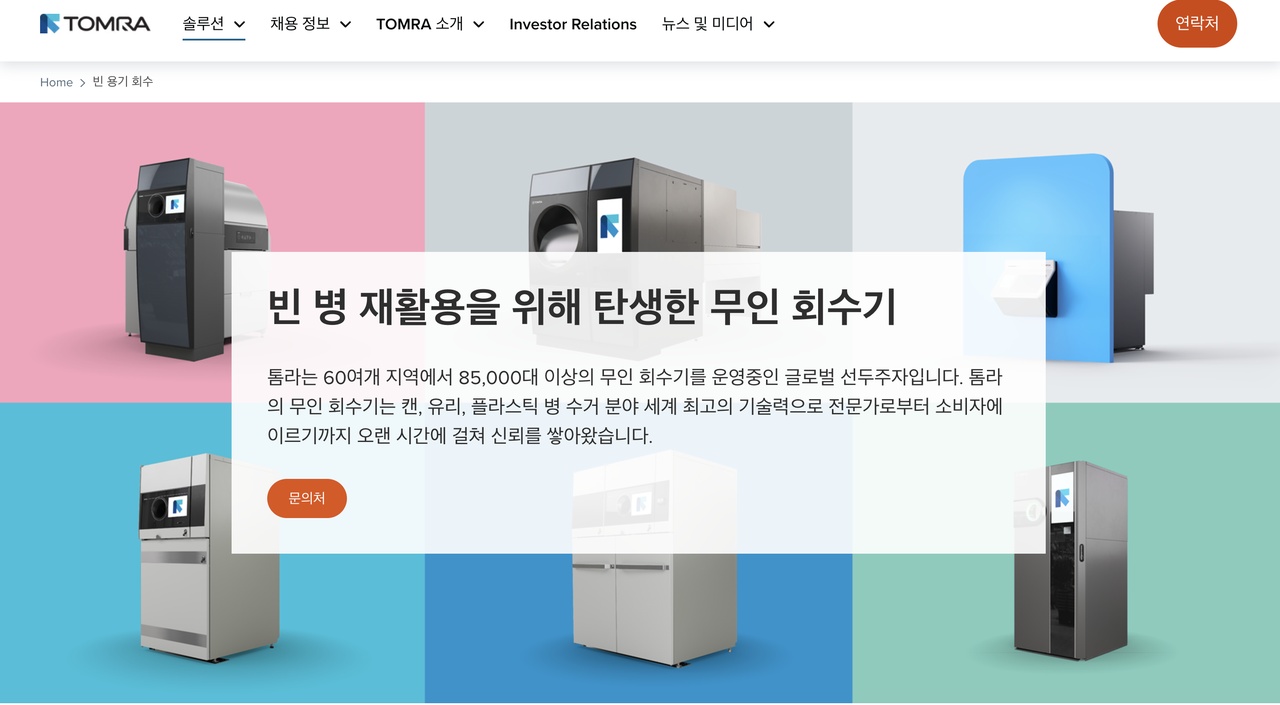

Tomra is the global market leader in reverse vending machines.

With over 80,000 systems installed in more than 60 countries, the company benefits directly from global environmental regulations.

According to an EU regulation, all member states must achieve a recycling rate of 90% for plastic bottles by 2029. In my opinion, this target cannot be achieved without deposit systems. I therefore expect more EU countries to introduce deposit systems, which should benefit Tomra considerably due to its leading market position.

