Hello my dears,

Anyone who knows me knows how much I like to think outside the box and look for exciting blade suppliers in the boom sectors.

And today I've taken a look for you at who actually offers the equipment, digital and automated solutions and technologies in the raw materials sector.

And what I have found for you Metso $METSO (+0,83%)

What do you think of shovel suppliers and Metso?

Metso Outotec Oyj specializes in the design, development, construction and maintenance of factories and equipment for the metallurgical and mining industries. The breakdown of net sales by activity is as follows:

- Mining (75.2%): Crushing machines, screening machines, conveyors, etc.;

- Aggregates industry and quarries (24.8%): Production plants, stations, modules and equipment, crushing and screening plants, conveyors, etc.

The geographical breakdown of net sales is as follows: Finland (3 %), Europe (15.2 %), South America (23.4 %), North and Central America (22.2 %), Asia/Pacific (21 %), Africa/Middle East/India (15.2 %).

Number of employees: 17,874

Metso is a pioneer and global leader in sustainable technologies, end-to-end solutions and services in aggregates, mineral processing and metal refining. By improving our customers' energy and water efficiency, increasing their productivity and reducing environmental risks with our product and process expertise, we are the partner for positive change.

Metso signs a landmark contract for a major copper smelter delivery in Asia

Fri, 09 Jan 2026 08:00 CET

Metso to supply high-capacity crusher to Grupo Mexico's copper concentrator plant in La Caridad

Tue, December 30, 2025, 13:00 CET

Metso announces updated strategy and new financial targets

Wed, Sep 24, 2025

Metso kündigt aktualisierte Strategie und neue finanzielle Ziele an – Metso Corporation

Metso Corporation will publish its financial reports in 2026 as follows

- Review of financial reports for 2025 on February 12, 2026

- Annual report for 2025 during the week of March 2, 2026

- Interim report for January - March 2026 on April 22, 2026

- Half-yearly financial report for January - June 2026 on July 24, 2026

- Interim report for January - September 2026 on October 22, 2026

The Annual General Meeting is scheduled for April 22, 2026 Metso's Executive Board will announce the convening of the Annual General Meeting in a separate stock exchange announcement.

Aggregate production

Customers in the aggregates markets need reliable crushing and screening equipment to produce or recycle aggregates for infrastructure or construction companies. The global market consists of large international companies and numerous smaller, more regional or local companies.

Metso's offering for aggregate customers includes grinding machines, screens and feeders, fixed and mobile screening plants, track-mounted equipment, spare and wear parts and services.

Mineral processing

Our unique offering and process expertise for mining customers starts with professional testing and pilot support and includes a comprehensive range of solutions for the entire process, from crushing and grinding to separation and filtration solutions, including advanced retention management. Our offering includes material handling equipment and slurry pumps as well as spare and wear parts and services. We provide comprehensive solutions and services to maintain and optimize process and equipment performance with advanced digital solutions and intelligent automation and control systems. For the growing battery industry value chain, Metso provides sustainable technology, equipment and black mass recycling.

Metal refining

Our metal refining customers are large and medium-sized mining companies as well as local mining and metallurgy companies.

For metal refining, Metso offers advanced melting solutions covering all types of oxidation, reduction and vaporization processes for the treatment of primary and secondary raw materials. Metso's sustainable flash smelting process is currently the most widely used copper smelting process in the world and results in high recovery of metals at the lowest total cost of ownership.

