Foreword:

An investment reserve can be a great thing, it smoothes out volatility and in extreme phases you have the opportunity to implement something meaningful in your portfolio, which has a very calming effect psychologically.

Unfortunately, the expected additional return from buy the dip often fails to materialize, as the opportunity costs eat everything up again.

Very nicely described here by Gerd Kommer:

https://gerd-kommer.de/buy-the-dip/

But what if we turn a few screws, don't hold our investment reserves in cash and buy leveraged?

I have thought too much about this topic and built a model for a war chest, which I am also implementing myself.

Building up the reserve:

Investment Reserve

-------------------------------------------

EURO

30.0% Money Market / 0-1y Bonds EUR $CSH2 (+0,01%)

30.0% German Gov. Bonds 7+Y $X03G (-0,06%)

-------------------------------------30%

Swiss Franc

20.0% Swiss Gov.Bonds 7-10Y $CH0440081393 (-0,04%)

-------------------------------------20%

Swiss Gold

20.0% Gold $EWG2 (+2,75%)

-------------------------------------20%

==========100%==========

The reserve must be structured in such a way that it is not torn apart in a crisis. In the best-case scenario, parts of the reserve should even rise during crises.

This is why part of it consists of government bonds; in economic crises, interest rates are generally lowered, which is why long-term bonds should rise.

As inflationary phases may well occur, I have decided to include gold, especially as gold has a low correlation with equities.

The total of 30% in money market funds exists in order to have a volatility-free position.

This reserve is not a standalone, it should be seen as part of a global portfolio and can make up between 10% and 30% of the total portfolio.

It is not intended to generate returns, but merely to compensate for inflation and to remain stable in value during crises.

The strategy:

As an anchor point we use the all-time high of the $ACWI (USD) from -10% we invest step by step. We try to buy the ACWI with increasing leverage. As there is no 2x ACWI, FTSE All-World, MSCI World or similar, we have to build our own as best we can. I only try to use ETFs and ETCs as long as this is practical, as they have no counterparty risk.

Mode 1 ACWI -10% - Lev. 1.28x - Correction

5.0% MSCI USA 2X Lev. $CL2 (+4,6%)

12.5% World ex USA $EXUS (+1,72%)

-------------------------------------17,5%

Mode 2 ACWI -20% - 1.55x Lev - Crisis

5.0% MSCI USA 2X Lev. $CL2 (+4,6%)

4.5% Euro Stoxx 50 2X Lev. $LVE (+3,48%)

1.5% FTSE 100 2X Lev. $LUK2

3.0% Japan $PRAJ (+3,32%)

6.0% Emerging markets $EIMI (+2,1%)

-------------------------------------20,0%

Mode 3 ACWI -30% - 1.68x Lev - Escalation I

12.5% MSCI USA 2X Lev. $CL2 (+4,6%)

6.0% Euro Stoxx 50 2X Lev. $LVE (+3,48%)

2.0% FTSE 100 2X Lev. $LUK2

4.0% Japan $PRAJ (+3,32%)

5.5% Emerging markets $EIMI (+2,1%)

-------------------------------------30,0%

Mode 4 ACWI- 40% - 3x Lev. - Escalation II

32.5% MSCI ACWI 2x Lev. $null (+2,14%)

-------------------------------------32,5%

==========100%==========

Rebalancing

After the crash is before the crash, the investment reserve must be replenished.

After the price has recovered a distance of approx. 60% from the low to the top (ACWI), I would recommend selling all MSCI ACWI 2X Lev. positions and thus filling the reserve.

You can then fill the rest of the reserve with your savings rates and partial sales of the 2x positions.

Since we do not put the return from this "trade" completely back into the bond, but keep a part of the "Do-It-Yourself-Leveraged-Getto-ACWI", we build up a small leverage over time, at favorable conditions.

Problems and risks:

Especially if it goes down further than 50%, things can get ugly.

In the 2019 financial crisis, for example, we would have made -58%. As a result, the recovery would have taken 1 year longer than if we had bought a normal ACWI. However, in all other corrections (including Corona), we would have come out of the crisis better with this strategy and would have generated an annual outperformance of 1-2% p.a. after tax (varies depending on the period).

In long bull markets, without significant corrections, this strategy underperforms. In sideways markets, we should outperform a 100% equity portfolio due to the interest income.

