I am faced with the same question every time. Do I let my profits run or do I take profits at regular intervals?

For my part, I have found my strategy. With very few exceptions, I am a fan of staggered profit-taking.

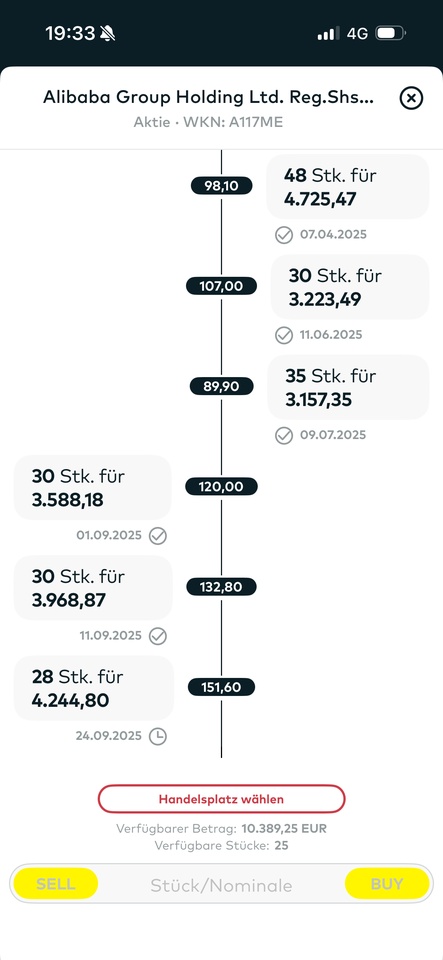

The screenshot shows this very well using Alibaba as an example. Only yesterday, after a 10% rise, I took further profits and reduced almost my entire position except for a small part.

So I rarely go "all-out" at once ... but I also rarely go "all-in" at once.

This has two advantages for me:

1) If I'm wrong (at the time of the sale - the share continues to rise afterwards or continues to fall after the purchase), I still profit from it

2) Profit-taking always feels good. You have something in your hand - and no one has ever been impoverished by profit-taking 😉

How do you handle this? What is your strategy?