My dears,

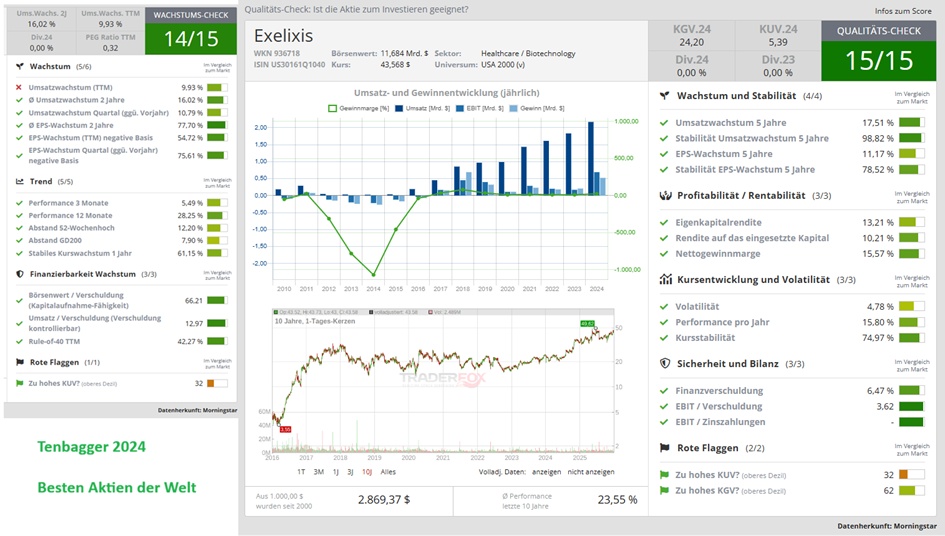

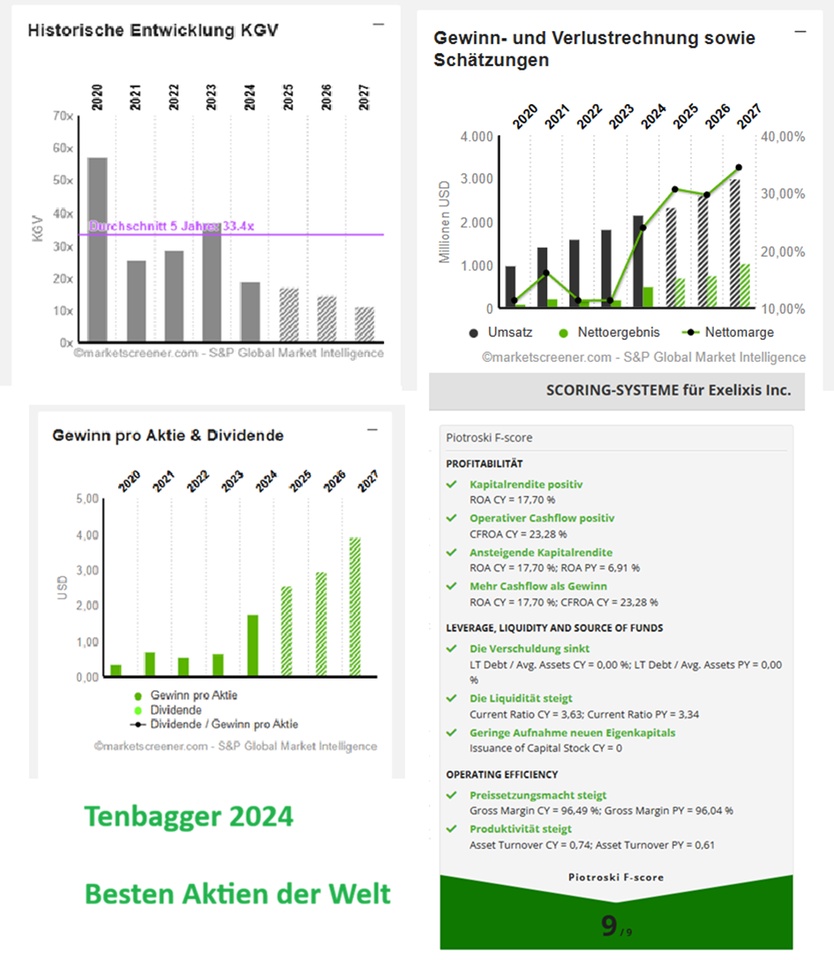

As promised, another share that scored quality check 15 points in the quality check. And which scores 14 points in the growth check.

