$TSLA (+10,24%)

$GOOGL (-1,98%)

3. operational & economies of scale

- Waymo operates the fleet itself. The high capital costs are cushioned by 24/7 utilization, but only open up where HD cards exist. Passenger fares recently averaged ≈ USD 11 per mile, reflecting the capital commitment. The Last Driver License Holder...

- Tesla is planning a franchise-like model: own Cybercabs + privately owned Teslas in a shared "Tesla Network". Elon Musk cites long-term operating costs of $0.20 - $0.40/mile - around a tenth of today's ride-hailing rates - but bases this on assumptions, not real fleet numbers. Reuters

Scale efficiency/risk profile

Waymo

Higher redundancy → expensive hardware; hardware costs dominate production price; scaling by area because mapping is expensive.

Technologically mature (thousands of paid trips daily), but capital-intensive.

Tesla

"Vision-only" saves LiDAR (7 000 - 10 000 USD +) and reduces power consumption & weight. Gigacasting manufacturing and own chip further reduce BOM.

Price and unit cost advantage plausible, but Robotaxi service does not yet exist; regulatory approval uncertain.

In short:

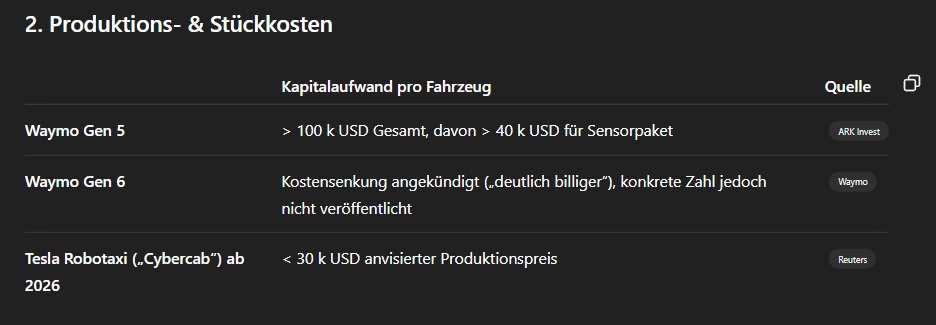

Looking purely at production costs, Tesla's camera approach looks much more efficient (≈ 30 k USD vs. > 100 k USD per vehicle). The downside: the figure is a target value - the vehicle is not yet on the road. Waymo is in commercial use today, but has not yet pushed the cost curve to Tesla's level.

For investors or cities that today robotaxis today, Waymo is the system that works, but is more expensive. If you look ahead to 2026+ and accept higher technical risks, Tesla's robotaxi could achieve significantly lower unit and operating costs with the same passenger volume.