The second month of 2025 is already over. Time is flying by again at breakneck speed and one event or statement follows the next this year. It's crazy what's going on at the moment and at the same time the market is somehow saying "I don't care".

Up down, up down, the markets are becoming more volatile and yet, or precisely because of this, my February was almost at +/-0.

But one thing at a time.

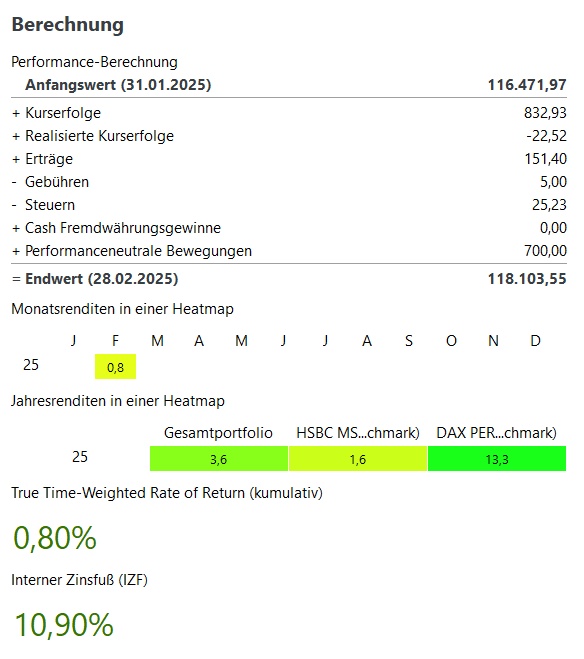

In February I achieved a plus of 0.8%. With my portfolio size, this corresponds to a value of almost €900. Not particularly good compared to the Dax (+3.77%), but still very respectable compared to the HSBC MSCI World (-2.49%).

Unfortunately, things do not look any better over the year (YTD).

The Dax is running away with 13.3%, while the MSCI World is bobbing along at 1.6%. Here, too, I was at least able to beat the World, but I still lag miles behind the DAX.

Overall, however, I am still very satisfied. As I don't have a lot of tech in my portfolio and my stocks are (mostly) rather stable, there is often no outperformance of the stocks and if there is, it is only marginal.

My high and low performers in February were (top 3):

