I've had the app for a long time. I rummaged around a bit and then dismissed it as a gimmick: SplintInvest and alternative investments.

With some time on the train, however, I took a closer look and was quite positively surprised. So here is my mini-analysis from the train:

What do I mean by "alternative investing"?

In this context, I would summarize it quite simply as follows: Investments in "real goods", with a limited number of units. For example:

- Scotch whisky 🥃

- Sneakers 👟

- Lego & works of art 🖼

- Watches, handbags or cars 🚗

With SplintInvest, you don't buy the whole barrel or the whole Rolex, but a small digital part of it (called a "splint" at SplintInvest) - from €50.

An exit example: 23.6% profit with a whisky investment in 2.2 years = approx. 10.1% p.a.

What are the real benefits of alternative investments?

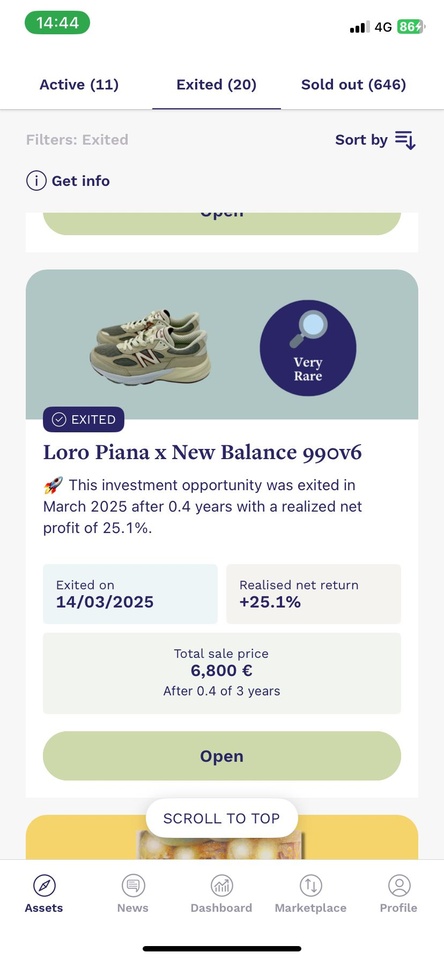

Two randomly selected exits are already quite impressive:

- +23,6 % with "Jura 2013" whisky (after 2.2 years)

- +25,1 % with Loro Piana x New Balance sneakers - in just 5 months (!)

A gain of 25.1 % in less than half a year? You have to achieve that with ETFs...

