👉 ASML ($ASML (+2,17%) ) is the most valuable tech company in Europe and the backbone of global semiconductor production.

The company builds the only EUV lithography machines in the world - without them, there would be no high-end chips for Apple, NVIDIA or TSMC.

What does ASML do? ⚙️

➡️ Core competence: Manufacture of lithography systems for chip production

➡️ EUV technology: Only supplier worldwide - indispensable for chips < 7 nm

➡️ Customers: TSMC, Samsung, Intel - the largest foundries in the world

➡️ Segments: 83 % Lithography | 9 % Services | 8 % Upgrades

💡 Absolute monopoly: Only ASML manufactures EUV machines in series. Every CPU, GPU or AI chip is created on ASML systems.

💡 Entry hurdle: > 100,000 individual parts, > 40 tons in weight, > €200 million in costs per tool.

Figures & growth (Q3 2025) 💰

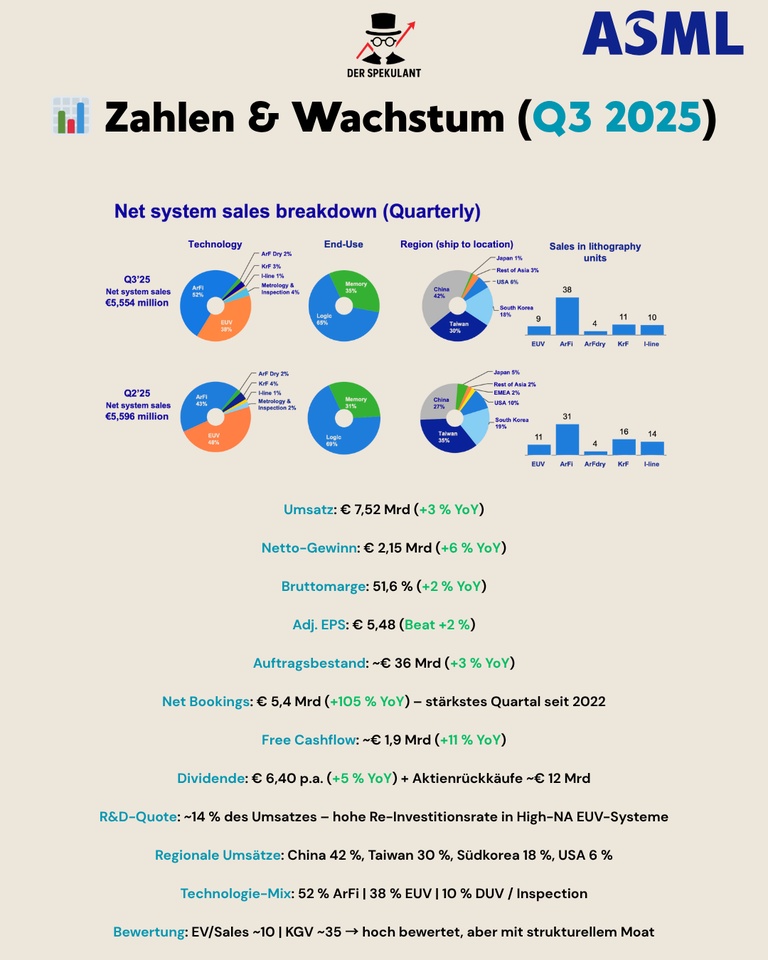

📊 Turnover: €7.52 billion (+3% YoY)

📊 Net profit: €2.15 billion (+6% YoY)

📊 Gross margin: 51.6% (+2% YoY)

📊 Adj. EPS: € 5.48 (Beat +2 %)

📊 Order backlog: € 36 bn (+3% YoY)

📊 Net bookings: € 5.4 billion (+105% YoY) - strongest quarter since 2022

📊 Free cash flow: € 1.9 billion (+11 % YoY)

📊 Dividend: €6.40 p.a. (+5%) + buybacks ~€12 bn

🧠 R&D ratio: 14% of sales → massive re-investment in high-NA EUV

🌍 Regional sales: China 42 % | Taiwan 30 % | South Korea 18 % | USA 6 %

⚙️ Technology mix: 52 % ArFi | 38 % EUV | 10 % DUV

💸 Rating: EV/Sales ≈ 10 | P/E ≈ 35 → highly valued, but with structural moat

The opportunities 🟢

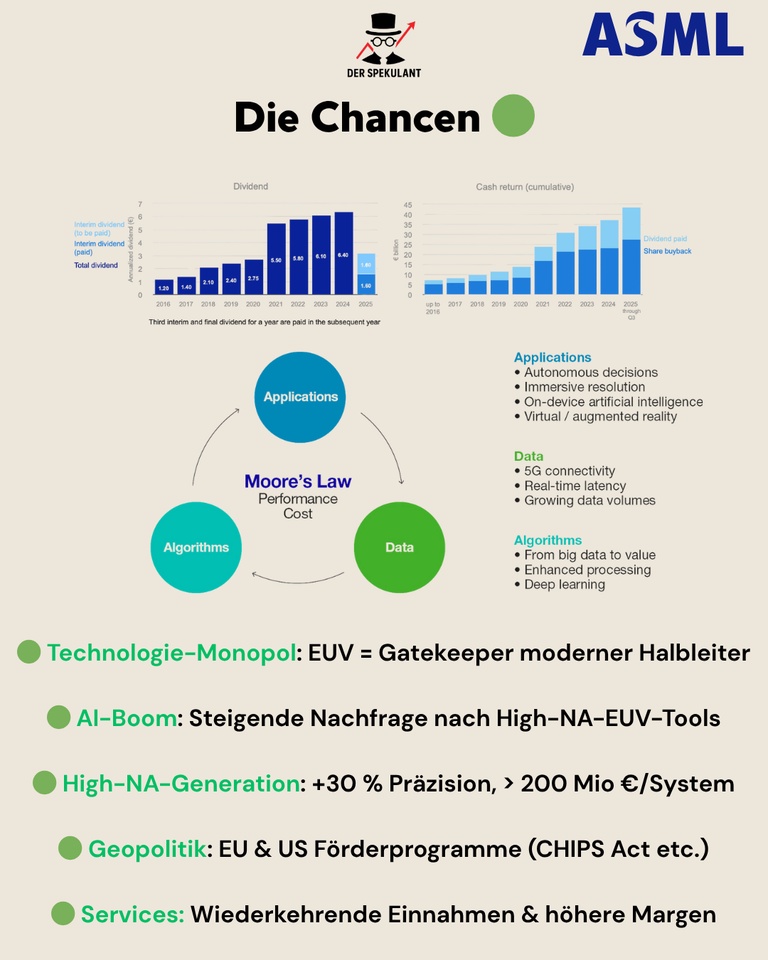

🟢 Technology monopoly: EUV = gatekeeper of modern semiconductors

🟢 AI boom: Rising demand for high-NA EUV tools

🟢 High-NA generation: +30 % precision → > € 200 million per system

🟢 Geopolitics: EU & US Chips Acts strengthen local production

🟢 Services: Recurring revenues and margin stability

The risks 🔴

🔴 China restrictions: Up to 15% of sales at risk

🔴 Cyclicality: CapEx dependency of TSMC & Samsung

🔴 Customer concentration: Top 3 = 70% of sales

🔴 High-NA rollout: Technical delays possible

🔴 Valuation: Premium multiple requires sustained growth

Conclusion 💡

ASML is the strategic bottleneck of the global semiconductor industry - the

the "pick and shovel" supplier of the AI revolution.

Cyclical in the short term, systemically relevant in the long term.

Long-term target: sales 2030 → € 44-60 bn with > 55 % margin.

💬 Community question

ASML - fairly valued for the next growth phase or already too expensive for the 2026 cycle?