You’ll have a hard time finding an industry-leading company as profitable as $NVO that is trading 65% below ATHs while the addressable target market continues to grow every day.

Thus, it raises the question whether we have a 2022 situation, where multiple market leaders like $NFLX or $META suffered sharp declines in their stock prices, or whether we are looking at a massive blue-chip value trap comparable to $PYPL, where once confident investors still wait on their recovery rally.

Let’s dive into all there is to know about $NVO’s downfall from grace and the opportunities this might present.

Overview

$NVO is a Danish multinational pharmaceutical company, present all across the world with production facilities and offices. The Novo Nordisk Foundation commands 28% of $NVO’s overall shares, and the majority of its voting shares.

The enterprise, mainly known for its diabetes and weight-loss treatments, reigned supreme as Europe’s most valuable company until it lost that title to $SAP, after a massive sell-off throughout the previous months. The formerly model growth company for Europe celebrated its 100-year-anniversary two years ago and employs over 77,000 people globally.

Products

$NVO offers a variety of medications used for treatment of diabetes type 1 and type 2, as well as obesity and in part other rare diseases. Ozempic is, undoubtedly, $NVO’s flagship drug, and apart from the newer Wegovy, the product most associated with the brand $NVO. Most notably, used to treat type 2 diabetes, Ozempic is responsible for ~36% of total sales, as per Q1.

Wegovy, on the other hand, was originally discovered by researchers during clinical trials for Ozempic, when they had noticed a major side effect with great potential; patients consistently lost weight while using Ozempic. Now, the semaglutide Wegovy stands out with remarkably high double-digit growth YoY and is projected to overtake Ozempic in total revenue as soon as 2026.

