An analysis by Consorsbank of over one million customer custody accounts, which is exclusively available to Handelsblatt, shows the savings behavior of Germans. According to the Bundesbank, the size of the sample corresponds to around one in 30 custody accounts held in Germany and therefore offers a representative view of the savings behavior of German investors.

According to the survey, the number of savings plans has increased compared to 2020. "Since then, the proportion of custody accounts with at least one savings plan has risen from 35.9% to 44.6%," reports Tino Benker-Schwuchow, Head of Consorsbank.

It's almost boring," says Benker-Schwuchow, "because year after year we see new sales records for ETFs." The boom in exchange-traded index funds is also noticeable in the Consorsbank custody accounts, especially in the savings plans.

"ETF savings plans are used disproportionately by people under 35," he explains. Older investors tend to invest regularly in actively managed funds and individual shares.

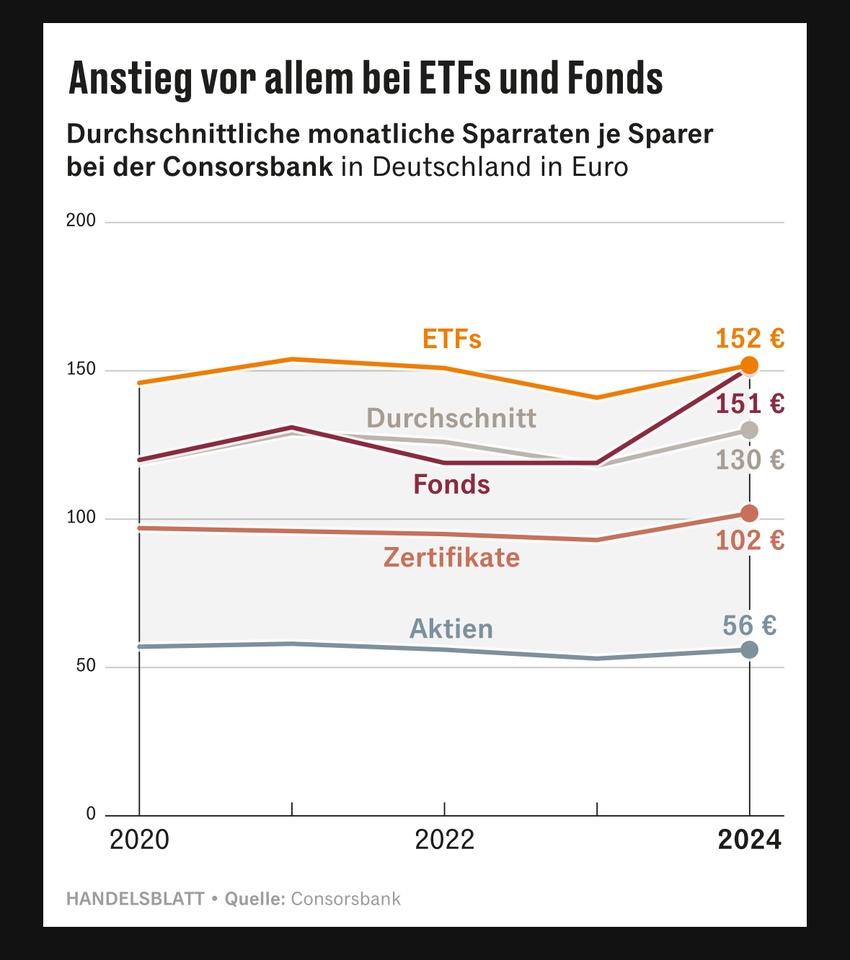

With an average of EUR 152 per savings plan per month, ETF and fund savings plans are in the lead.

Eight of the ten most popular ETFs track the MSCI World. Also among the top ten ETFs are the "Xtrackers MSCI Emerging Markets UCITS ETF", which allows investors to invest in emerging markets, and the "Xtrackers MSCI World Information Technology UCITS ETF", which specializes in tech companies.

There is a clear focus on the United States 🇺🇸 among the most popular stocks for holders of equity savings plans. This is dominated by the major tech companies Microsoft $MSFT (+0,56%), Apple $AAPL (+0,36%), Nvidia $NVDA (+2,24%) and Amazon $AMZN (+0,84%). They occupy the first four places. They are followed by savings plans on Berkshire Hathaway $BRK.B (+0%). The shares of the beverage company Coca-Cola $KO (-0,01%) is also regularly invested in. In seventh place is the Allianz share $ALV (-0,39%) the first and only German stock 🇩🇪 in the list of ten.

Market observers advise investors to diversify their portfolios as much as possible. "After around ten years of the tech boom, it can make sense to diversify your portfolio with an emerging market ETF or a global ETF that excludes the USA," explains financial mathematician Andreas Beck. He is head of the investment consultancy Index Capital.

Source (excerpt) & graphic: Handelsblatt,

25.02.25