Hello my dears,

On the occasion of today's quarterly figures, I would like to remind you of Secunet.

Perhaps an underestimated value due to the increasing threats.

Feel free to share your opinions in the comments.

At the request of @Iwamoto just a short analysis.

Facts and figures

secunet Security Networks AG consists of five divisions: eHealth, Homeland Security, Industry, Public Sector and Defense & Space. Our customers include federal ministries, federal and state authorities, several DAX companies as well as international authorities and organizations. We are an IT security partner of the Federal Republic of Germany and a partner of the Alliance for Cyber Security.

secunet was founded in 1997, is listed on the stock exchange and generated sales of around 406 million euros in 2024. Our main shareholder is Giesecke & Devrient GmbH.

Secunet Security: a potential winner of Federal Interior Minister Dobrindt's cyber plan? The risk of cyberattacks from Russia is growing!

Secunet Security wants to become the leading provider of sovereign cyber security in Europe.

The company specializes in border controls, cryptography, secure mobile workstations and connectors for the healthcare sector.

The company already ensures that its products are "post-quantum cryptography ready" and cannot be circumvented through the use of quantum computers. Secunet Security is one of the few companies that work for the state.

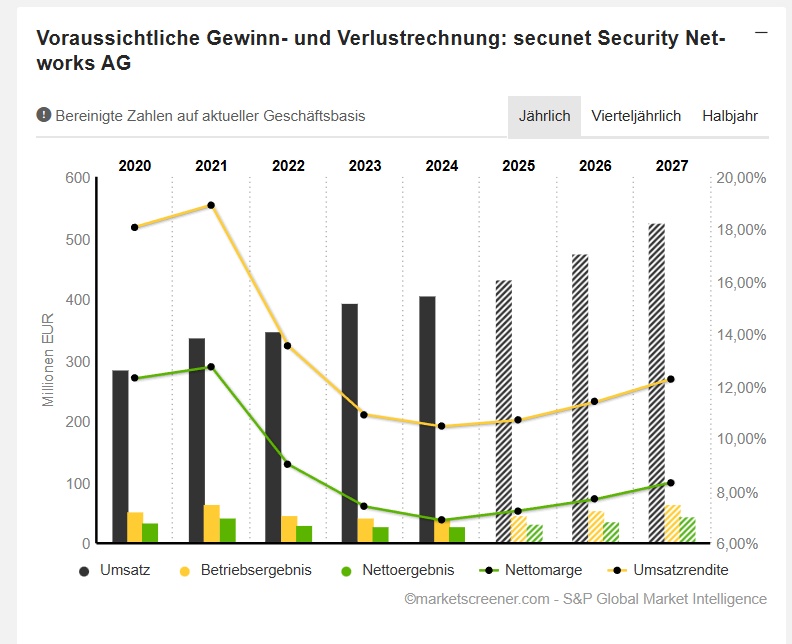

Key valuation figures /estimates in million Eur.

Year Turnover Change

2025 432,4 6,41 %

2026 475,1 9,86 %

2027 525,4 10,58 %

Year EBIT change

2025 46,28 8,84 %

2026 54,15 16,99 %

2027 64,55 19,22 %

Year Net result Change

2025 31,31 12,02 %

2026 36,49 16,53 %

2027 43,73 19,85 %

Year Net debt

Free cash flow

Capex

2025 -56,1 32,04 16,32

2026 -79,5 43,3 14,55

2027 -106 48,03 15,57

(@Liebesspieler still healthy)

Year EbiT Margin

ROE

2025 10,7 % 19,48 %

2026 11,4 % 19,28 %

2027 12,29 % 19,72 %

Year Enterprise Value P/E ratio

PEG

2025 1.040 35,1 3

2026 1.016 30 1,8

2027 989,9 25,1 1,3

Current multiples

Palo Alto P/E 137.65 PEG 5.56

CrowdStrike P/E ratio 1576.82 PEG 7.56

Secunet Security: Sales and margins increase - full order books overshadow slump in international business

ESSEN (IT-Times) - The cybersecurity company Secunet Security secunet Security Networks today published its results for the third quarter of financial year 2025 and recorded a small increase in revenue.

The turnover of the secunet Security Networks AG (ISIN DE0007276503) reached 113.1 million euros in the third quarter of 2025, an increase of 2.4 percent compared to the same period of the previous year.

In the same period, the company's EBITDA reached EUR 22.5 million (up 11.6%) and EBIT EUR 17.7 million (up 9.1%). The EBIT margin thus improved to 15.6% (previous year: 14.7%).

secunet Security Networks achieved a net result of Euro 12.2m, an increase of 2.8% on the previous year. The operating cash flow amounted to Euro 14.5m (minus 15.7 percent).

"We are very satisfied with the results for the first nine months and believe we are well on the way to achieving our targets for the year," says Marc-Julian Siewert, CEO of secunet Security Networks AG.

"Incoming orders increased significantly once again in the third quarter, which shows that our growth drivers remain intact. The market for cybersecurity continues to grow strongly, making our technical solutions increasingly important for customers from both the public sector and private companies."

NATO is considering including cybersecurity in the new 5% spending target - Secunet Security would be a winner!