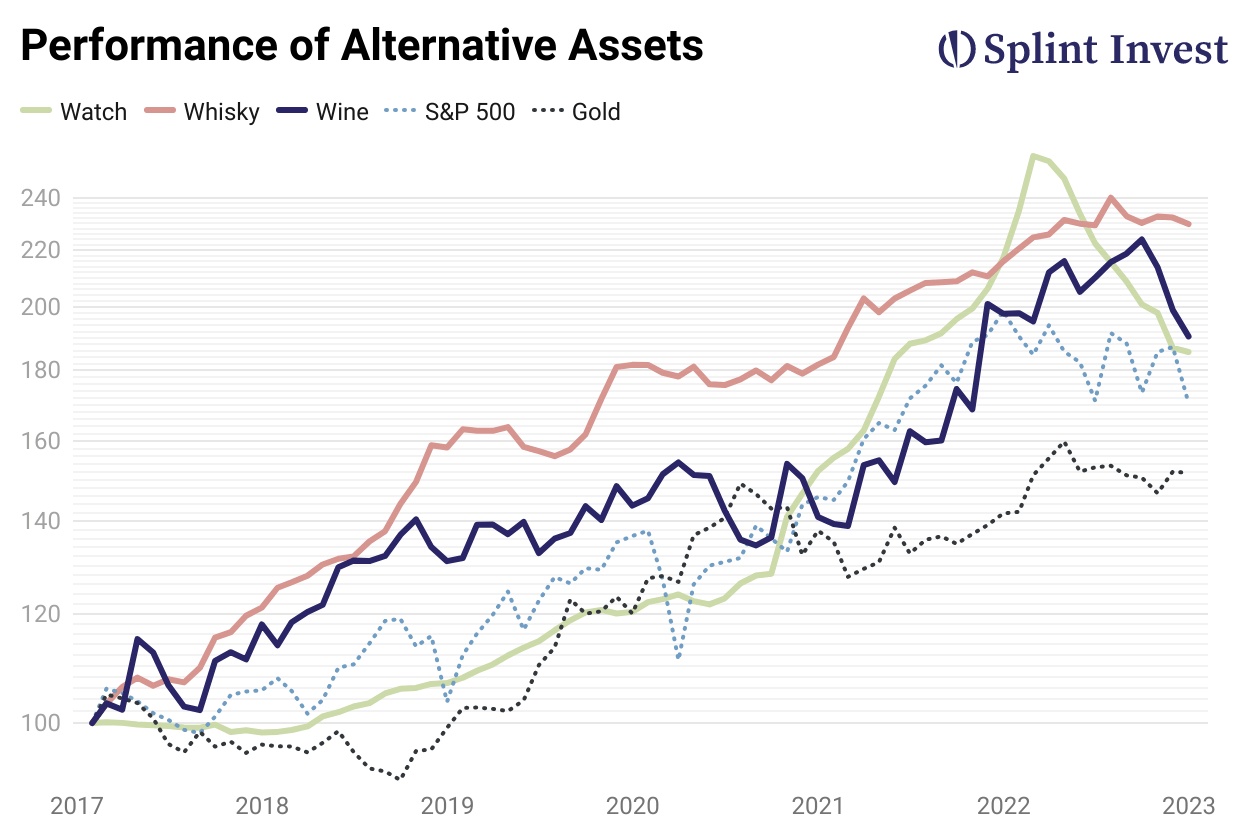

And how does that compare with the stock market?

Here we see that whisky, wine and watches have in some cases outperformed the S&P 500 in recent years. better than the S&P 500 [But note the time span].

Sure, not equally strong every year - but in the long term really competitive.

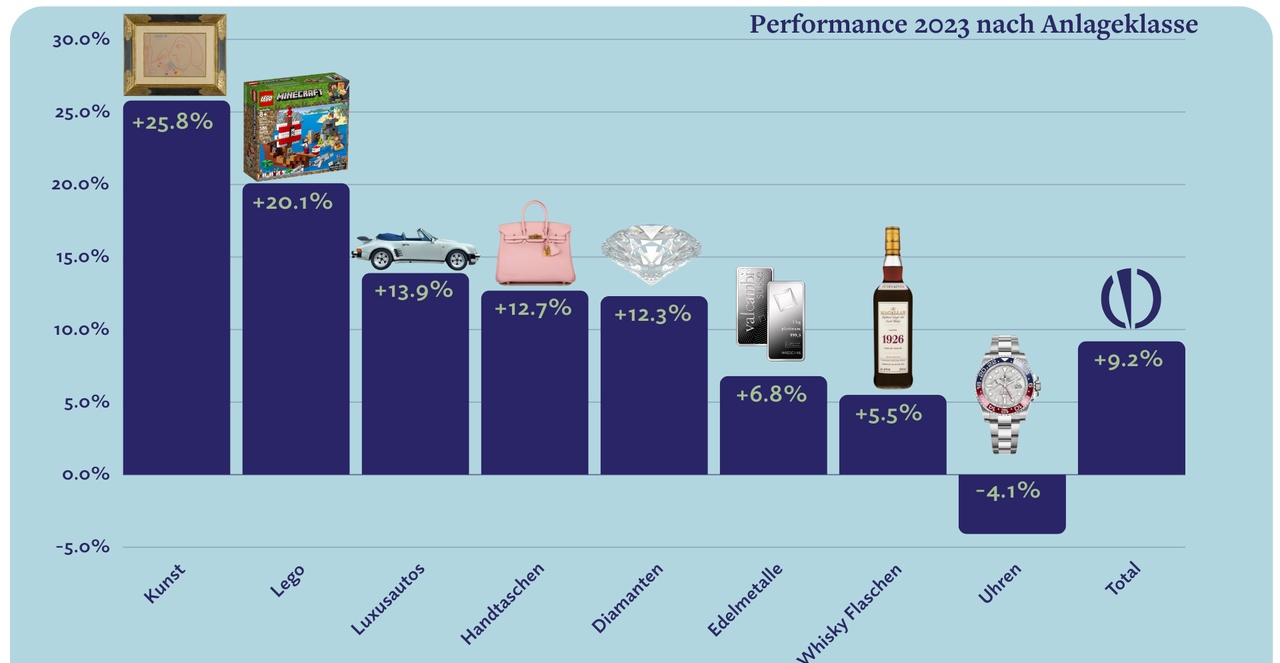

Here is the performance from 2023, more recent figures could not be found:

What does it all cost?

