Hello my dears,

Today I have picked out a company from Poland for you.

US. We've had enough US companies recently, and there's already been a Japan special.

And we are supposed to diversify.

Today I focused on growth in my selection.

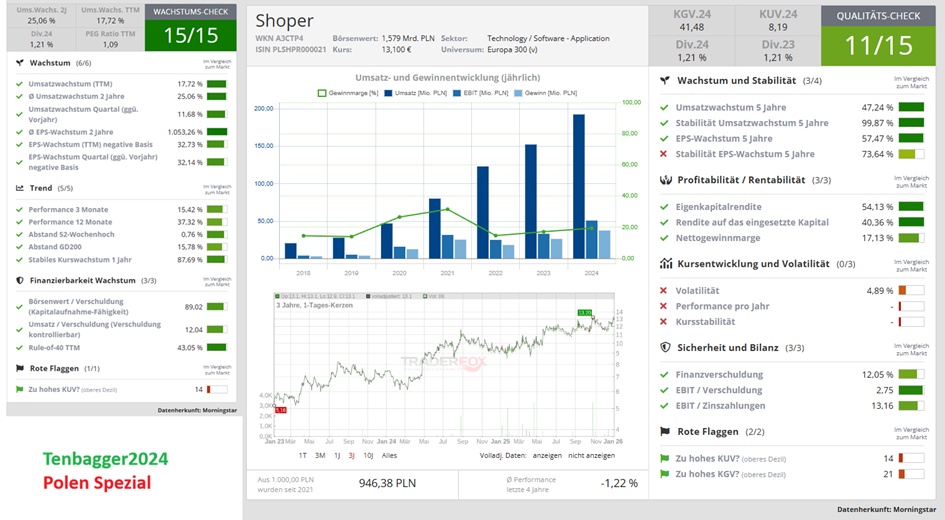

With 15 out of 15 points in the Traderfox growth check, I should be able to achieve this with Shoper I should have succeeded.

Shoper is a software-as-a-service providerthat enables retailers to their own online stores similar to Shopify, but with a strong focus on the Polish market.

🧩 Business model

Shoper operates a classic SaaS model with recurring revenues:

🔹 1. subscription-based store software

- Private label stores for retailers

- Hosting, templates, store management, integrations

🔹 2. additional services (most important growth driver)

Shoper has an ecosystem that provides retailers with numerous services:

- Marketing & advertising services

- SEO & positioning services

- Payment processing (Shoper Payments)

- logistics solutions

- Security solutions

- Shoper Connect (integration online ↔ offline)

The share of these additional services in sales is set to increase to 80 % by 2026

As always, I look forward to your views in the comments.

Who knows the company or is already invested?

Shoper SA is a Poland-based company that operates an internet store with online payments. The company's software includes all the necessary tools and integrations for professional online sales: modern payments, bilateral integration with Allegro, courier services and magazines as well as a Facebook store.

