Hello Community,

After this week's brand new quarterly figures, it's time for a detailed deep dive into one of my biggest conviction positions: MercadoLibre ($MELI (-3,44%) ). Many know the company as the "Amazon of Latin America", but this description falls far short.

The ecosystem: a twin-engine giant ⚙️

MercadoLibre is not a simple online store. It is a self-reinforcing ecosystem consisting of two main business areas:

➡️ E- Commerce 🛒: The dominant online marketplace in 18 countries with an unbeatable logistics infrastructure (Mercado Envios).

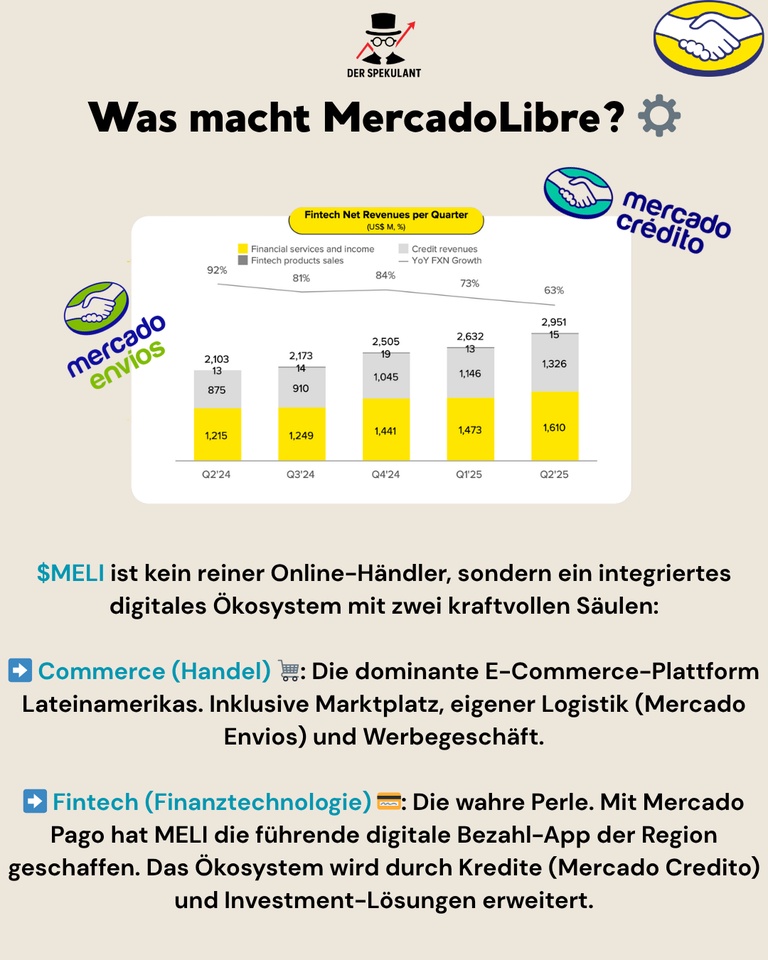

➡️ Fintech 💳: The true pearl and future profit driver. Mercado Pago is not just a payment service, but is becoming the region's leading financial super app. Millions of people without a traditional bank account use it for payments, loans (Mercado Credito), insurance and even investing.

The hard facts (Q2 2025): Endless growth 📊

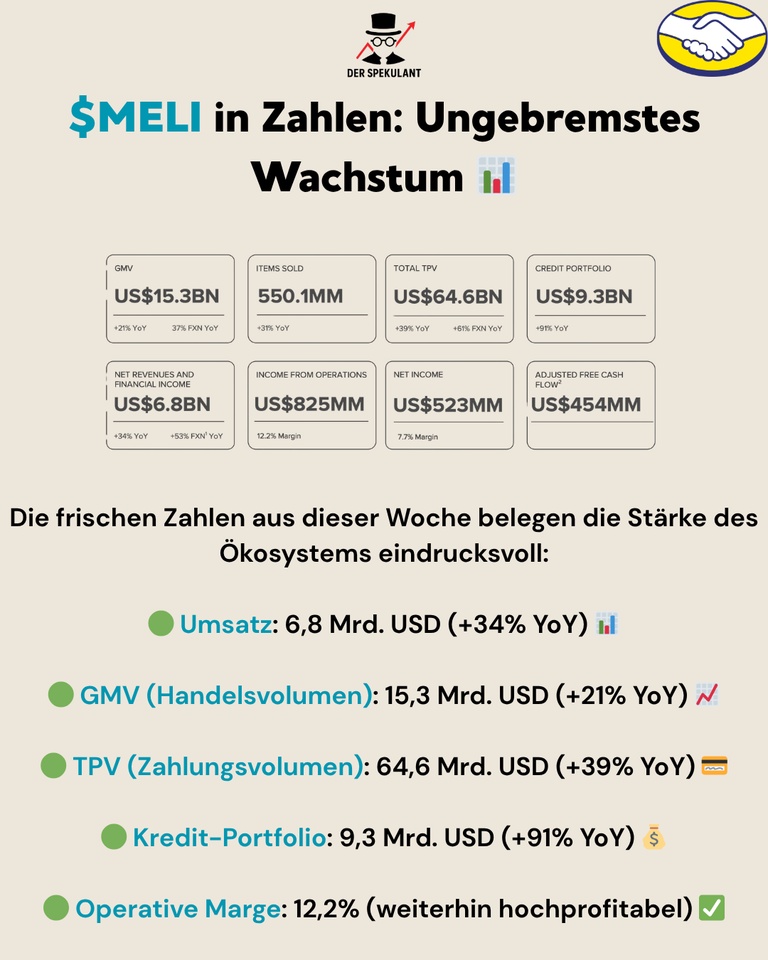

Monday's figures were further proof of the strength of this model:

✅ Total payment volume (TPV): Exploded to USD 64.6 billion (+39% year-on-year). That's the money flowing through the fintech ecosystem.

✅ Total trading volume (GMV): Continues to grow strongly to USD 15.3 billion (+21% year-on-year).

✅ Loan portfolio: Grows exponentially to USD 9.3 billion (+91% year-on-year). This is where the big money is made.

✅ Profitability: Despite massive investments in growth, the company remains highly profitable with an operating margin of 12.2%.

$MELI (-3,44%) has managed to create an almost unassailable network effect. Every new user on the trading platform is a potential customer for the financial services - and vice versa. That is an extremely deep moat.

The opportunities 🚀📈

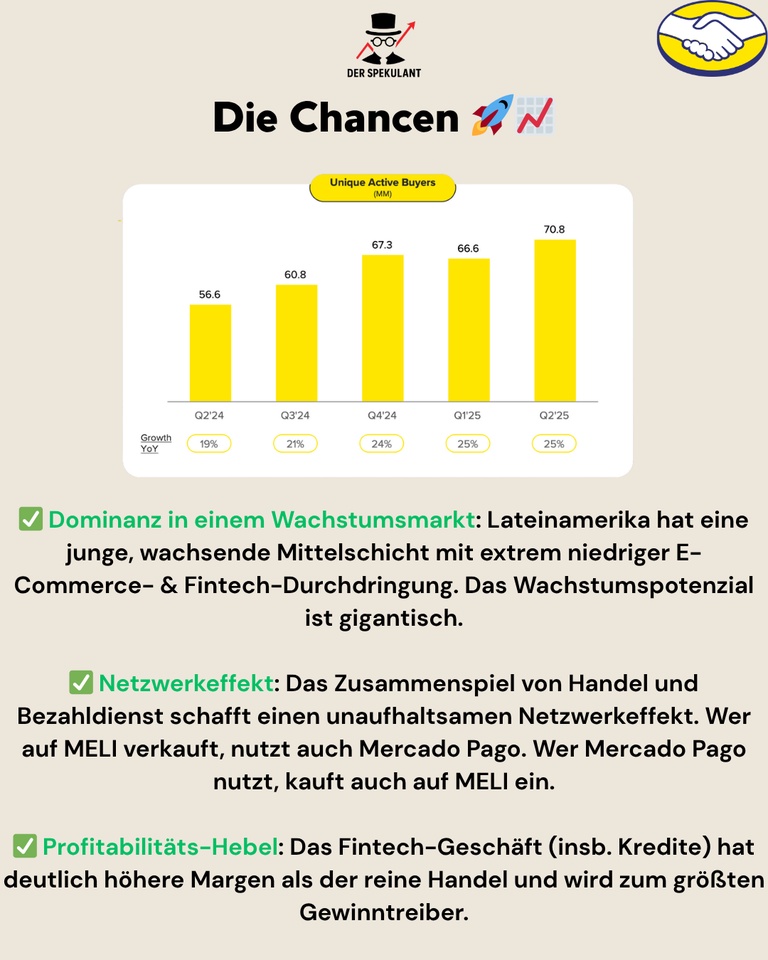

🟢 Dominance in a growth marketLatin America has a young, growing middle class with extremely low e-commerce & fintech penetration. The growth potential is huge.

🟢 Network effect: The interaction between retail and payment services creates an unstoppable network effect. Anyone who sells on MELI also uses Mercado Pago. Those who use Mercado Pago also buy on MELI.

🟢 Profitability leverageFintech business (especially loans) has significantly higher margins than pure trading and is becoming the biggest profit driver.

The risks ‼️

🔴 Macro risksPolitical instability and extreme inflation (especially in Argentina) remain the biggest risks and lead to currency fluctuations.

🔴 CompetitionGlobal players such as Amazon and Sea Ltd. are also trying to gain a foothold in Latin America.

🔴 RegulationStronger regulation of the financial sector could slow down the growth of the highly profitable credit sector.

The investment thesis: Why I am invested 💡

My bet on MercadoLibre is a bet on the macro development of an entire region. Latin America has a young, growing and increasingly digitized population of over 600 million people. The penetration of e-commerce and digital financial services is only just beginning.

My conclusion & my strategy 🧠

For me, MercadoLibre is one of the clearest "compounders" for the next decade. The company is perfectly positioned to benefit from Latin America's digital rise. The combination of a dominant e-commerce business and an explosively growing, highly profitable fintech division is unique in this form. Therefore, it is and remains one of my biggest "buy & hold" positions.

Question for you:

Do you see in $MELI (-3,44%) one of the strongest compounders for the next decade? 👇