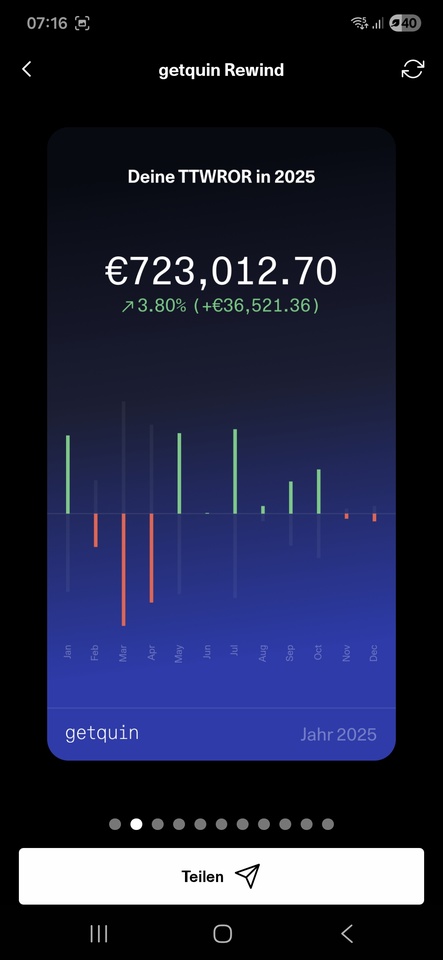

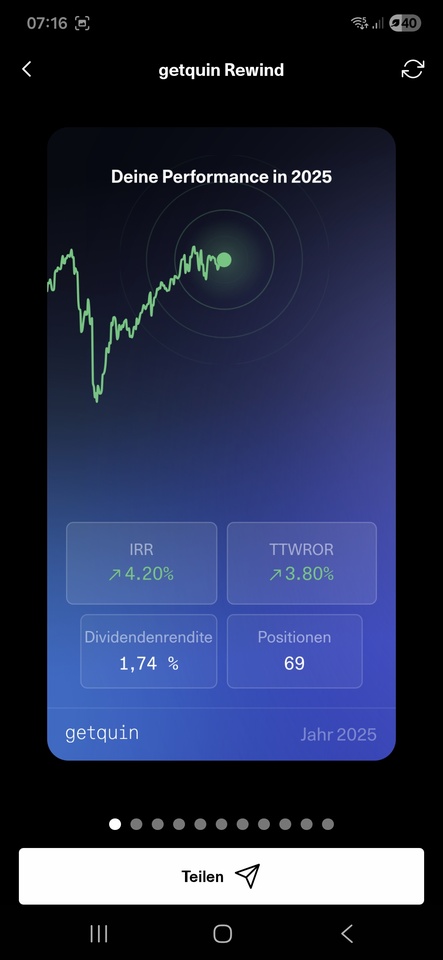

Today, on the last day of 2025, I started another updated rewind to really have the whole year with me. Thanks for the hint in a comment the other day, by the way, I had actually overlooked the button.

It's really not that much compared to other rewinds here, but I'm still happy, because even with this increase you can afford a lot in real life. And there are still 45% that were even worse, but I've hardly seen any of them here.

