Hello my dears,

for the last few days I have been missing our dear @Klein-Anleger .

I recently read in one of his comments that he is still looking for a cybersecurity company.

In order to lure him back into the community, I've gone back into the engine room. I'm unlikely to be able to lure him back with the well-known companies such as Palo Alto or Crowdstrike.

That's why I dived deep into the M-space.

And I found a great stock from Israel, which should fulfill some of his criteria. First and foremost, growth and increased profits through higher margins and new products.

The stock should also be interesting because, unlike some software stocks, there is no sell-off.

I ask the community for many comments and also 👍.

Would you recommend our friend @Klein-Anleger recommend an entry here?

Allot Ltd. (NASDAQ: ALLT, TASE: ALLT) is a leading provider of innovative converged cybersecurity solutions and network intelligence for service providers and enterprises worldwide, driving value for their customers. Its solutions are deployed globally for network-native cybersecurity services, network and application analytics, traffic steering and shaping, and more. Allot's multi-service platforms are deployed by over 500 mobile, fixed and cloud service providers and over 1000 enterprises. The industry-leading, network-native, security-as-a-service solution is already used by millions of subscribers worldwide.

- Headquarters in Hod Hasharon, Israel

Markets:

- Security for service providers - protecting mobile devices, homes and businesses from cyber threats

- Intelligence for service providers - generating actionable intelligence and maximizing end-user QoE

- Enterprise - Easily identify and prioritize business-critical applications

BY THE NUMBERS:

- Revenue for the last twelve months to Q3 2025: USD 98.5 million

- Gross margin Q3 2025¹: 72%

- Growth in SECaaS ARR Q3 2025²: +60% year-on-year

- Positive operating result in Q3 2025

- Over 1,000 customers and around 400 partners worldwide

SELECT CUSTOMERS:

- Accenture

- MC. Donalds

- Verizon

- BMW

- ROGERS

- VISA

- IBM

- Telefonica

- Vodafone

ELIOT has a strong recurring and profitable financial profile with fast growing SECaaS offering

- 1000's of enterprise customers across a wide range of industries.

- 25%+of the Fortune 500 are Allot customers

- Allot is the market leader with extensive expertise in traffic intelligence solutions

Compax Venture partners with Allot for its new mobile cybersecurity services

Solution Overview

CYBERSECURITY 36% of revenue in fiscal year 2024

- Mass market security

✓ Network-based security solutions and services

✓ Network security for business customers

✓ Security for networked households

✓ Converged security solutions

- Network security solutions

✓ 5G network security

✓ DDoS protection

✓ IoT security

Protect network and subscribers

NETWORK INTELLIGENCE 64% of turnover in the 2024 financial year

- Service provider intelligence

✓ 5G service protection

✓ Network transparency

✓ Traffic management

✓ Network protection

✓ Policy and billing control

✓ Compliance with legal regulations

- Traffic intelligence solutions

✓ Traffic intelligence & monitoring

✓ Digital experience monitoring

✓ Network and service resilience

Generate actionable information

Leading service providers secured by Allot

- Telefonica

- Vodafone

- Verizon

- Yettel.

- Proximus

- Singtel

- Safaricom

- Play

- Rakuten Mobile

Recently announced achievements

- Verizon Business partners with Allot to provide enhanced cyber protection for its customers' mobile devices.

- Allot brings its cloud-native network protection and deep network intelligence solutions to Rakuten Mobile.

- Vodafone UK launches cyber protection services for fixed broadband customers, supported by AllotSecure.

- Allot signs a landmark contract worth tens of millions of dollars with a Tier 1 telecom provider in the EMEA region.

- Más Móvil is the first operator in Panama to deploy Allot NetworkSecure to provide touchless cyber protection to its subscribers.