Splint is transparent, but it's not free:

- 4-6 % fees on purchase (incl. storage & insurance)

- 2 % exit fee, for secondary trading another +2 %

- No subscription, no performance fees

(Important: The return shown is apparently after deduction of fees).

How to sell again?

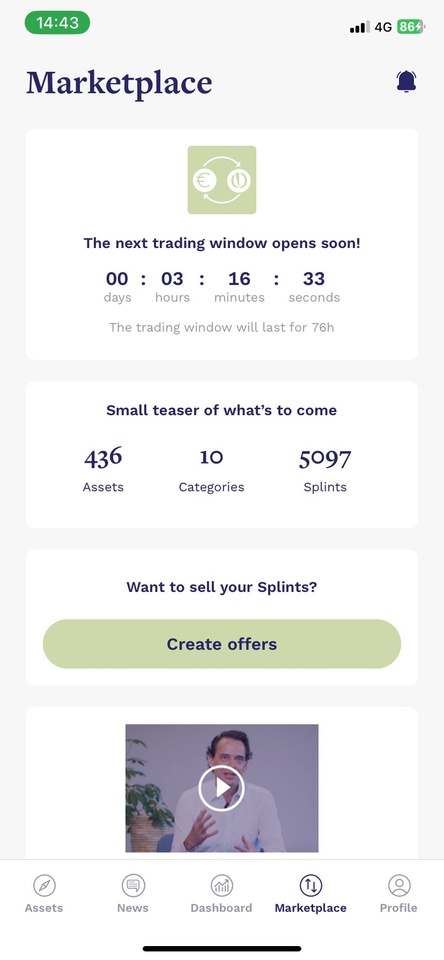

Splint works with a "trading window":

Every few weeks the secondary market opens for 72h. You can then sell splints or buy new ones.

Currently: 436 assets in 10 categories with over 5,000 splints in circulation.

Is it worth it?

If you do it right - yes.

✔ Returns of 10-25 % p.a. are possible

✔ Entry from € 50

✔ Low correlation to the stock market

✔ Also "fun factor" - art & sneakers are more emotional than dividends

But:

❗ Liquidity is limited - you are dependent on the trading window

❗ Short-term flips are a matter of luck - many assets run for years

❗ Only a small portfolio share (5-10%) makes sense - no substitute for ETFs

Alternative investments via splint investing are not a "get rich quick" solution - but an exciting addition for anyone who wants to diversify their portfolio - or just a love affair if you can't (or don't want to) buy the Porsche quite yet, as $DRO (-2,15%) or $SOFI (+0,46%) not quite going off as desired 😉 This can only be achieved @Charmin with $NVDA (-3,33%) the lout.

I'll definitely have a look at the next Trading Window - and maybe take a sip of whisky, Pokemon cards or a Lego set with me (for performance reasons, of course 😉). The notifications are definitely switched on again.

If you're interested in the topic:

Let me know - I'll be happy to do a follow-up with figures, strategies or further exits.

I've also "briefly" added my referral code to the link tree for those interested. The train ride isn't completely free 😉 You can find information about it there, I don't need to go into it here.

Happy investing

GG

Here still NOT tested alternatives, according to ChatGPT:

- Timeless (DE)

- Investments in sneakers, watches, art & co. - very similar to Splint. Entry from 50 €, based in Berlin. Focus: pop culture assets.

- Convi (EU)

- Specialized in watch investments. Co-ownership model, also from € 50, long-term investment horizon. Based in Estonia.

- Collectable (USA)

- Focus on sports memorabilia (e.g. Jordan jerseys, baseball cards). US platform, strongly geared towards collector target group.

- Rally Rd. (USA)

- Fractional investing in cars, comics, sneakers, rare books. Cool app, but currently only accessible to US investors.

- Masterworks (USA)

- Investments in blue-chip art (e.g. Basquiat, Banksy). Entry at approx. 500-1,000 USD. Very focused, but with a strong track record.

- Mintus (UK)

- Similar to Masterworks, but British. Access to artworks via tokenization.

- Alts.co

- Newsletter + platform around alternative assets. Focus on analysis, no direct investment access, but great for knowledge & deals.

- Upcide (CH)

- Swiss platform for fractional real estate and tangible assets (still under construction / early stage).