Fundamentals

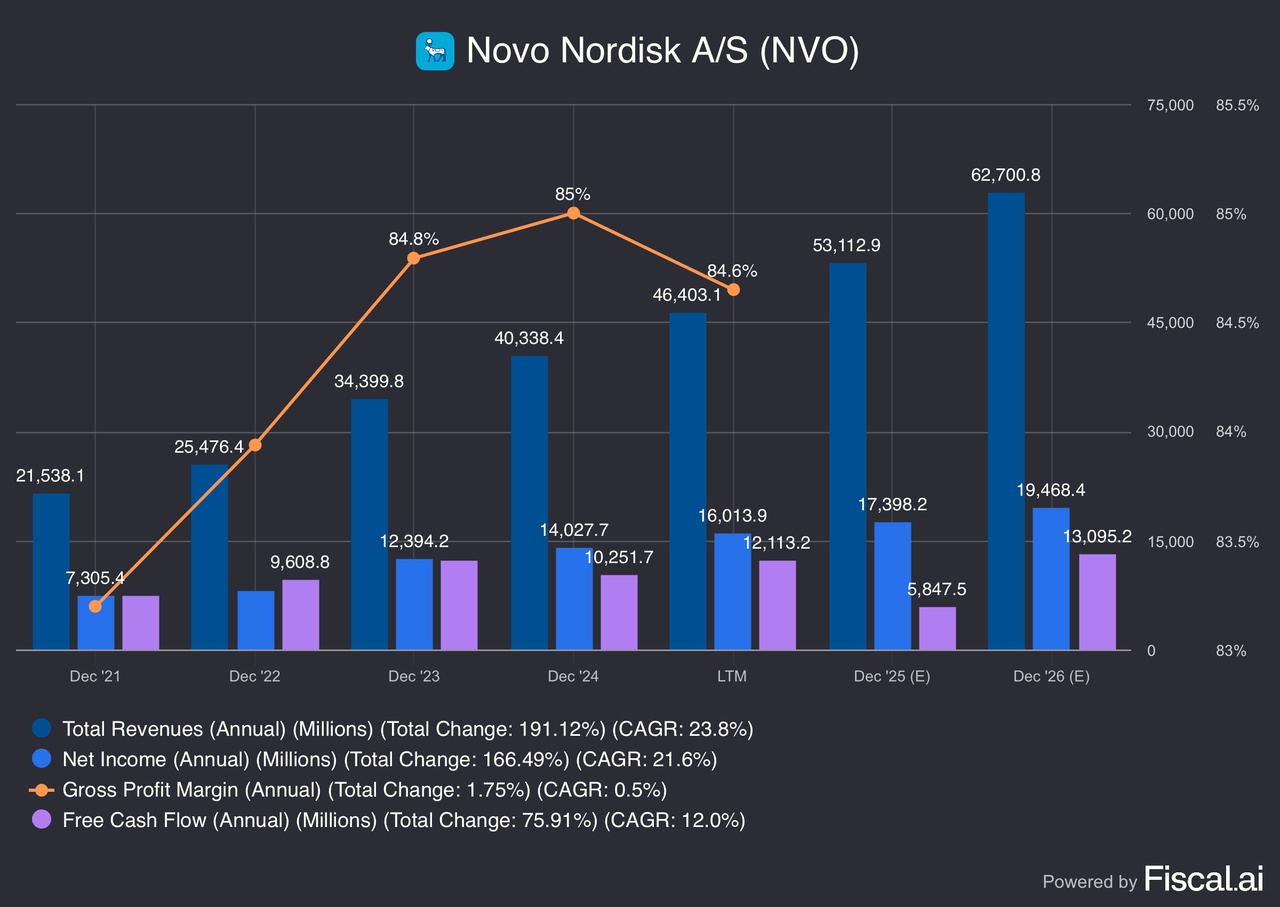

After discussing the kind of drugs $NVO is producing, let’s take a look at how that is reflected by the numbers. In the graph below, showing revenue, net income, free cash flow, and gross profit from 2021 onwards – the year Wegovy got FDA approval – $NVO’s expansion and high profitability is clearly illustrated.

While much of the growth has been driven by the newly developed, explosively growing Wegovy (~175% revenue CAGR since 2021), $NVO’s more established drug Ozempic still impressed with over ~36% growth in sales YoY.

$NVO dominates the global diabetes/obesity market, with a commanding 51% share of the global insulin production and a staggering 55% share of GLP-1 drugs, as per the company’s Q1 2025 report. With these numbers and a strong execution $NVO is in a prime spot to utilize its position in the market to continue to overshadow its competitors in the future.