TraderFox has developed a quality check to find the best shares in the world that are suitable for long-term investing. A total of 15 different key figures are evaluated in the following areas:

- Growth and stability

- Profitability and profitability

- Price development and volatility

- Security and balance sheet

- Excessive valuation

Each share is compared with all other shares in order to react dynamically to changing markets. The quality check is designed to help investors reduce the risk of investments. At the same time, the selection offers excellent investment opportunities.

Despite the still not outstanding performance in the pharmaceutical sector, I have selected a stock from this sector for you today.

(Dear all, even if there are 15 points in the check, pharma and biotech stocks always have a slightly higher risk).

Exelixis is derived from Exelixi the Greek word for evolution - an apt name that reflects the company's growth from a functional genomics startup to a fully integrated biopharmaceutical company that has learned to adapt, survive and thrive.

Exelixis - Oncology specialist with strong pipeline, Positive Phase III clinical trial data on zanzalintinib opens up billion-dollar sales potential!

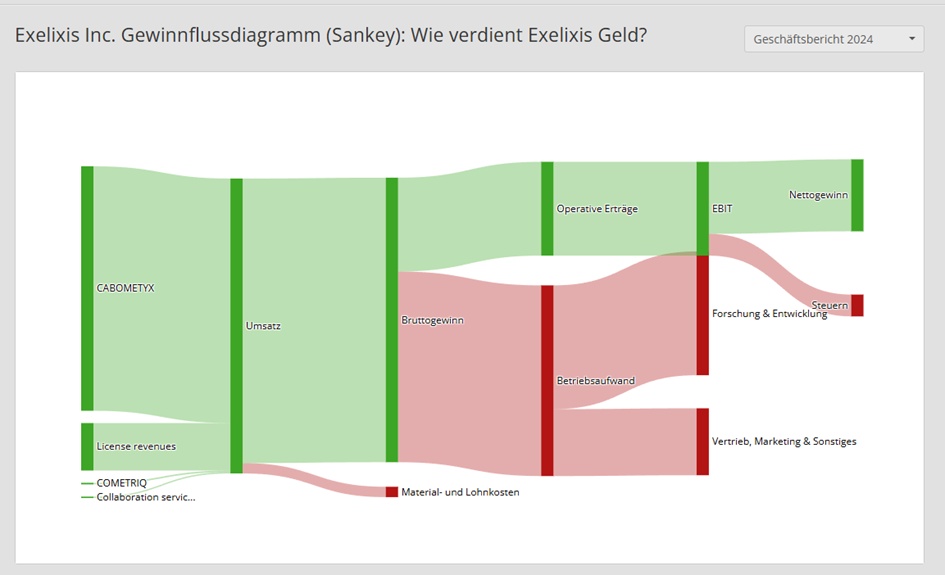

Business driver: The US company Exelixis (EXEL) specializes in the development of active ingredients and drugs in the field of oncology. With Cabometyx, Exelixis has a blockbuster drug in this high-margin segment that has already been approved for various indications (including renal cell carcinoma, hepatocellular carcinoma and medullary thyroid cancer), including advanced renal cell carcinoma (RCC), hepatocellular carcinoma (HCC) and medullary thyroid cancer (MTC). Cabometyx acts as a tyrosine kinase inhibitor.

Exelixis advances cancer research with successful active ingredients

Exelixis, Inc. (ISIN: US30161Q1040) is a biopharmaceutical company that develops cancer drugs. Its goal is to discover innovative therapies for various types of cancer using advanced drug development technologies. The company was founded in 1994 and has been listed on the NASDAQ since 2000.