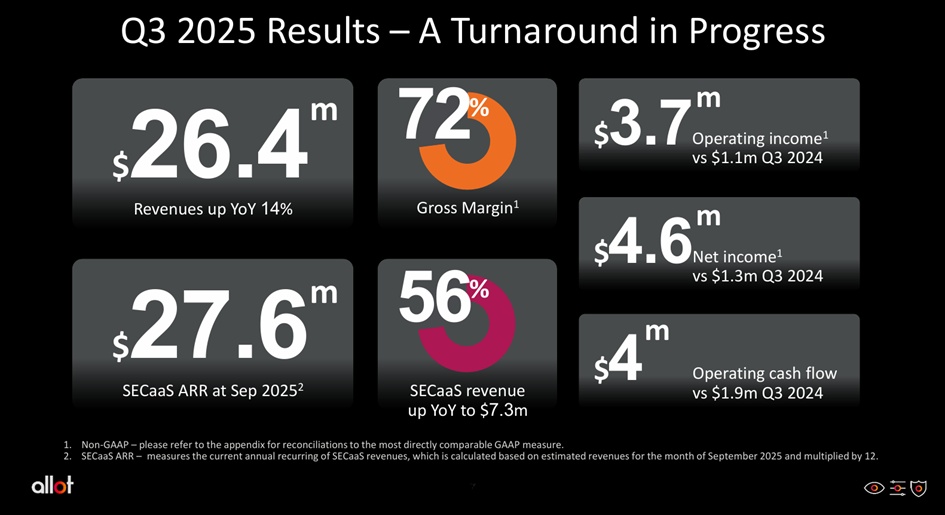

Q3 2025 Earnings Nov 20th, 2025

Allot Brand & Theme Guidelines - PPT template

Q3 2025: KEY HIGHLIGHTS

- Continued annual revenue growth of 14% to $26.4 for Q3 2025

- Accelerated SECaaS growth with 60% year-on-year growth in SECaaS ARR to $27.6 million as of September 30, 2025

- Gross margin improvement to 72% and profitability increase to 14% operating profit (non-GAAP)

- Net profit of $4.6 million for Q3 2025 (non-GAAP)

- High cash and short-term bank deposits of $81m, no debt

We are raising our 2025 SECaaS revenue and SECaaS ARR growth expectations to above 60% y/y. We have introduced total revenue guidance for 2025, with expected $100m to $103m, positioning Allot for a year of profitable growth.

Key financials

- Recurring revenue growth accelerates - SECaaS ARR up 60% year-on-year to $27.6m and now accounts for 28% of total revenue

- Positive operating income1 of $3.7 million and $4 million in operating cash flow in Q3 2025

- Strong gross margin profile - 72% in Q3 2025, with upside potential as higher margin SECaaS continues to scale

- Strengthened balance sheet with USD 81 million in cash as of September 30, 2025 and no debt

- Positioned for sustainable growth - Expanded pipeline and recent customer acquisitions lay the foundation for continued momentum

USD in millions

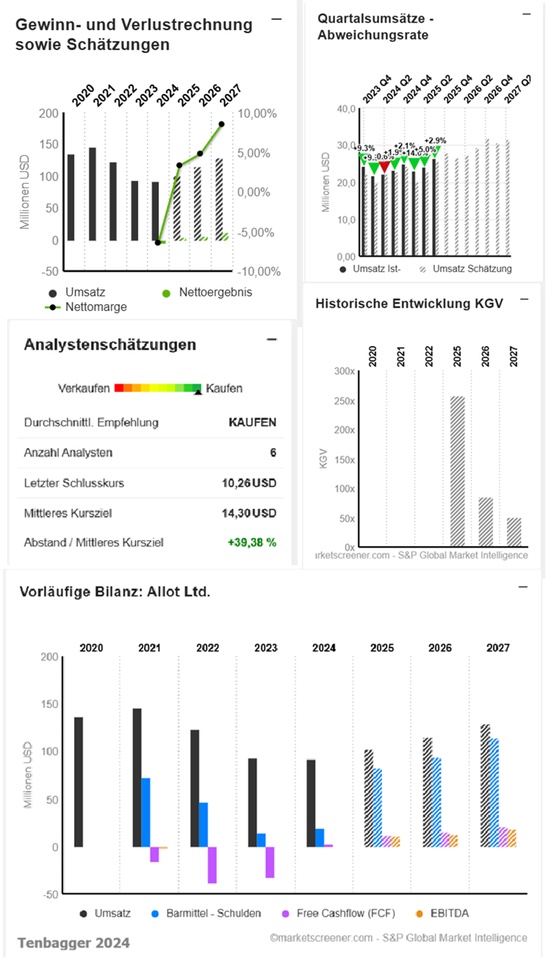

Estimates

Year Sales Change

2024 92,2 -1,03 %

2025 101,6 10,17 %

2026 114,7 12,94 %

2027 129,3 12,69 %

2028 152,00

2029 167,00

Year EBIT Change

2024 0,634 101,15 %

2025 8,547 1.248,08 %

2026 13,34 56,03 %

2027 19,76 48,19 %

2028 30,00

2029 36,00

Year Net result Change

2024 -5,869

2025 3,333 156,8 %

2026 5,5 65 %

2027 11 100 %

Year Net debt CAPEX

2024 -18,8 2,117

2025 -82,8 1,052

2026 -94,2 1,572

2027 -114 1,763

Year Free cash flow Change

2023 -32,22 15,66 %

2024 2,71 108,41 %

2025 11,48 323,57 %

2026 15,19 32,32 %

2027 20,55 35,3 %

2028 30,00

2029 36,00

Year EBIT margin EBITDA margin

2024 0,69 %

2025 8,41 % 10,96 %

2026 11,62 % 11,02 %

2027 15,29 % 14,4 %

Year Earnings per share Change

2025 0,04

2026 0,12 200 %

2027 0,2 66,67 %

2028 0,34 105,00 %

Year P/E ratio PEG

2025 257x

2026 85.5x 0x

2027 51.3x 0.8x

Market value 497.1

Number of shares (in thousands) 48,453

Date of publication 25.02.2025

Allot Brand & Theme Guidelines - PPT template