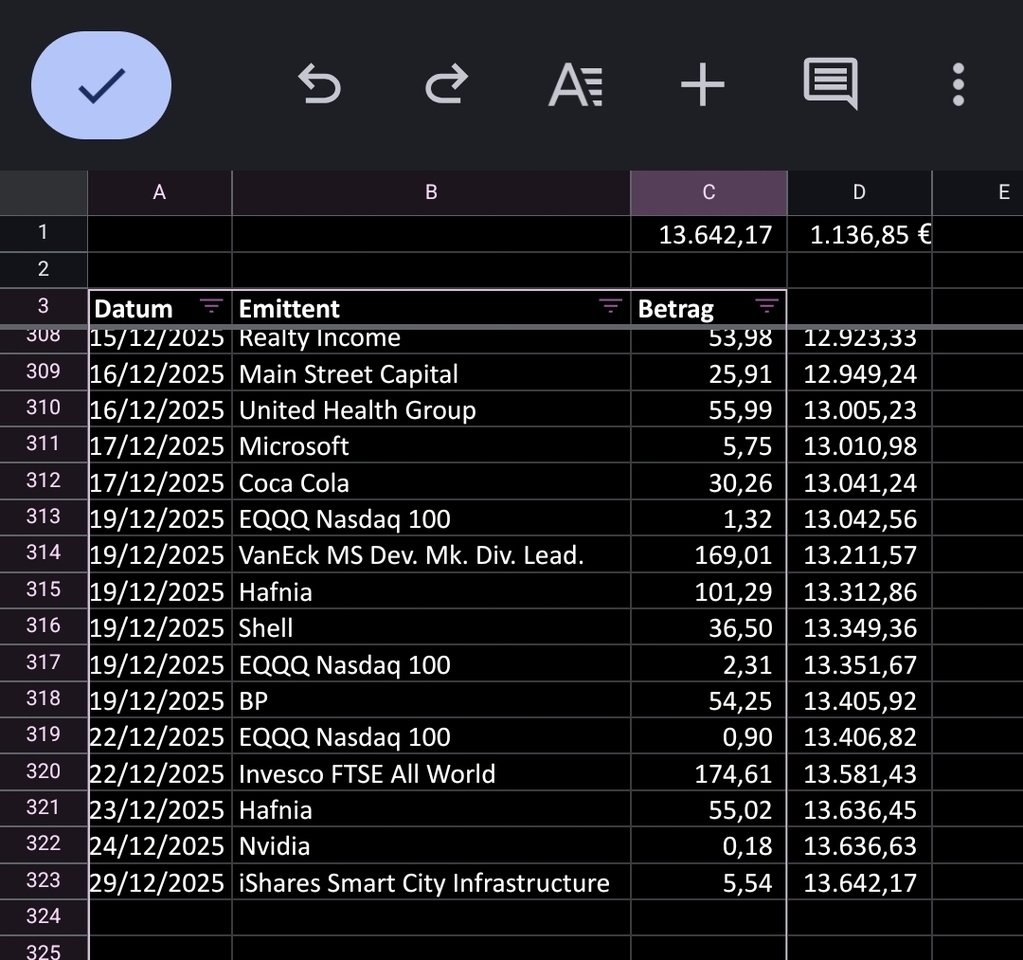

As far as dividends are concerned, four more payments are due today. Problem: they're all with scalable and I don't think they'll make it in time, based on previous experience with scalable. But it doesn't matter, I still keep a separate Excel list in which I stubbornly enter the payments when they actually come and also in the amount in which they come, i.e. net.

I actually received €13,642.17 afterwards. That's a little more than get Quinn shows, even with the outstanding payments. But that is clear anyway, because get Quinn does not take the partial exemption into account for ETFs.

Strangely enough, the dividend section in get Quinn also shows something different than the dividend section in rewind. You don't have to understand that either.

Basically, I am not on a designated dividend strategy. I also have the popular $TDIV (-0,05%) and some Cc ETFs, but that doesn't make up 10% of the portfolio.

Apart from that, I only used liberation day to switch some previously accumulating ETFs to distributions without paying taxes on the capital gains, which were gone. 😵💫

The additional cash flow supplements my salary a little. So I don't reinvest the dividends, in fact I hardly pay anything into my portfolio anyway. Now that I'm over 50, I'm taking it a little easier and prefer to treat myself to something from time to time.

I believe that my portfolio should serve me and not the other way around.

Let's see if the portfolio manages to reach the million mark before I retire, largely without any help from me.

Now I wish everyone a happy new year and a successful and, above all, healthy 2026.🗯🎆🧨