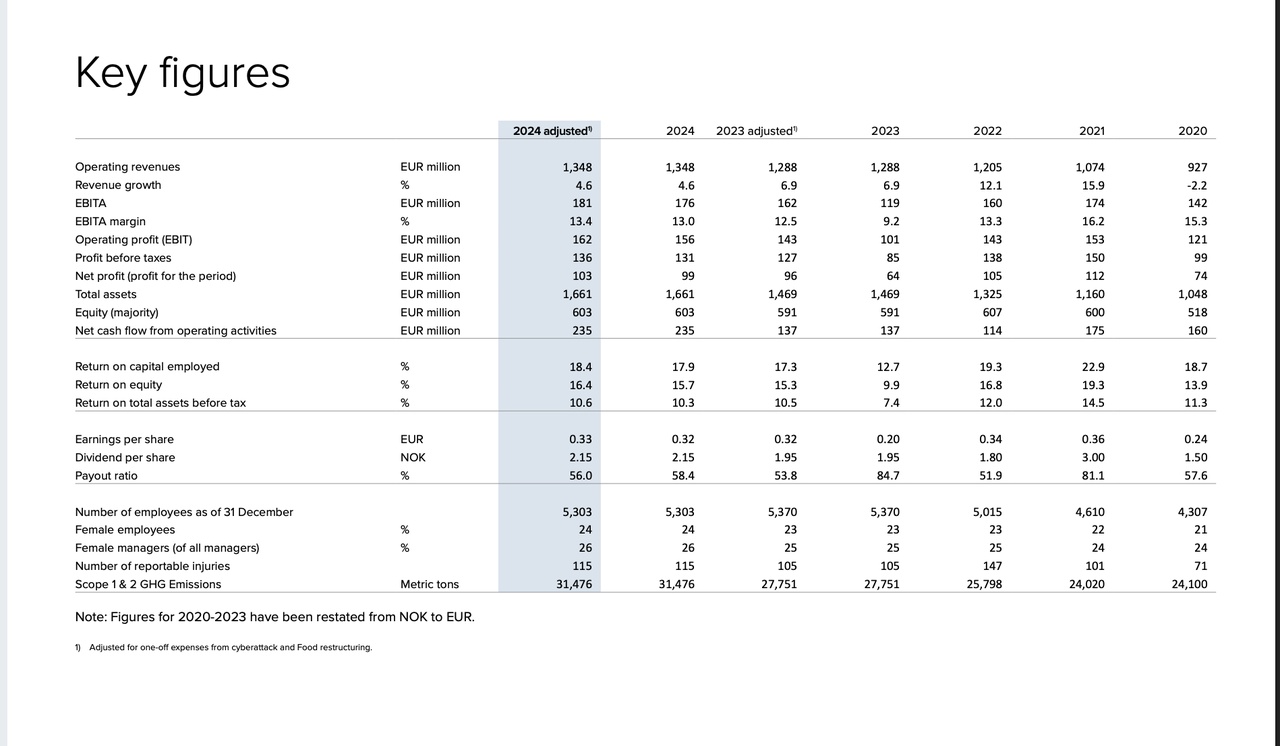

From a fundamental perspective, the company looks good and solid.

