The Novo share has lost around 72% since its high in mid-2024. Numerous dips have been bought in these approximately 1.5 years. Perhaps a few were able to take short-term profits, many others probably closed their positions at a loss, but the vast majority are probably still in the red and are simply waiting to break even (as I did with Metaplanet 🤪).

Isn't this a catastrophe? Doesn't this constellation sabotage any upward breakout because selling pressure is created immediately?

Perhaps the turnaround will succeed anyway, but perhaps it will take much longer than one might currently assume. Have you ever experienced a similar decline, accompanied by so much euphoric buy-the-dip followed by paper hands? How did it end?

I certainly don't expect a black swan like "Warren Buffett goes big". On the contrary, I fear that Eli Lilly will also follow suit with a weight loss pill.

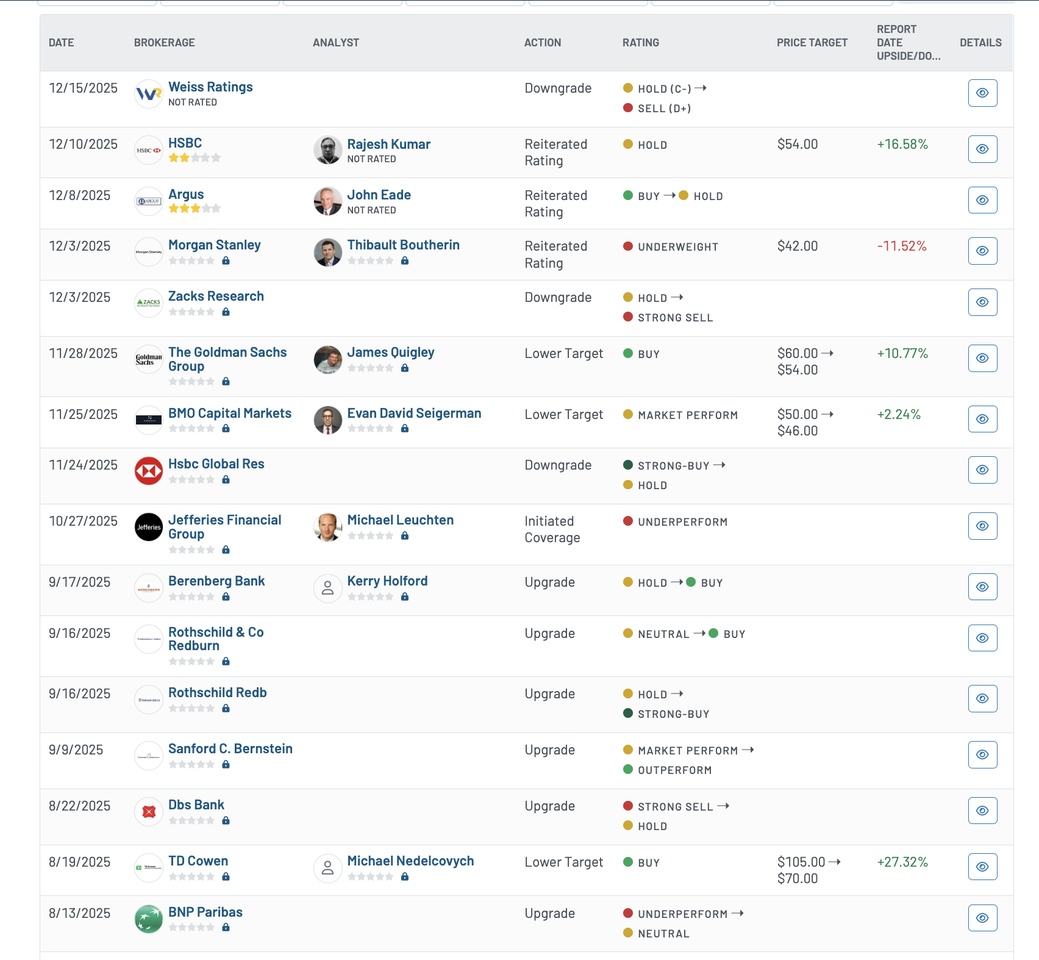

The analysts are still quite pessimistic with a consensus hold rating and an average price target of $53.33, which is the equivalent of around DKK 338 and therefore a price potential of "only" around 4.5%.