Number of employees: 321

Fundamental

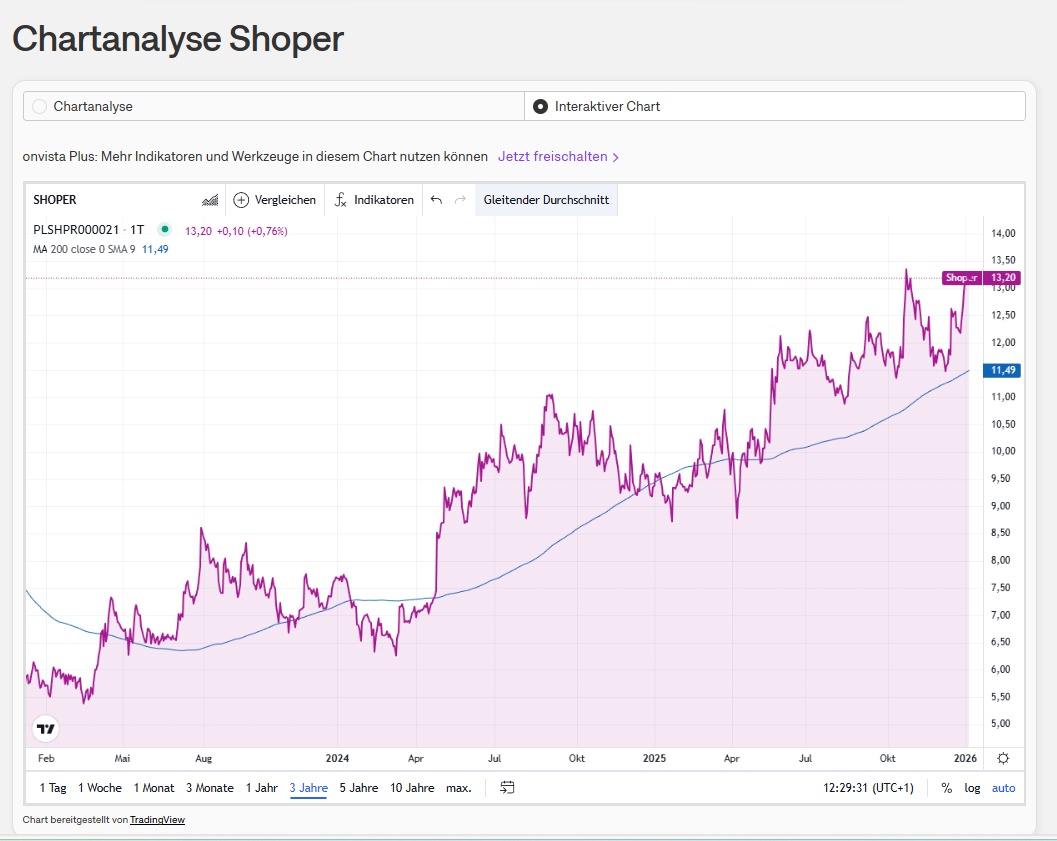

Shoper Spolka Akcyjna Bearer Shs Share Profile

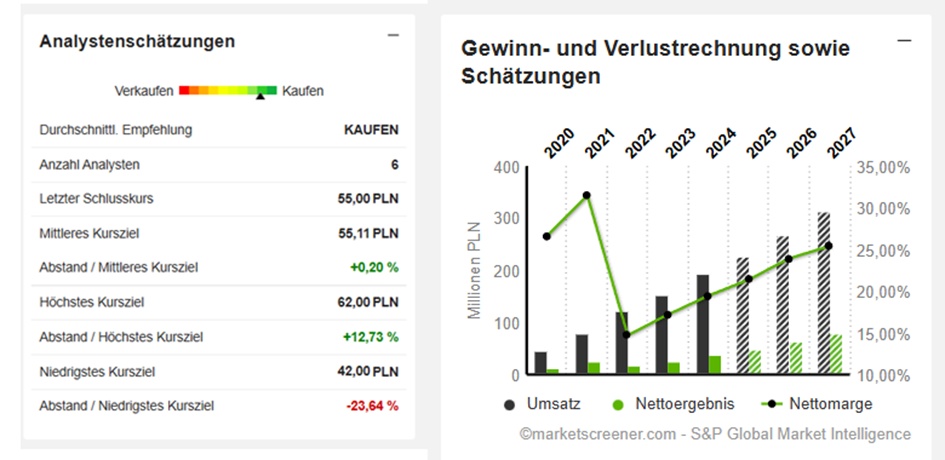

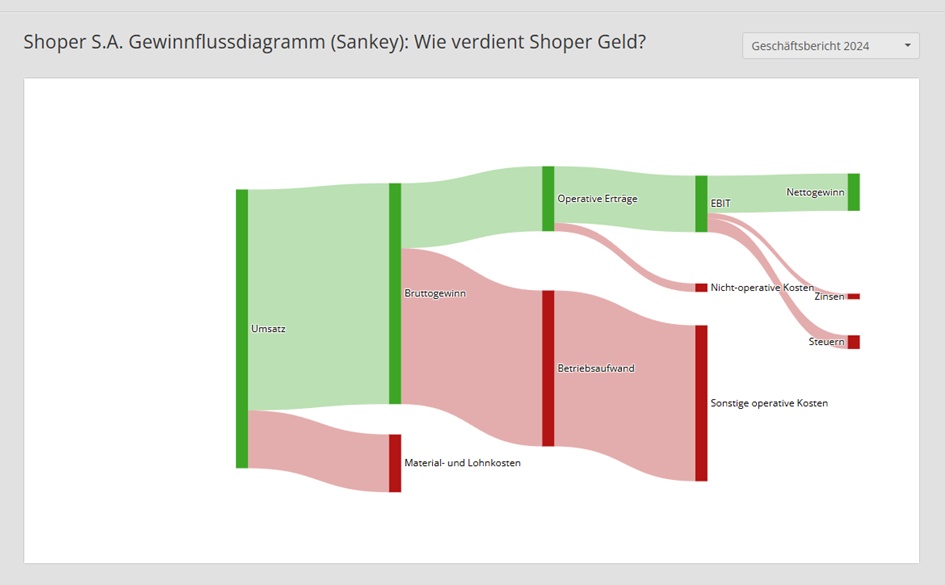

The Shoper Spolka Akcyjna Bearer share is traded under ISIN PLSHPR000021. In the past financial year, Shoper Spolka Akcyjna Bearer generated sales of PLN 192.8 million, which corresponds to growth of 26.35% compared to the previous year. The operating profit amounted to PLN 45.27 million, an improvement of 42.82%. Net profit for the year amounted to PLN 37.51 million, an improvement of 42.86%. As at the balance sheet date, the company had total assets of PLN 153.39 million. Reported equity amounted to PLN 73.96 million, which corresponds to an equity ratio of 48.21%. Total debt amounted to PLN 18.49 million, with a debt/assets ratio of 12.05%. Shoper Spolka Akcyjna Bearer had 353 employees at the end of the financial year, a decrease of 2.22% compared to the previous year. Turnover per employee amounted to PLN 0.55 million. The company paid a dividend of PLN 1.03 per share for the past financial year, which corresponds to a dividend yield of 2.59%. The price/earnings ratio (P/E ratio) is 29.77 and the price/book ratio (P/B ratio) is 15.1.

Investments in AI

New products:

- SIBS Gateway (online payment solution)