It is not entirely clear which part of the investment reserve will be sold first and which last. Depending on the nature of the crisis, some shares may rise and others may fall.

If it is a debt crisis, for example, it may not be wise to sell your gold right at the beginning. If it is an economic crisis, long-dated bonds are king, although inflation-linked bonds will probably suffer somewhat.

If you don't want to be caught on the wrong foot here, you can always sell 50% of the best-performing asset and 50% of the worst-performing asset at the same time.

Which wouldn't be a good thing if we had two cycles in quick succession before we had the opportunity to rebalance.

Colorful pictures:

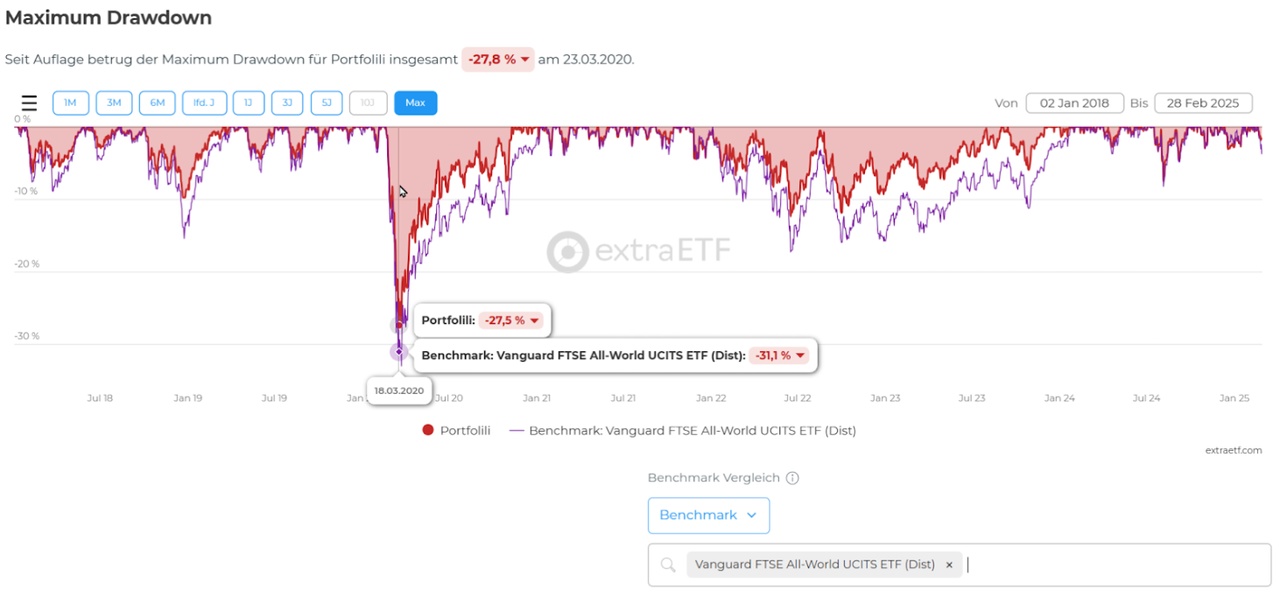

I have recreated the period from 01.01.2018 to 01.01.2025 in ExtraETF.

Unfortunately, you can't currently share the portfolio there, which is why I've used a few screenshots here.

I chose this period because I am familiar with it and it had both negative and positive interest rates. In addition, there were a total of 3 drops of more than 10% and a bond crash.

Note during the negative interest rate phase, the portfolio held no bonds (except the inflation-indexed ones) and instead held negative interest cash.

Here you can see a

100% FTSE-All World $VWCE (+1,89%) vs

80% FTSE-All World + 20% investment reserve.

Maximum Drawdown VS FTSE-All World

Although we buy leveraged products, the maximum drawdown is lower, at least as long as it does not go lower than approx. 35%.

The meme for Sunday (even if it's not Sunday):

I have created an 80% FTSE All-World + 20% Reserve portfolio starting 01.01.2025 and will continue to maintain this, so everyone can see the real performance of this module. And of course I will update you when we are down 10%.

What do you think of the pyramized investment reserve and the Do-It-Yourself-Leveraged-Getto-ACWI?