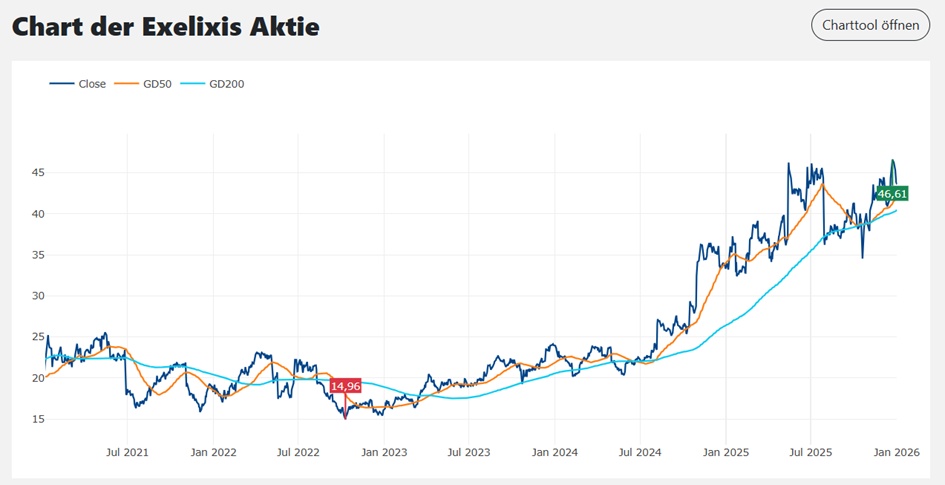

In recent months, the Exelixis share price has risen significantly after the cancer drug Cabometyx was approved by the FDA in March 2025. On 20.06.2025, it was also announced that approval by the EMA would follow this year, which would further increase the sales market for the new cancer drug.

Exelixis published its results for Q1 2025 on 13.05.2025. Revenue increased by 31% to USD 555.4 million, exceeding expectations. At USD 0.62, earnings per share also significantly exceeded the previous year's result (USD 0.17) and analysts' estimates (USD 0.36). Following the strong results, the company also raised its annual sales forecast by USD 100 million to up to USD 2.35 billion.

In addition, positive results from the phase 3 approval trial with the active ingredient zanzalintinib caused euphoria among investors on June 22, 2025. Analysts subsequently raised their price targets further. The share also scored an outstanding 15/15 in the TraderFox growth check and is close to its all-time high of USD 50.50 from the year 2000. The share offers an interesting starting point for both risk-taking investors and traders.

Conclusion

Exelixis is a leading biotechnology company that focuses on the development of innovative cancer drugs. With the aim of fundamentally changing the treatment of cancer, the company is working on the further development of Cabometyx and the novel drug zanzalintinib. The company is now growing profitably and at the same time offers potential thanks to promising phase 3 candidates. A breakout to a new all-time high would trigger a buy signal.

Exelixis, Inc. is an oncology company. The company is at the forefront of developing drugs and combination products for the treatment of cancer. It has four marketed pharmaceutical products, two of which are formulations of its flagship molecule, cabozantinib. Cabozantinib is an inhibitor of multiple tyrosine kinases, including MET, AXL, VEGF receptors and RET, and has been commercialized as CABOMETYX tablets for advanced renal cell carcinoma (RCC), pretreated hepatocellular carcinoma (HCC) and pretreated, differentiated thyroid carcinoma (DTC) refractory to radioactive iodine (RAI) and COMETRIQ capsules for progressive, metastatic medullary thyroid carcinoma (MTC). The company's two other products are COTELLIC, a MEK inhibitor approved as part of several combination treatments for the treatment of certain forms of advanced melanoma, and MINNEBRO, an oral, non-steroidal, selective blocker of the mineralocorticoid receptor (MR) approved for the treatment of hypertension.

Number of employees: 1,147

Dear all, please share your opinions in the comments.

