The shares of UnitedHealth Group ($UNH (+4,71%) ), one of the largest US healthcare groups, has seen a dramatic 50% fall since its all-time high. This is unusual for a company with a stable history and a low beta of 0.56. The share price fall was triggered by a combination of disappointing quarterly results, the surprise resignation of the CEO, the cancellation of the annual forecast and external risks. Nevertheless, various valuation models and technical indicators suggest that the share is undervalued and offers long-term opportunities.

1. trigger of the share price decline

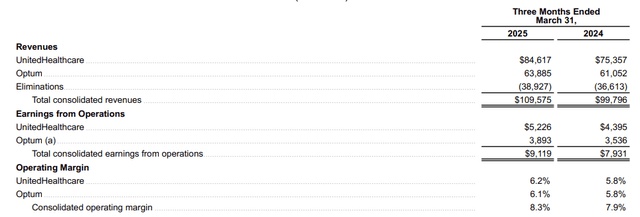

- Slight miss on Q1 2025 results (April 16, 2025):Revenue: $109bn (expected: $111bn), EPS: $7.20 (expected: $7.29).

- Despite the miss, sales grew by almost 10% year-on-year, driven by the UnitedHealthcare and Optum segments.

- EPS growth: 4.2 % YoY and 5.7 % QoQ (after adjusting for cyberattack costs and the sale of the Brazilian unit in 2024)

- Operating margin: Slightly improved to 8.3 % (+4 basis points YoY).

- Main reason for the miss: Higher care costs.

- Reaction: Share fell by over 17 % after publication.

Resignation of the CEO and new management:

- On May 13, 2025, CEO Andrew Witty resigned for personal reasons, causing the share price to plummet another 18%.

- Context: 2024 was a turbulent year for UNH (cyber attack, murder of ex-CEO Brian Thompson), which makes Witty's decision understandable.

- Successor: Stephen J. Hemsley, an experienced manager who was CEO from 2006 to 2017. During this time, sales and EPS grew at a compound annual growth rate (CAGR) of 10 % and 12.4 % respectively.

- Hemsley's target: long-term growth of 13-16 % per year. The market currently considers this to be unrealistic.

- Assessment: Hemsley's experience gives reason to hope that he can overcome the crisis.

Cancellation of the FY2025 forecast:

UNH has completely withdrawn its already downgraded forecast for 2025.

- This led to a massive loss of confidence among investors, as there were no positive aspects to communicate.

- The withdrawal of the guidance justifies the strong sell-off as uncertainty about the future grows.

2 Challenges and risks

- Cost issues:Rising Medicare and Optum costs are weighing on margins.

- Higher care costs could slow future profit growth or even lead to declines, which would make the stock expensive even at current prices.

- High-profile controversies:After the murder of ex-CEO Brian Thompson in 2024, the slogan "Deny, Defend, Depose" went viral and significantly damaged UNH's image.

- This could lead to lower patient growth, more lawsuits and a negative reputation in the long term, even if the results have not yet been directly affected.

- Legal risks:On May 14, 2025, the Wall Street Journal reported on a possible investigation by federal prosecutors looking into whether UNH manipulated risk scores to receive higher Medicare payments.

- Additionally, there is an existing civil DOJ investigation into fraudulent Medicare billing practices.

- Such cases often result in large penalties and can drag on for years, straining the company and investor confidence.

- UNH denies contact with the DOJ and questions the legitimacy of the WSJ report. Nevertheless, this remains a serious risk, as confirmed allegations could jeopardize business relations with the US government.

3. assessment and opportunities

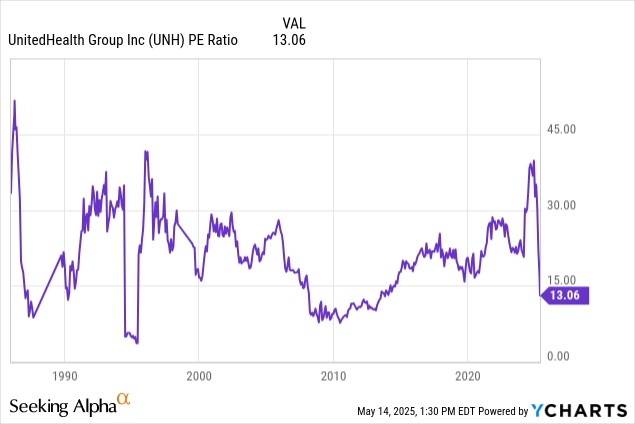

- Valuation models:Multiples valuation:UNH's long-term average P/E ratio is ~18x, currently indicating an undervaluation of 37%.

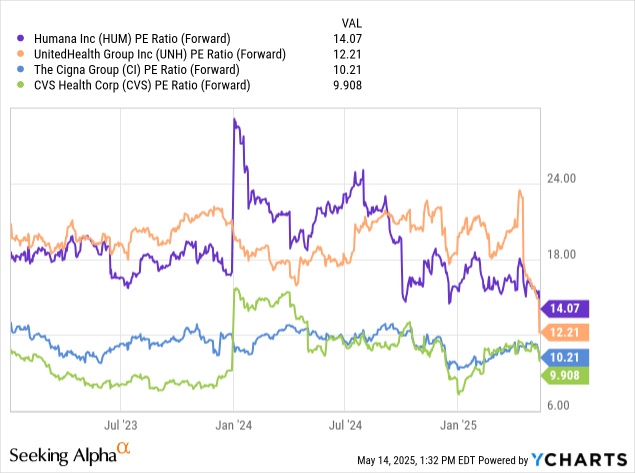

Compared to peers (Humana, Cigna, CVS), UNH is in the mid-range of forward P/E ratios. Due to the most consistent earnings growth history, UNH earns a premium, which makes the stock relatively attractive.

- Dividend Discount Model (DDM):Assumptions: Cost of equity 7.58% (risk-free rate 4.5%, risk premium 5.5%, beta 0.56), dividend next year +10%, long-term dividend growth 5.5% (historical: 19%).

- Result: Value of $432 per share, which implies an undervaluation of 28 %.

- Discounted cash flow model (DCF):Assumptions: Free cash flow (FCF) grows at 5% p.a. for 10 years (historical: 13%), cost of equity 7.58%, terminal growth 1%.

- Result: Present value of FCF by year 10: $194 bn, terminal value: $296 bn, total value: $490 bn.

- After deducting $50 bn net debt and dividing by 918 m shares, this results in a value of $480 per share, which means upside potential of 54 %.

- Technical analysis:The monthly Relative Strength Index (RSI) is at 33, indicating a strong oversold condition, comparable to the 2008 financial crisis. At that time, buying offered high returns.

- Support zones: $315 (currently contested) and $290 (should hold).

- These technical indicators suggest a possible end to the downtrend and a potential recovery.

- Long-term strength:UNH has a strong growth history (10-year FCF growth of 13%, dividend growth of 19%).

- Even with conservative assumptions (e.g. 5% FCF growth), the company remains attractive.

- Historically, UNH has outperformed the S&P 500, especially when investors have stepped in during dips.

4 Conclusion and investment strategy

- Current Situation:UNH is facing significant challenges: Cost increases, legal uncertainties and a tarnished image are weighing on the stock.

- Nevertheless, the share is clearly undervalued according to valuation models (multiples, DDM, DCF) and technical indicators (RSI, support zones).

- Opportunities:The appointment of Stephen J. Hemsley as CEO brings stability and experience, which could enable a turnaround.

- In the long term, UNH's business model remains robust as demand for healthcare services in the US is high.

- Historically, share price declines at UNH have always offered good entry opportunities.

- Risks:If costs continue to rise or legal issues escalate, earnings growth could fail to materialize, making the stock less attractive.

- Negative headlines could further undermine customer and investor confidence.

- Conclusion:For long-term investors, the current valuation offers an attractive risk/return ratio.

- Strategy: Establish an initial position and hold the stock for the long term, as has been historically successful.

- Investors should closely monitor developments in the DOJ investigation and cost trends.

Despite the crisis, UNH remains a company with strong fundamentals and an experienced management that has successfully mastered crises in the past. The current drop in the share price could represent a rare opportunity for patient investors, but I am continuing to analyze the company in greater depth before investing just €1.

Disclaimer: No investment advice + The information was my input written by LLM