$ULTA (-1,51%) has been one of our favorite holdings.

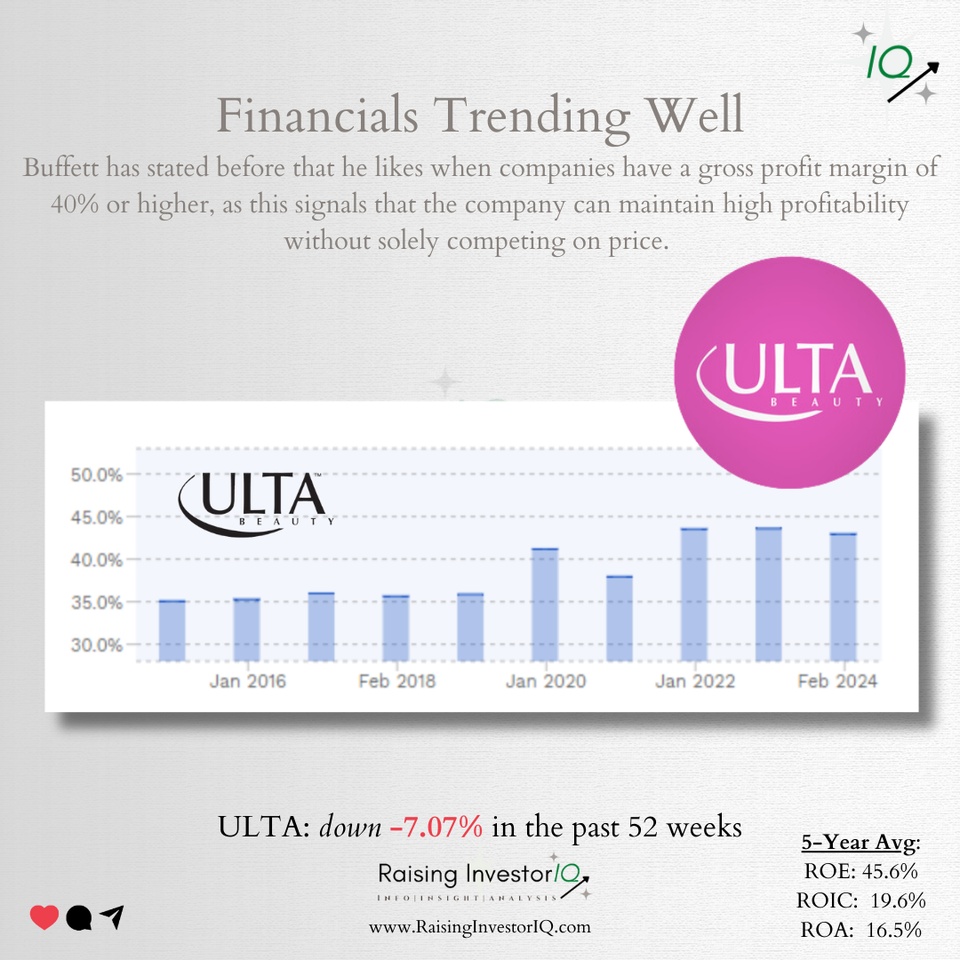

Take a look at its historical ROE. For the trailing 12 months, this figure comes out to 55%, and the five-year average is 46.9%. Generally, an ROE over 20% is considered to be very high in that industry.

The company has also achieved this high level of ROE without the use of much debt.