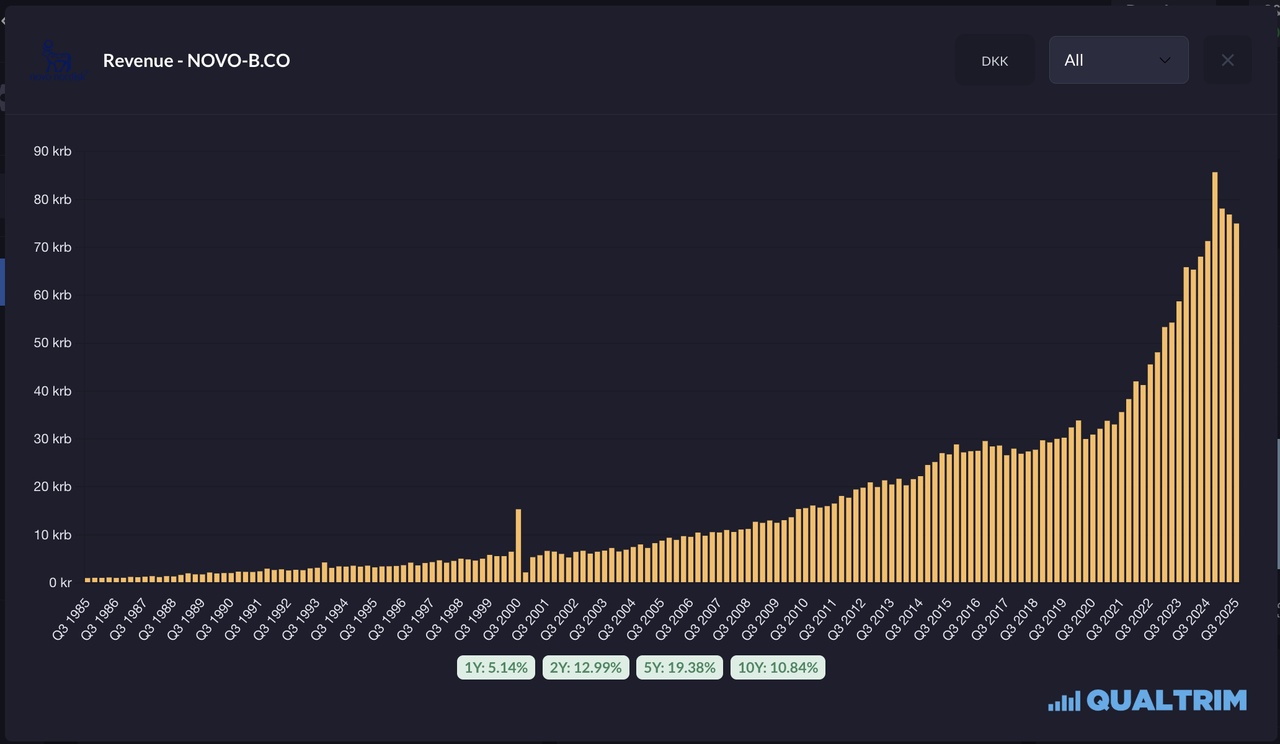

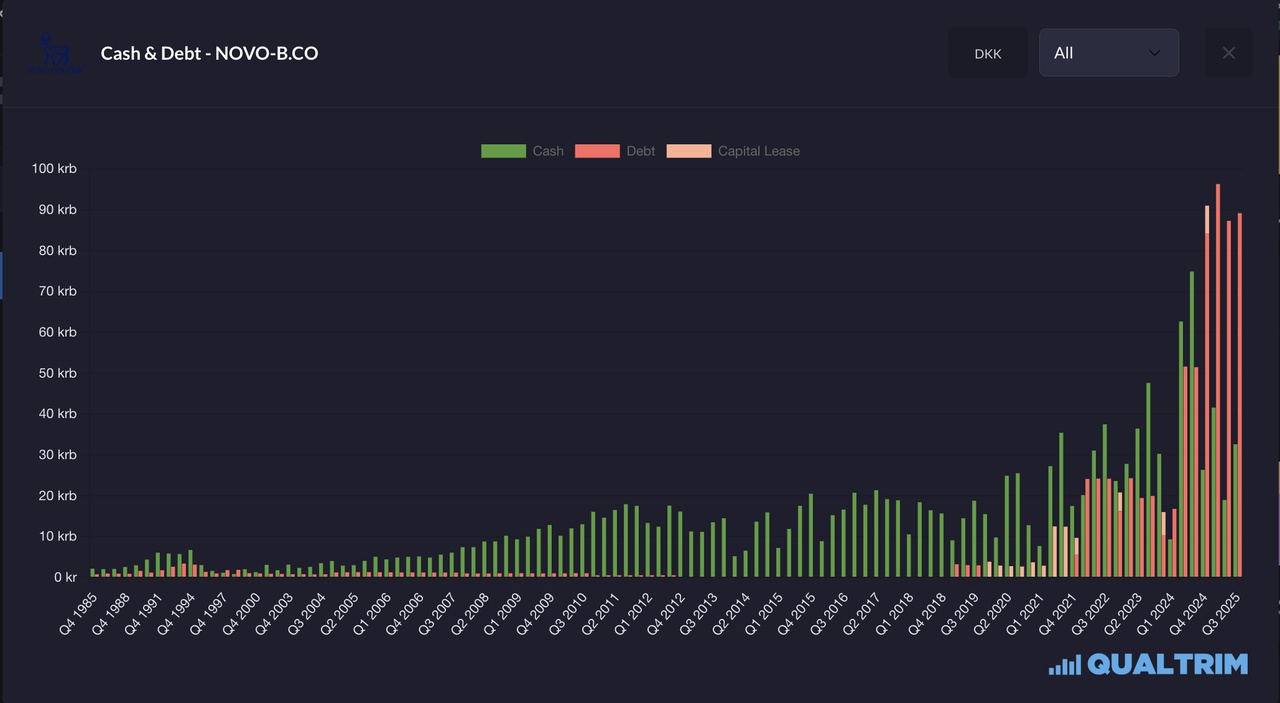

While sales are declining, debt is increasing 👇

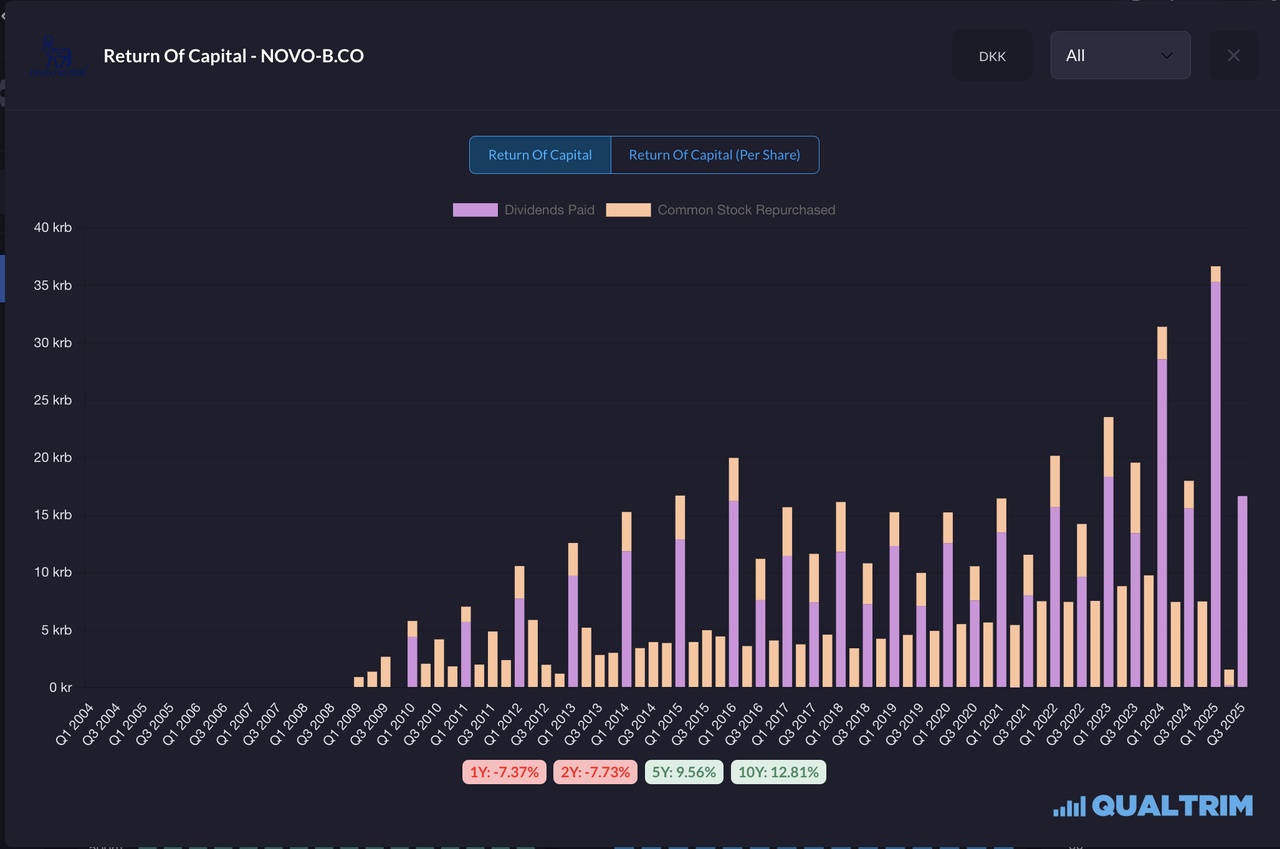

But where is the money going, the capex investments are significantly lower than the debt?

Share buybacks are not relevant either...

In view of all this, perhaps I should regard my long-term position as a successful swing trade and realize it 😵💫