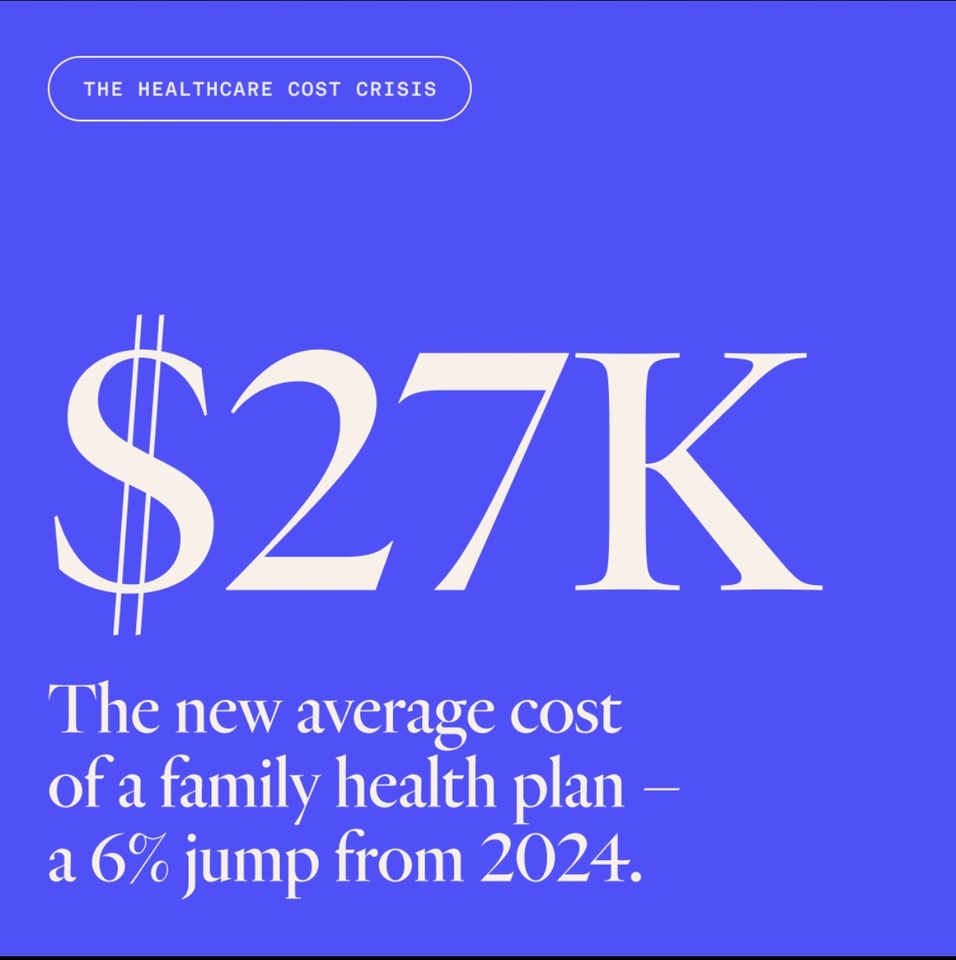

The American healthcare crisis of 2025 is deepening, and nowhere is this pressure felt more acutely than among small businesses. According to new data publicized by $OSCR (+6,05%) , 51% of small companies experienced a surge of at least 10% in their health insurance costs this year. The average annual premium for a family health plan has now hit $27,000—a 6% increase from 2024—far outpacing both general inflation and wage growth. These rising costs are not just numbers in reports, but hard facts transforming business decisions, workforce planning, and the stability of entire communities.