- Findnado - AI-based e-commerce search engine

Prezentacja programu PowerPoint

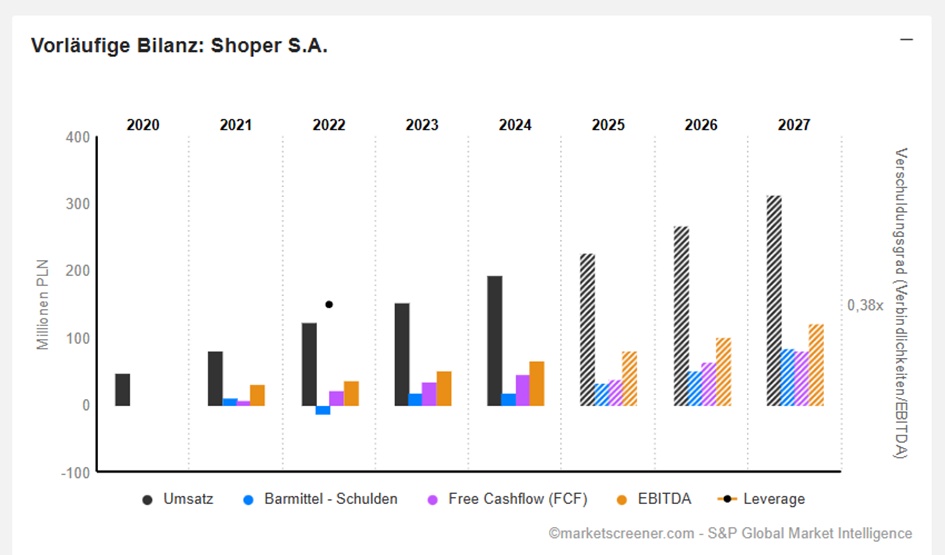

Historical fundamental figures

PLN in millions

Estimates

Year Turnover Change

2024 192,8 26,35 %

2025 227,0 17,74 %

2026 267,3 17,73 %

2027 313,3 17,24 %

Year EBIT Change

2024 44,96 42,26%

2025 61,50 36,80 %

2026 78,86 28,22 %

2027 97,18 23,24 %

Year Net profit Change

2024 37,51 42,86 %

2025 48,55 29,44 %

2026 63,95 31,71 %

2027 79,58 24,45 %

Year Net debt CAPEX

2024 -18,7 14,55

2025 -32 17,95

2026 -51,4 19,75

2027 83,8 20,10

Year Free cash flow Change

2024 46,04 34,84 %

2025 37,88 -17,71 %

2026 63,87 68,59 %

2027 80,22 25,60 %

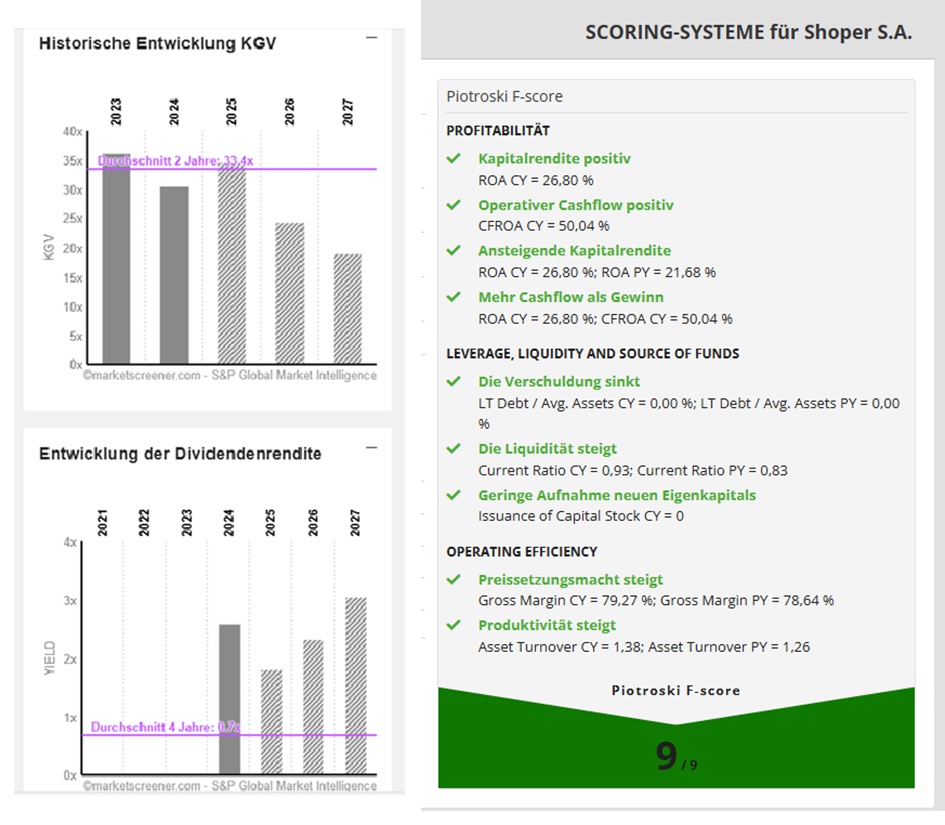

Year EBIT Margin ROE

2024 23,32 % 57,64 %

2025 27,09 % 56,70 %

2026 29,51 % 56,56 %

2027 31,02 % 54,70 %

Year Earnings per share Change

2024 1,3 42,86 %

2025 1,59 22,31 %

2026 2,258 41,98 %

2027 2,897 28,31 %

Year P/E ratio PEG

2024 30.5x 0.7x

2025 34.6x 1.6x

2026 24.4x 0.6x

2027 19x 0.7x

Year Dividend p share Yield

2024 1,03 2,59 %

2025 1,002 1,82 %

2026 1,283 2,33 %

2027 1,682 3,06 %

Number of shares (in thousands) 28,135

PLN in millions

Market value 1,547

Date of publication 28,03,2025