Hi there,

Today I would like to introduce you to Alzchem Group AG.

A brief introduction:

$ACT (+2,75%) based in Trostberg (Bavaria) is one of the more quiet representatives of the German chemical industry. It is a company that has undergone a clear strategic realignment in recent years.

Alzchem historically comes from the traditional chemical industry, but has increasingly focused on higher-value specialty products. It is precisely this change that is exciting from an investor's perspective.

The business model is broadly based. Alzchem supplies various end markets. From nutrition and pharmaceuticals to industrial applications and highly specialized niches. In some areas, the company is one of the few one of the few suppliers

OUTSIDE CHINAwhich is a factor that should not be underestimated in times of sensitive supply chains.

Financial perspective:

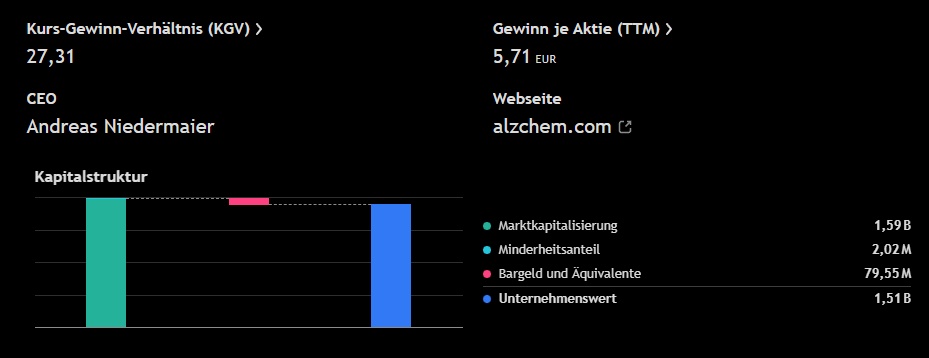

From a financial perspective, it is noticeable that the company is performing rather moderately, while earnings and cash flow are growing more strongly. This speaks for a better product mix and greater efficiency. In the chemical industry in particular, this is often more important than pure volume growth.

Earnings per share are rising much faster than sales - an indication that Alzchem is growing not by volume but by margin.

Future:

Alzchem is faced with the task of consistently pursuing the path it has taken. The increasing focus on higher-margin specialty products, the improved cost structure and the recent solid cash flow development basically offer good conditions for further profitable growth. At the same time, external factors such as the economy, energy prices and raw material costs remain decisive for future development.

This company offers more of a long-term investment with many opportunities. In addition, there is a dividend of €2.42 per share. (once a year)

Sources: