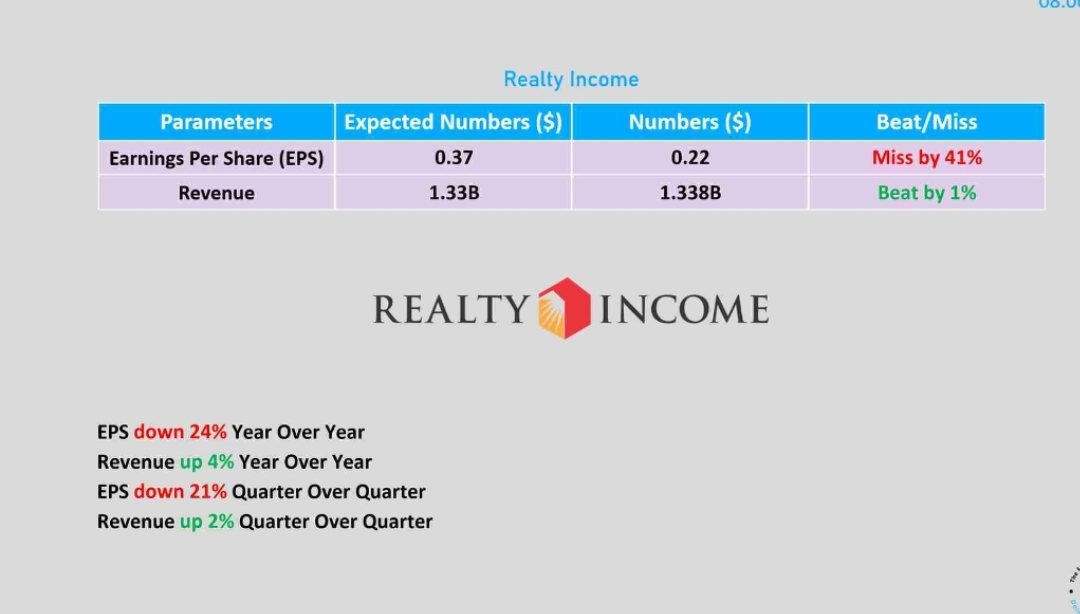

Earnings Update: Realty Income (O) presented mixed results. The company missed expectations for earnings per share (EPS) by a significant margin of 41%, with actual EPS of $0.22 versus an expected $0.37. This reflects a 24% year-on-year and 21% quarter-on-quarter decline in EPS.

However, there is also good news. Revenue (revenue) exceeded expectations by 1%, coming in at $1.338 billion, versus the expected $1.33 billion. Revenue also showed positive growth of 4% year-on-year and 2% quarter-on-quarter.

These results paint a complex picture. The strong revenue growth indicates continued demand and a robust operating base. However, the sharp decline in profitability may indicate higher costs or other operational challenges. Investors should review the details of the report and conference call to understand what is pressuring profitability. The stock price reaction will likely depend on how the market values the balance between revenue growth and declining earnings per share. $O (-0,45%)