Valuation

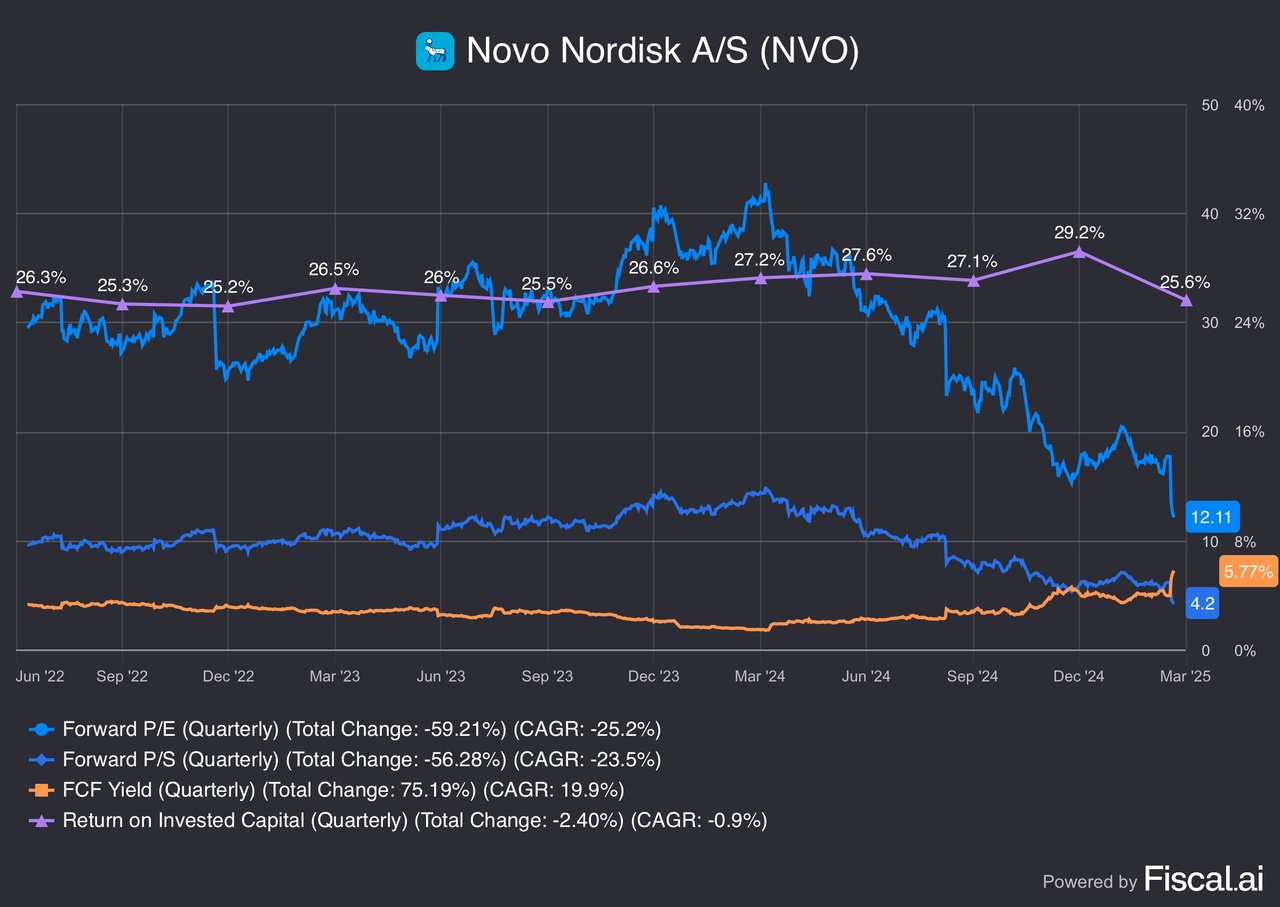

$NVO used to be trading at a P/E ratio of 30, justifiably so, due to its incredible position in the market, innovative nature and historically strong execution, underlined by an impressive ROIC of around 25%. And has any of that changed? The ROIC certainly did not, while the P/E ratio took a dive to almost 12 and sits thereby at a historically low valuation and the free cash flow yield is as high as never before.

As of now, on a pure valuation standpoint, based on past growth and market standing, $NVO seems like a generational buying opportunity that bears incredible upside potential over the coming years.

But the recent dip in all these valuation metrics had its catalysts, which we will come to later on in the analysis, but just keep the numbers from the graph in mind as we continue.