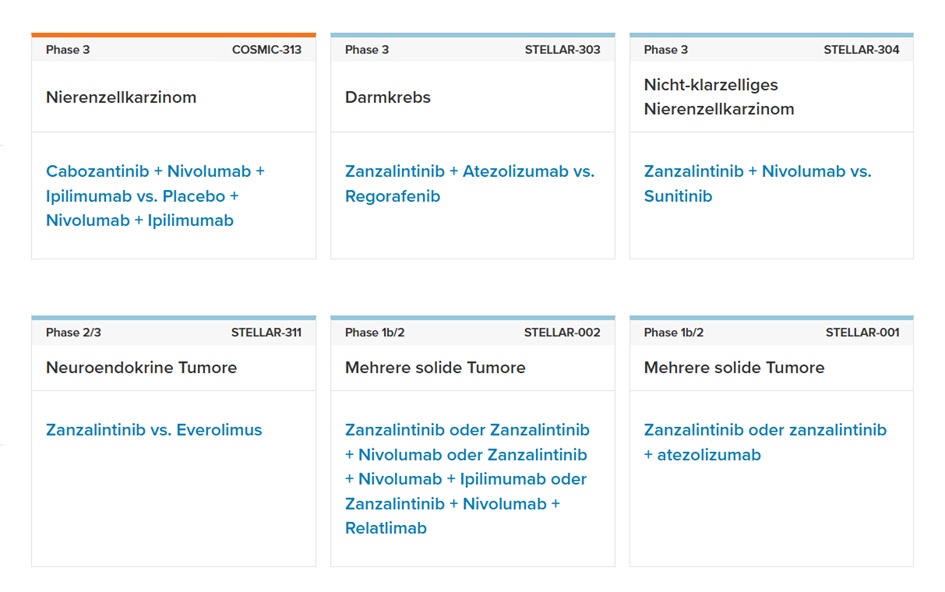

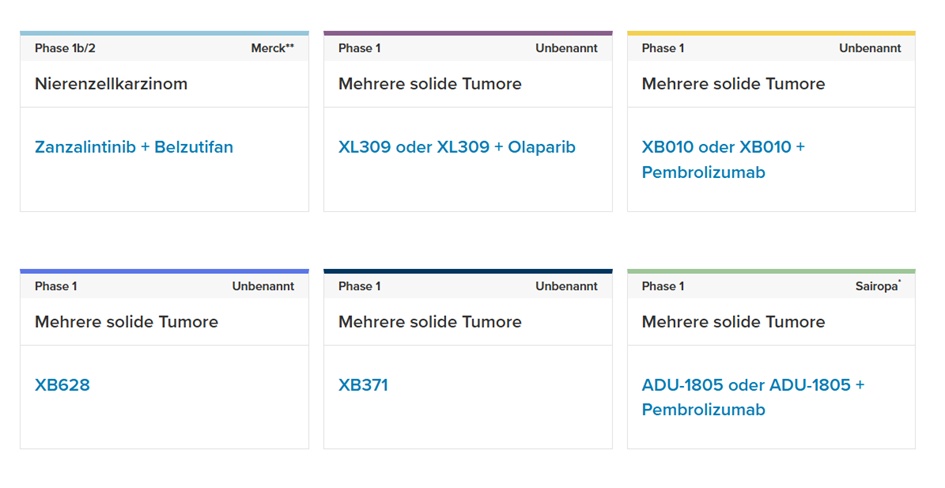

Clinical trials & pipeline

Small molecule drug discovery: past successes inspire future potential

Our small molecule legacy began with the discovery of our franchise molecule, cabozantinib, which has been successfully commercialized in multiple cancer indications and countries. We complement our small molecule discovery activities with research collaborations and licensing agreements with other small molecule discovery companies.

Cabozantinib | Zanzalintinib | XL309

Biotherapeutics: A new dimension to our pipeline

Much of our drug discovery activity is focused on the discovery and development of various biotherapeutics that have the potential to become anti-cancer therapies, such as bispecific antibodies, ADCs and other innovative treatments. Several biotherapeutic product candidates have entered clinical trials.