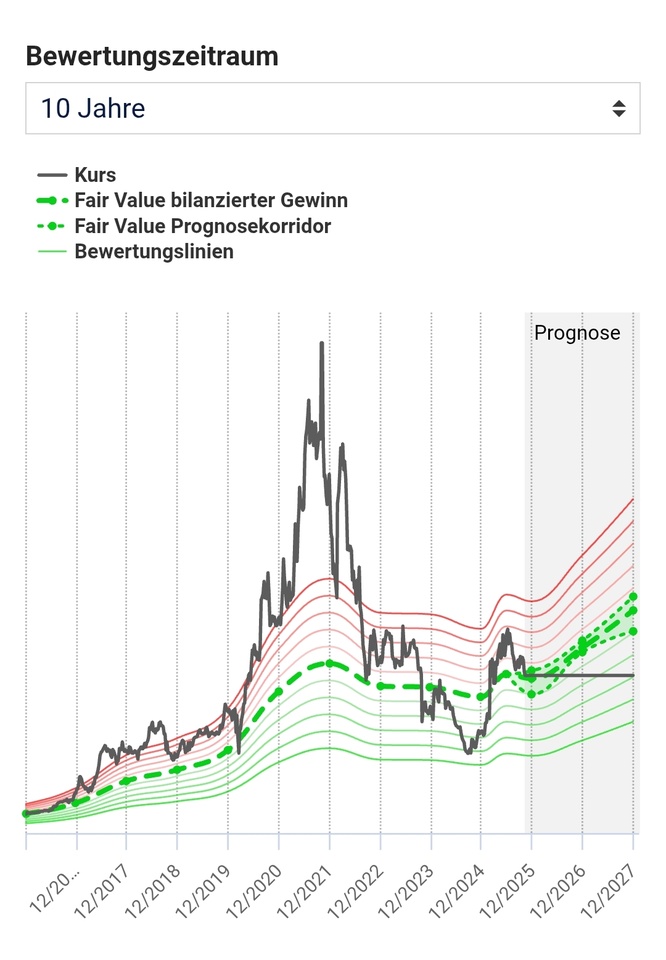

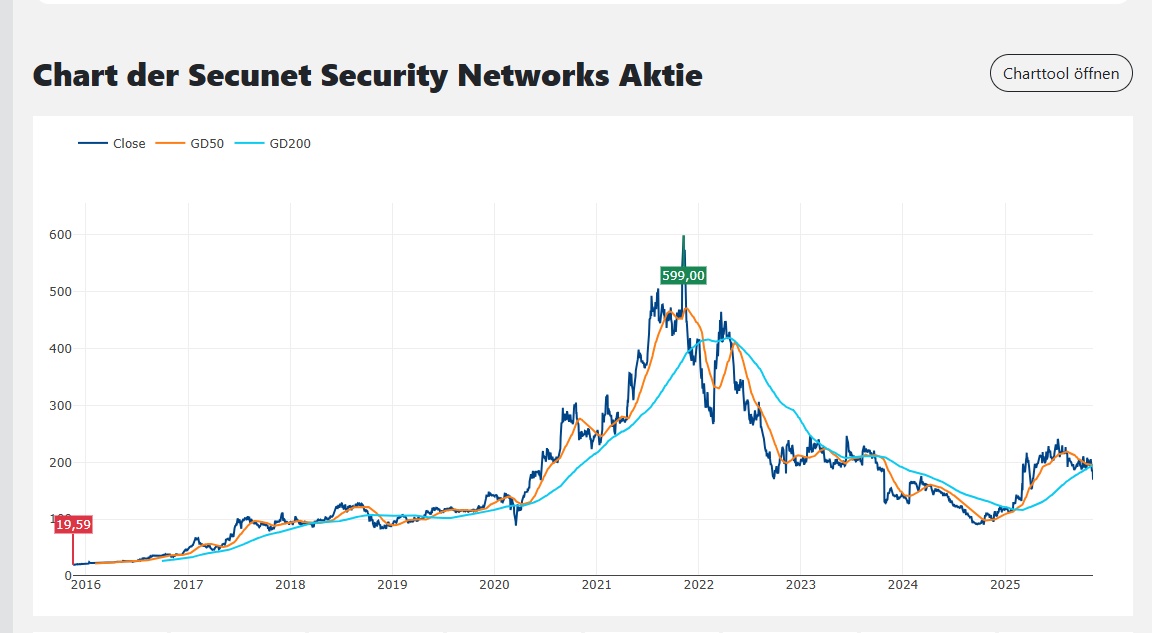

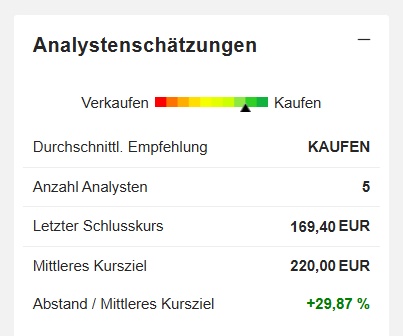

The key figure with the highest stability for the secunet Security Networks share is the reported profit, which is used below for the valuation. The P/E ratio (price/earnings ratio) calculated from this key figure is 34.30, which is 2.78 points below the historical average of 37.08 for the last 10 years. From this perspective, the secunet Security Networks share appears to be favorably valued.