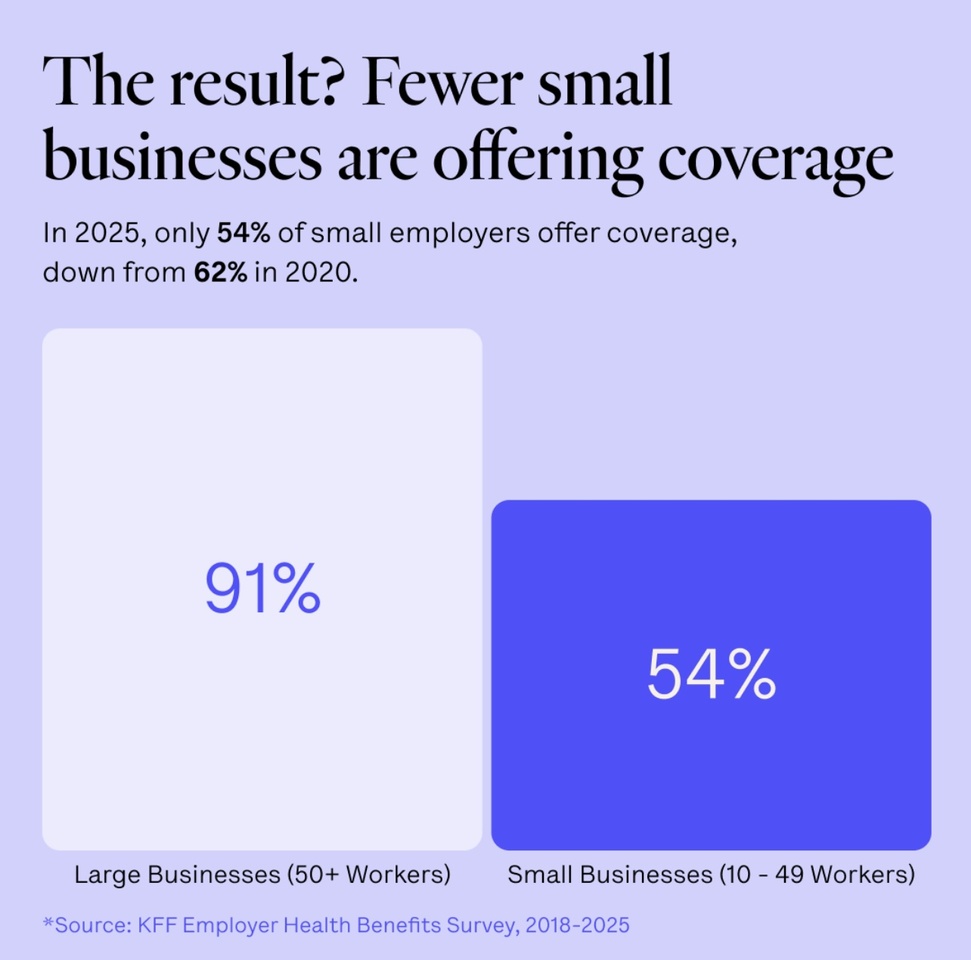

This escalation in expenses is forcing many small employers to rethink their role as providers of health benefits. While larger corporations can negotiate favorable rates and absorb price spikes more effectively, the majority of small businesses lack this leverage. Today, only 54% of small employers offer health insurance—a sharp decline from 62% in 2020, according to Oscar’s analysis of industry data. In stark contrast, 91% of larger businesses with more than 50 workers still provide health coverage, highlighting the growing disparity in benefits and access to care across the labor market.

Employees feel the effects as well. The costs assumed by employers often translate into higher paycheck deductions or reduced benefit quality, especially when premium surges are this dramatic. For 2025, the typical employee contribution toward health care expenses (including premiums, deductibles, and co-pays) is projected to exceed $5,000 for the first time ever—a sum equivalent to several months’ worth of groceries for the average household. The result: More working Americans are underinsured or forced to go without basic coverage, and a greater share of their take-home pay is devoted to health costs instead of genuine security.