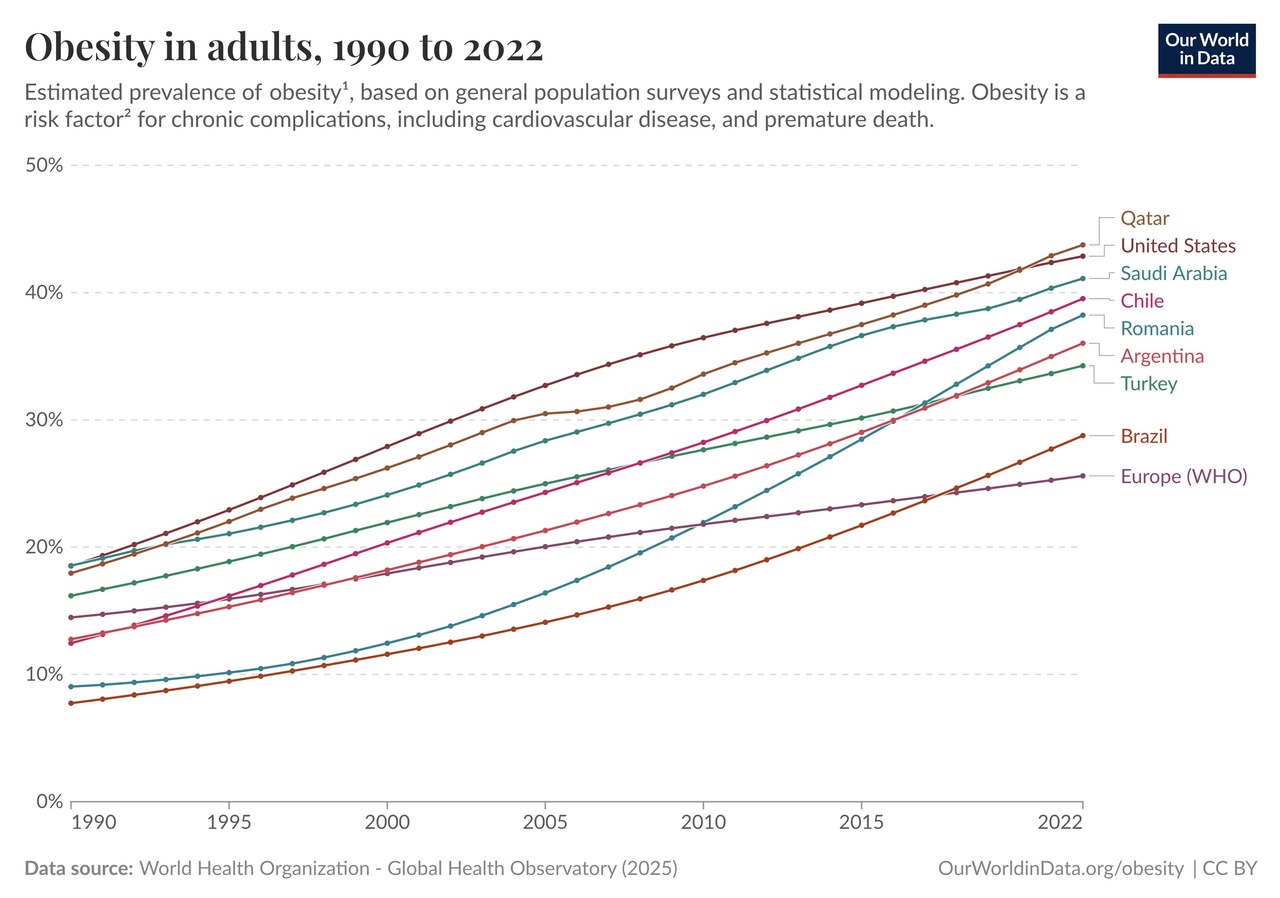

Macro Environment

Obesity rates are climbing rapidly, in fact, projections suggest that by 2030 more than 1.13 billion people will be classified as overweight; 1 in 5 women and 1 in 7 men will be living with obesity.

Another cash machine, diabetes, is expected to rise to more than 55 million in the US alone. That’s a massive market already, but what often goes unnoticed are the high levels of wealth and welfare creation that has been happening and continues to happen in emerging countries all over the world.

Every additional degree of prosperity countries experience directly leads millions of potential new customers to $NVO’s products. Unlike the US, where $NVO is facing increased competition, additionally to heightened costs and uncertainty around the Trump administration, the emerging markets are where the management could really take market share.

Therefore it seems like a valid strategy to shift the focus gradually from the US market toward the rest of the world and establish yourself as a force to be reckoned with in fast growing regions.