$HSY (+1,93%) Hershey +15.63%

$T (+1,16%) AT&T +14.07%

$NESN (+1,84%) Nestle +13.10%

$ADM (+1,31%) Archer Daniels -8.57%

$UNH (+2,39%) United Health -13.16%

$TSLA (-1,42%) Tesla -27.59%

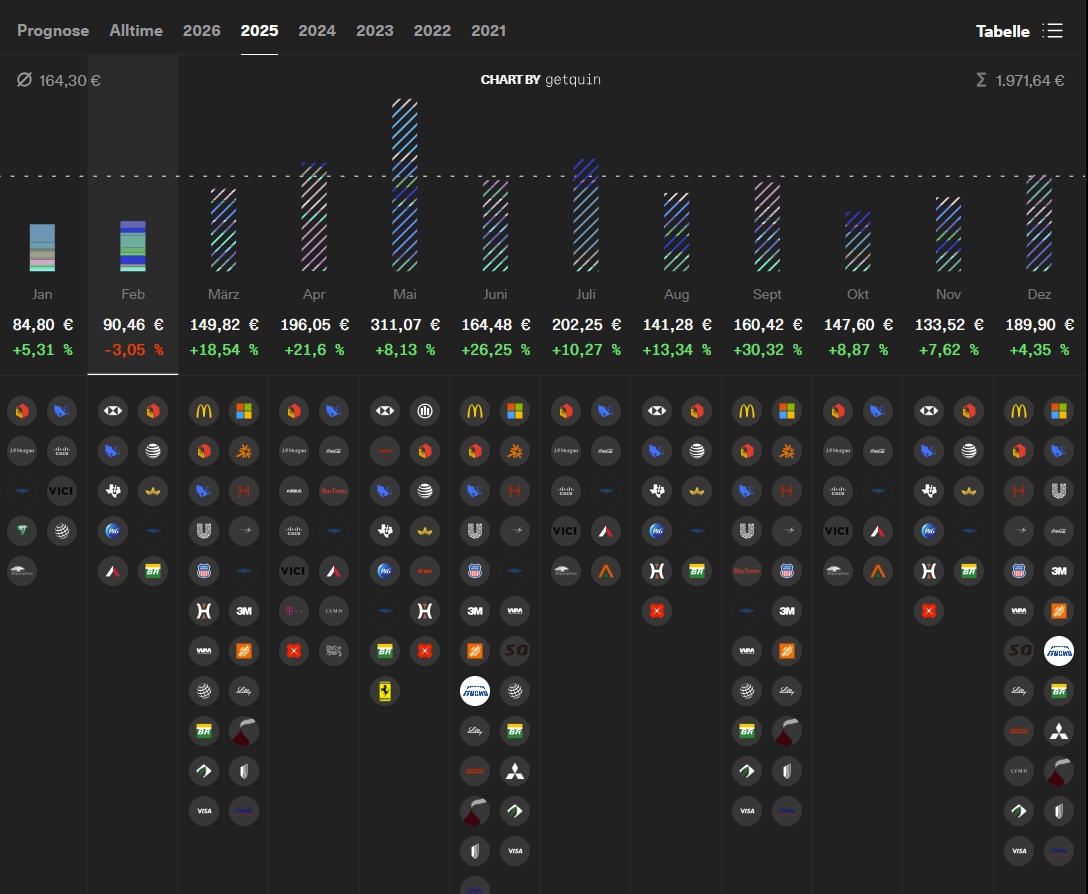

Dividends:

In February, I received a net €123.62 from a total of 10 distributions.

Compared to February 2024 (€99.26), this was an increase of 24.54%

Investments:

Due to the construction work on the house last year, the focus continues to be on building up the nest egg and saving up a "leisure account" again, as everything was really used up completely last year and only the custody account remained.

The savings plans will of course continue unabated, but individual investments are probably not possible for the time being.

Purchases and sales:

I have parted with Mercedes ( $MBG (-0,47%) ) and Medical Properties ( $MPW (-0,19%) ).

I then added to Lockheed Martin ( $LMT (+2,6%) ), Hershey ( $HSY (+1,93%) ) and Petroleo Brasileiro ( $PETR4 (+1,19%) ).

My savings plans remain unchanged, but it is quite possible that I will stop them for the time being in order to build up investment cash again.

Savings plans (350€ in total):

- Realty ($O (+0,76%) )

- STAG Industrial ($STAG (-0,33%) )

- Gladstone Invest ($GAIN (-2,6%) )

- Hercules Capital ($HTGC (-7,01%) )

- Cintas ($CTAS (+1,28%) )

- LVMH ($MC (-3,08%) )

- Monster Beverage ($MNST (-0,42%) )

- Microsoft ($MSFT (+0,04%) )

Goals 2025:

My goal is to have €130,000 in my portfolio at the end of the year. The goal is to be achieved by reinvesting the dividend, making payments and, of course, increasing the share price. The share price increase is of course impossible to predict in any way, so the motto is: if the share price falls or does not rise enough, more cash is needed.

This comes from selling useless stuff on eBay, additional income from e.g. "neighborhood help" etc. The worse the share price, the more additional cash has to be raised.

Target achievement at the end of February 2025: 37.41%

So I'm on the right track (so far). I'm curious to see what else will happen in 2025 and hope that the crash, which seems to be getting closer and closer, will take a little longer (so that I can continue to accumulate cash).

How was your February? Are you happy so far? I think that, due to the volatility, the portfolios in February are far more spread out than they were in January or even at the end of last year.