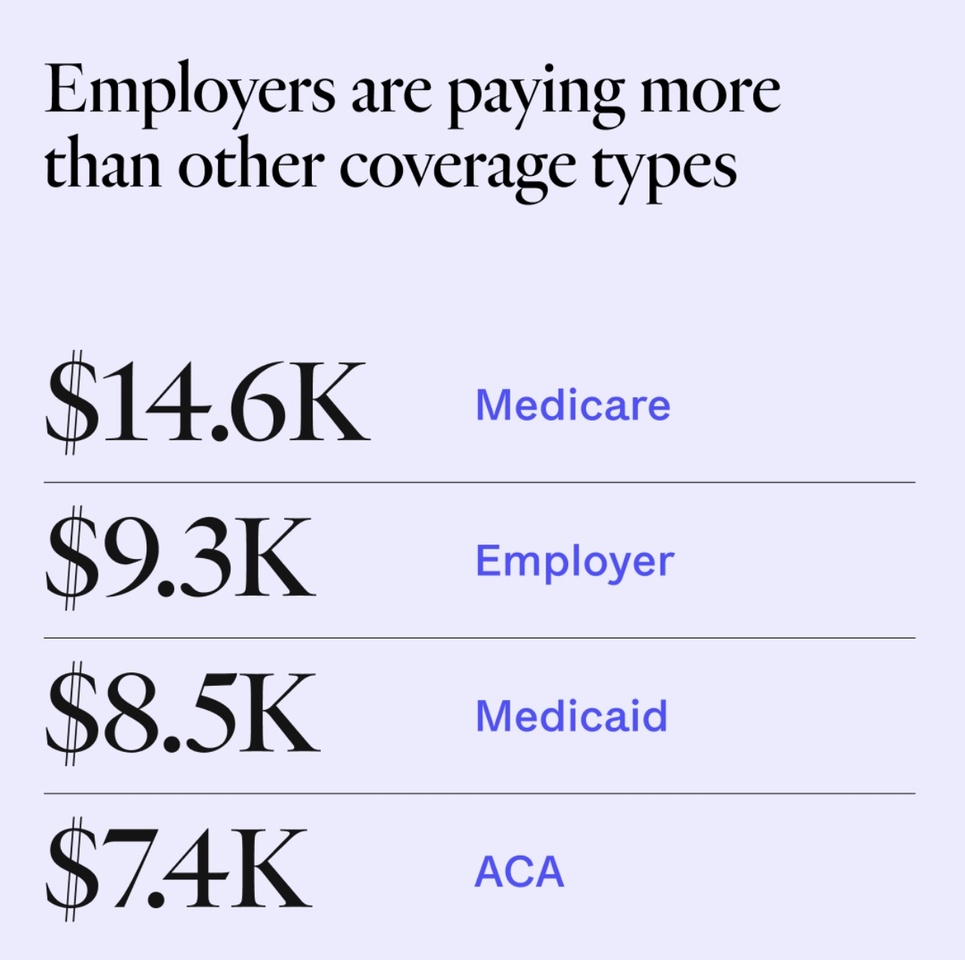

For those businesses that still manage to offer coverage, the financial landscape is daunting. According to Oscar’s recent data, U.S. employers pay upwards of $9,300 per year per worker for employer-based coverage, compared to $14,600 for Medicare, $8,500 for Medicaid, and $7,400 for coverage under the Affordable Care Act marketplaces. For smaller companies, where profit margins are already thin, these high fixed costs have a cascading effect: staff reductions, frozen hiring, and the inability to attract or retain skilled workers are now common outcomes.

The drivers of this crisis are complex and far-reaching. The U.S. faces ever-higher costs for new medical technologies and specialty drugs, growing demand for care (especially for chronic diseases), and a shrinking pool of affordable group insurance options. Industry reports underscore that insurer and provider consolidation means fewer plan choices for small employers, and some national carriers—including the Cigna + Oscar co-branded partnership—have exited the small group market altogether to focus on the individual market. These dynamics further erode the bargaining power of small businesses and limit their ability to control expenses.

Oscar Health’s communications highlight how unsustainable this trajectory has become, both for business owners and their staff. Solutions are emerging—such as Health Reimbursement Arrangements (HRAs), digital platforms, and tailored use of artificial intelligence—but these remain out of reach for many, or are not yet mature enough to solve the issue at scale. The sector’s continued pain is evident in the company’s own financial reporting: Oscar posted a loss of $228 million in Q2 2025, with dramatically rising claims and an MLR (Medical Loss Ratio) eclipsing 86% for the year. These data points illuminate the gravity of the crisis and why so many businesses are evaluating whether they can continue providing health insurance at all.

Ultimately, the surge in healthcare costs, as quantified and explained by Oscar Health, is more than a financial burden—it’s a threat to competitiveness, social stability, and social mobility across America. If the current trends persist, even fewer small companies will be able to offer insurance, exacerbating inequality and potentially undermining economic progress. Finding viable, affordable, and scalable solutions is a challenge that will define the future of American business and the health of its workforce.