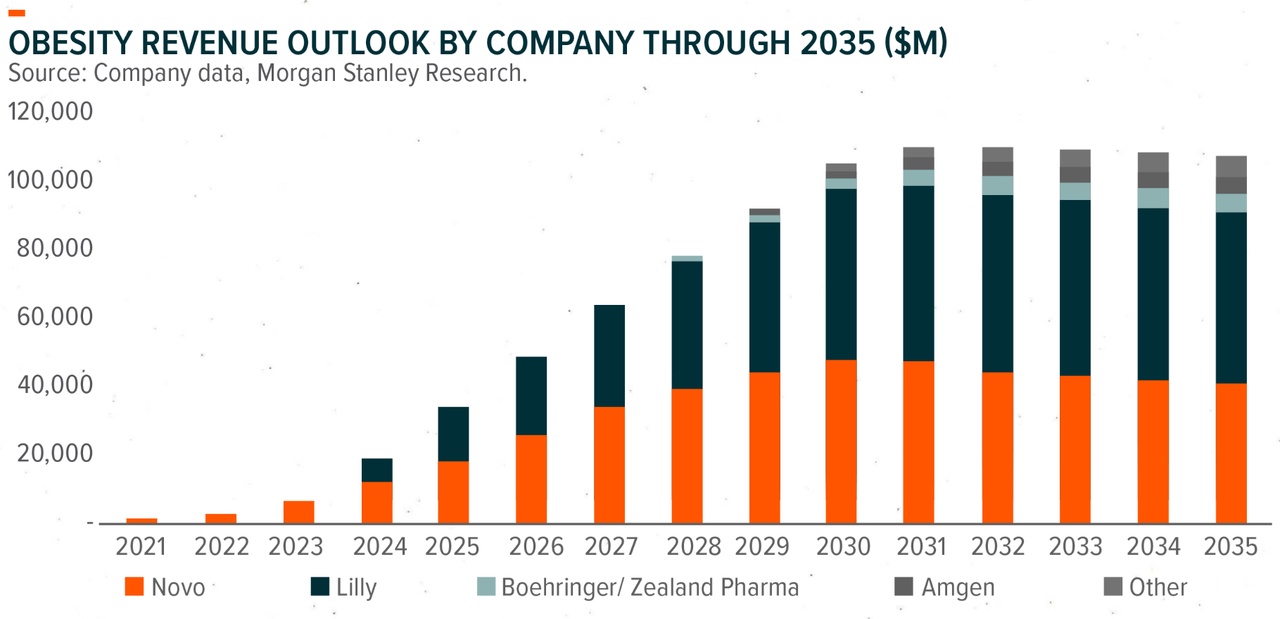

Duopoly

The market for obesity and diabetes treatments is essentially divided between two big players, $NVO and $LLY. Just to put in context what that means: By 2030, GLP-1 sales are projected at $140-150 billion, with $NVO and $LLY commanding ~94% of that revenue. That is a massive moat for these two companies that split the market almost equally, as presented in the graph below.

Newer players are likely to be acquired if they were to pose a serious threat and the duopoly would be preserved. And while $LLY is considered the main competitor and the slightly faster growing of the two giants, $NVO is far from being irrelevant, especially with its strong pipeline.

Recent Troubles

$NVO certainly hasn’t been a loved stock in the last months. In fact, the share price fell by more than 65% since it had reached an ATH in July last year, erasing almost the entire gains made since the launch of Wegovy in 2021.

Most recently, a leadership change, combined with a slashed guidance for sales growth this year from 13-21% down to 8-14%, led to a massive slaughter of the company’s stock of almost 35% temporarily. While that may sound hard to believe, considering the already low valuation and still solid growth prospects, $NVO’s stock has been retreating for a long time now, due to several reasons.

Not the least of them is intensified competition through the marginally faster growing American competitor $LLY. However, the biggest and as we now inherently most unpredictable factor in the share price’s decline, is undoubtedly the Trump administration and the trade restrictions that are being pushed, additionally to the president’s dislike for major pharmaceutical companies and their pricing strategies.

Risks

Stocks usually don’t sell off for no reason and $NVO has been experiencing some issues, including the previously mentioned $LLY’s advances, geopolitical tensions and an anti pharmaceutical sentiment. Down the road, this could lead to $LLY taking a bigger chunk of the market share or slower growth rates in the huge US market.

But the big caveat to this story: It is plausible to assume that many of the risks are already priced in. After all, there is a reason why $NVO is trading at a third of $LLY. Furthermore, I see quite a real chance of the new CEO deliberately setting a low bar by slashing the outlook drastically, to avoid disappointing again next quarter. There is high chance that $NVO will beat on the next earnings, considering the conservative estimates.

Future

As already explained in the macro section, $NVO has a strong future in the already very present diabetes and overweight treatment market, but what I haven’t talked about is $NVO’s pipeline: The company is researching and developing a range of highly promising innovations including, an oral semaglutide (Wegovy capsule), which is under Priority Review, CagriSema (cagrilintide + semaglutide), Amycretin and UBT251 as additional weight-loss drugs and ultimately the testing of GLP-1 drugs for alternative use cases such as Alzheimer’s, which if successful could drive incredible returns.

Another catalyst for reviving growth prospects, mitigating tariff-induced risks, is the massive $4 billion production facility, currently under construction in North Carolina, dedicated to the production of Ozempic, Wegovy and future developments. In 9 out of 10 scenarios $NVO has a bright future ahead, and the 10th is likely already priced into the stock.

Conclusion

After all, the question still looms: Is $NVO a discounted and mispriced giant with significant potential or a cautionary tale for investors seeking the great opportunities in turnaround plays. I would say, while recent headwinds might cause short-term weakness, the persistent long-term trends remain in place.

Investor confidence has been shaken by geopolitical pressures, but the worst is probably behind $NVO after the EU-US trade deal. Valuations are at historic lows, while EPS and sales growth remain mostly intact.

Consequently, I think the underlying fundamentals, the dominant market share, strong pipeline and prosperous macro outlook will eventually lead to more success for this company and the stock price will follow.

The recent sell-off provides a great opportunity for investors with a long-term horizon who always wanted to own a part of this rapidly growing pharmaceutical giant. And as usual, as soon as some positive, or not as negative, news pops up, the bears will be quick to jump on the accelerating train and analysts will start outbidding each other with price targets.

Don’t forget: “Buy when there’s blood in the streets, even if it’s your own blood.” - Baron Rothschild