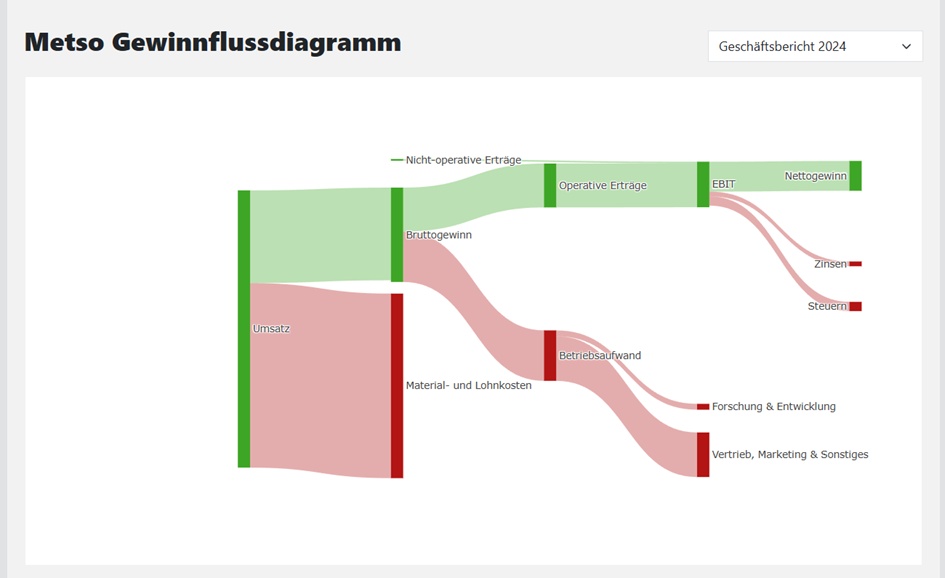

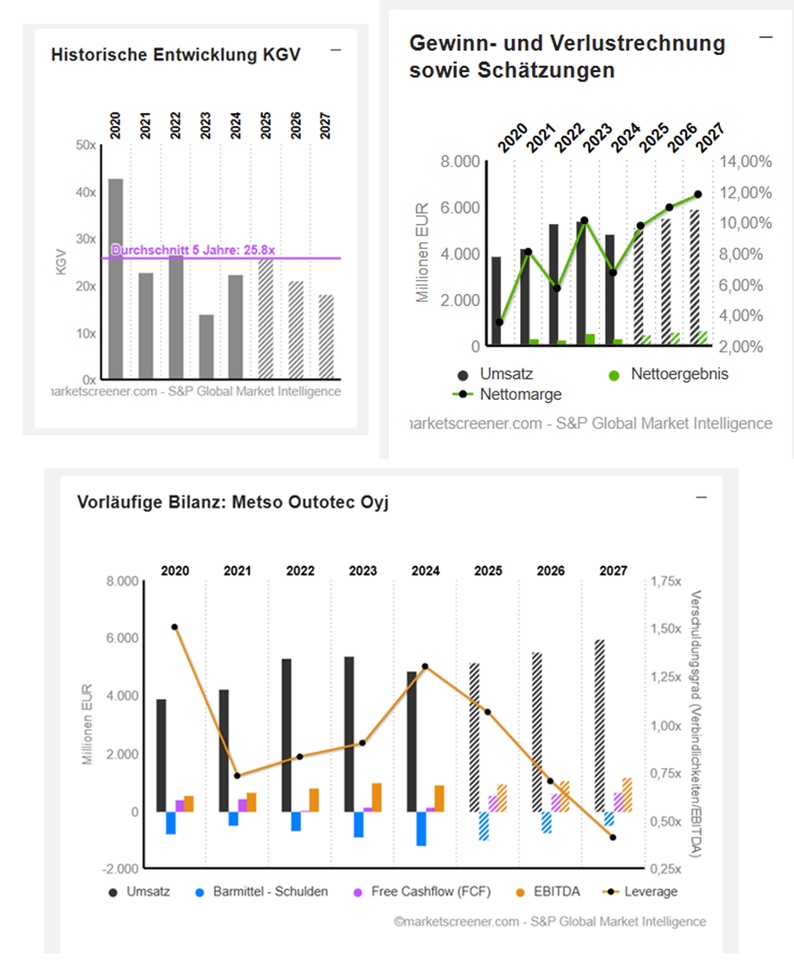

EUR in millions

Estimates

Year Sales Change

2024 4.863 -9,78 %

2025 5.165 6,22 %

2026 5.540 7,24%

2027 5.973 7,82%

Year EBIT Change

2024 804 -9,36%

2025 808,7 0,59%

2026 927,2 14,65%

2027 1.042 12,44%

Year Net result Change

2024 329 -39,41%

2025 503,2 52,96%

2026 606,7 20,56%

2027 702,4 15,78%

Year Net debt CAPEX

2024 1.173 188

2025 994 164,3

2026 746 169,7

2027 484 170,1

Year Free cash flow Change

2024 144 9,09%

2025 558,1 287,57%

2026 609,8 9,27%

2027 657,6 7,84%

Year EBIT margin ROE

2024 16,53% 18,94%

2025 15,66% 19,23%

2026 16,74% 21,3%

2027 17,45% 22,21%

Year Earnings per share Change

2024 0,4 -39,39%

2025 0,6038 50,96%

2026 0,732 21,23%

2027 0,8481 15,85%

Number of shares (in thousands) 827,761

Date of publication 13.02.25

Market value 12,859

Year P/E ratio PEG

2024 22.5x -0.6x

2025 25.7x 0.5x

2026 21.2x 1x

2027 18.3x 1.2x