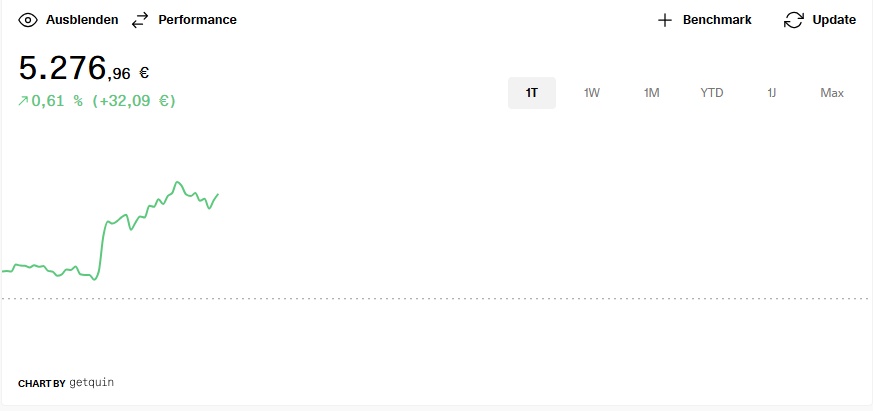

I spent the days between Christmas and New Year intensively rethinking and redesigning my investment strategy. After the first trading week got off to a good start yesterday in the new target state, things are going really well today thanks to $NOVO B (+2,31%) things are going really well in my (still small) portfolio:

Let's take another look at the end of the quarter to see how the situation has developed in the first quarter :-)