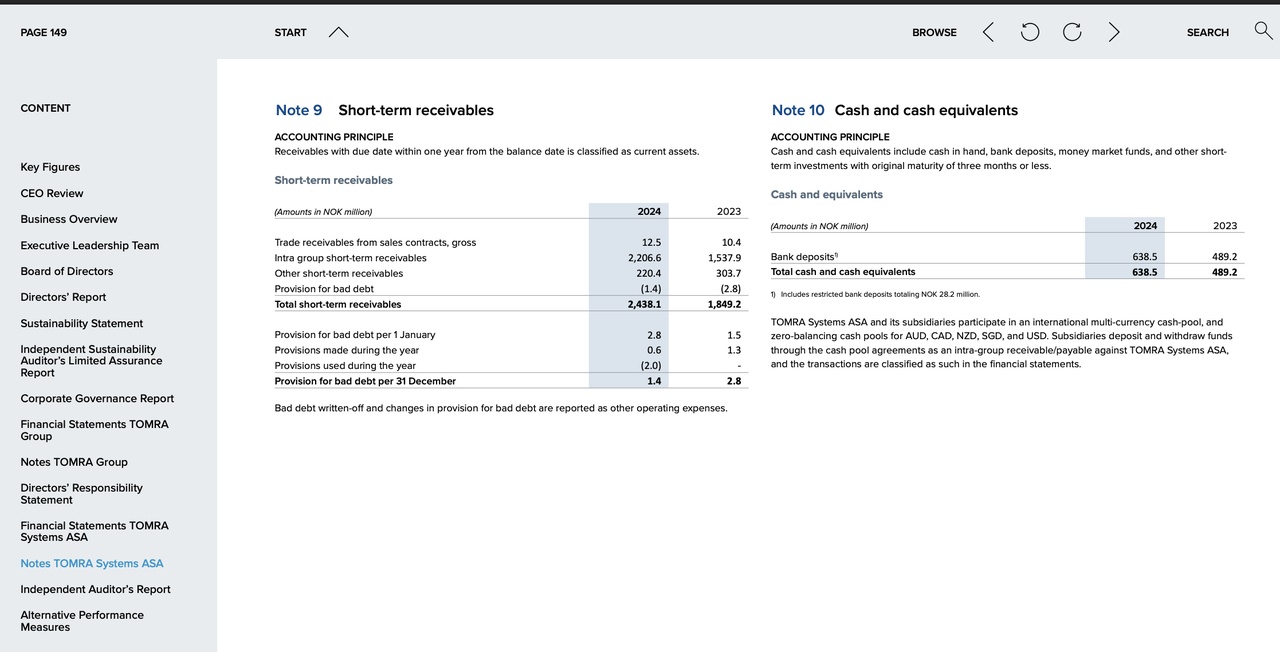

The only thing I am critical of is the steadily increasing debt ratio of around 150%, although the company has also been able to increase its cash reserves.

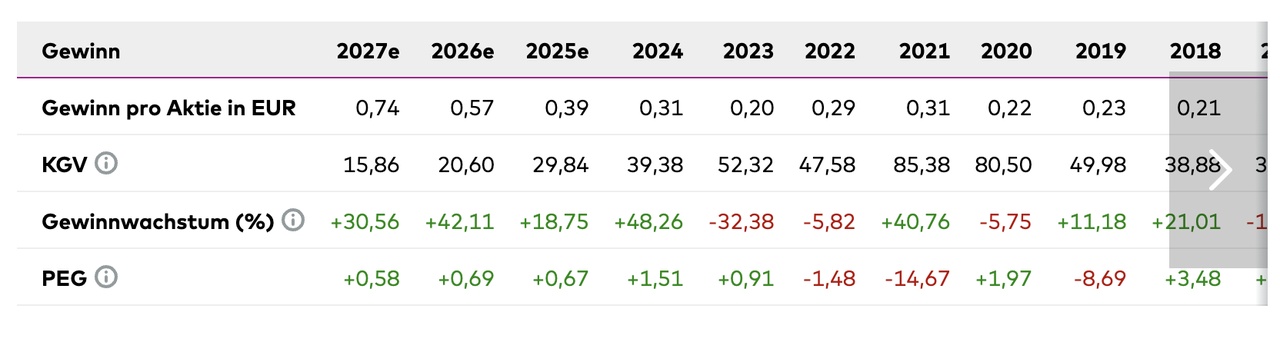

The share reached its all-time high of around €32 in Jan. 2022 and has fallen sharply since then. Today the share is at € 11.87, i.e. > 60 % lower. The low was € 6.80 in October 2023, followed by a recovery and a stable sideways movement.

The reasons for the share price decline could have been the following: A very high valuation without corresponding growth. Falling margins and slower sales growth.

Conclusion:

In my view, Tomra Systems is an interesting company in the long term, which is getting a tailwind for the marketing of its deposit machines due to regulatory requirements such as the EU directive.

Nevertheless, I am critical of the debt and, above all, the share price performance in recent years. Even if the business model itself is solid and they are well positioned for the coming years, not only with the recycling division but also with the food division.

Source: