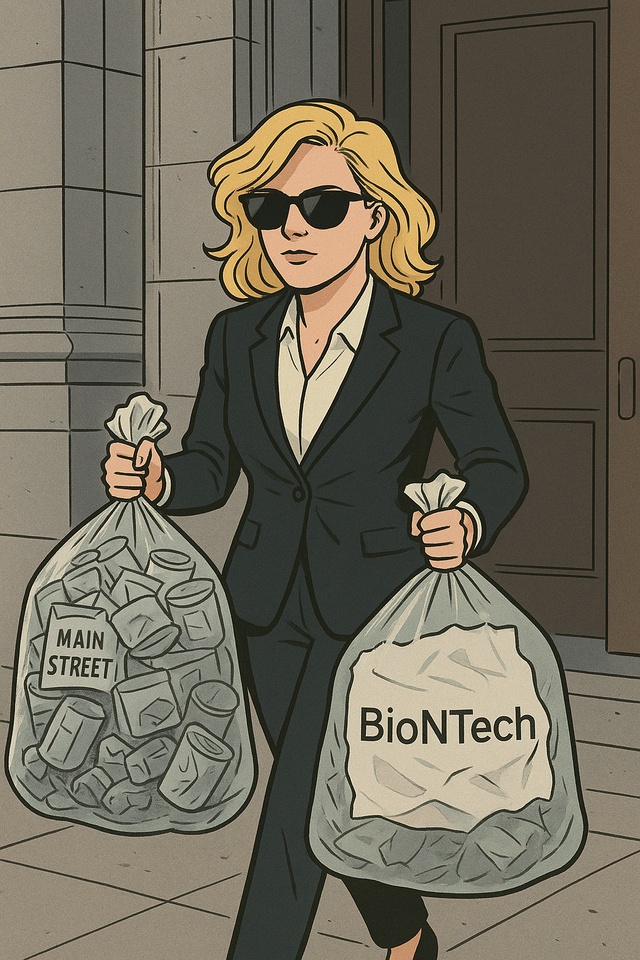

I am considering selling BioNTech and Main Street Capital.

I would use the capital freed up to expand existing positions if the opportunity arises or, if no attractive opportunities arise in the next few weeks, simply switch into my ETFs.

I currently see too many risks with BioNTech: The pipeline is exciting, but competition in the biotech sector is fierce and the big players (Pfizer 😎 etc.) are already strongly established. In addition, the market currently seems to be valuing the company less because of actual progress and more out of speculative interest.

In my opinion, Main Street Capital has benefited greatly from a certain amount of hype in recent months, probably triggered by Finfluencer due to the dividend (left pocket, right pocket...). The quarterly figures were definitely weak in 2025, and I also see risks due to monetary policy, high interest rate sensitivity (although one could probably still benefit here in the short term), but the general banking and economic situation could also hit Main quite hard. Am I seeing this wrong?

How do you see it? Are these shares dirt?