ADU-1805* | XB010 | XB628 | XB371 | XB064 | XB773

USD estimates

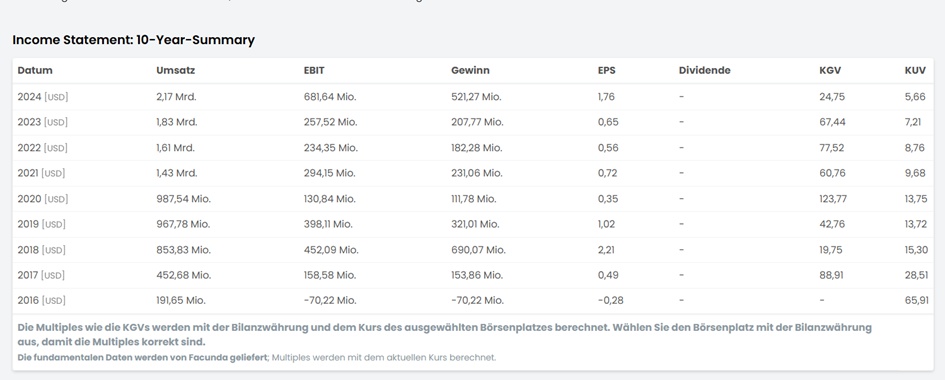

Year Sales Change

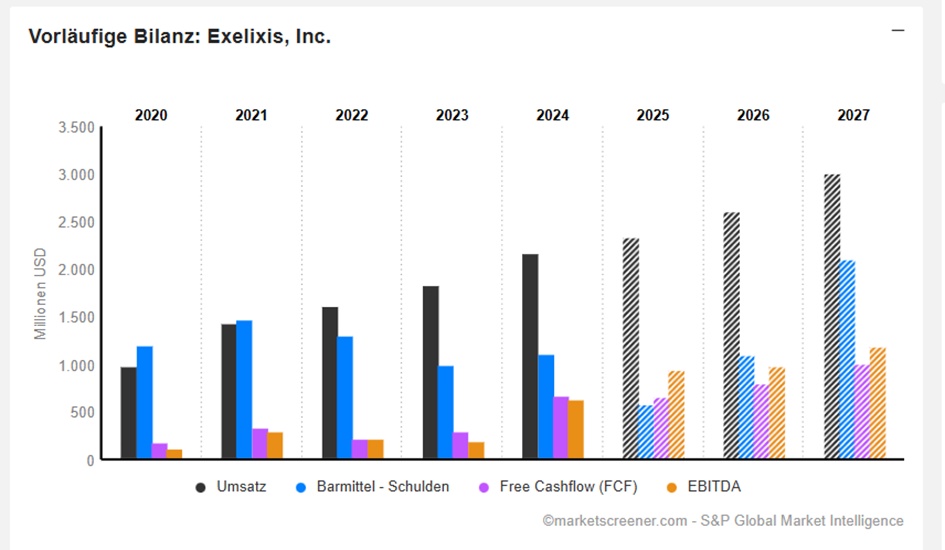

2024 2.169 18,49 %

2025 2.335 7,66 %

2026 2.614 11,96 %

2027 3.004 14,91 %

Year EBIT change

2024 604,6 253,82 %

2025 837,1 38,45 %

2026 959,8 14,66 %

2027 1.223 27,41 %

Year Net result Change

2024 521,3 150,89 %

2025 716,1 37,37 %

2026 775,7 8,33 %

2027 1.034,0 33,3 %

Year Net debt CAPEX

2024 -1.111 28,44

2025 -580 26.45

2026 -1.104 32.20

2027 -2.107 33,13

Year Free cash flow Change

2024 671,5 129,31 %

2025 655,9 -2,32 %

2026 803,7 22,53 %

2027 1.013,0 26,1 %

Year EBIT Margin ROE

2024 27,88 % 23,13 %

2025 35,85 % 28,29 %

2026 36,72 % 23,95 %

2027 40,71 % 24,28 %

Year Earnings per share Change

2024 1,76 170,77 %

2025 2,548 44,75 %

2026 2,972 16,67 %

2027 3,922 31,96 %

Number of shares (in thousands) 269,203

Market value11,732

Year P/E ratio PEG

2024 18.9x 0x

2025 17.1x 0.4x

2026 14.7x 0.9x

2027 11.1x 0.3x

Date of publication 11.02.25

What was the performance of the Exelixis share?

2025 +31,62 %

2024 +38,81 %

2023 +49,56 %

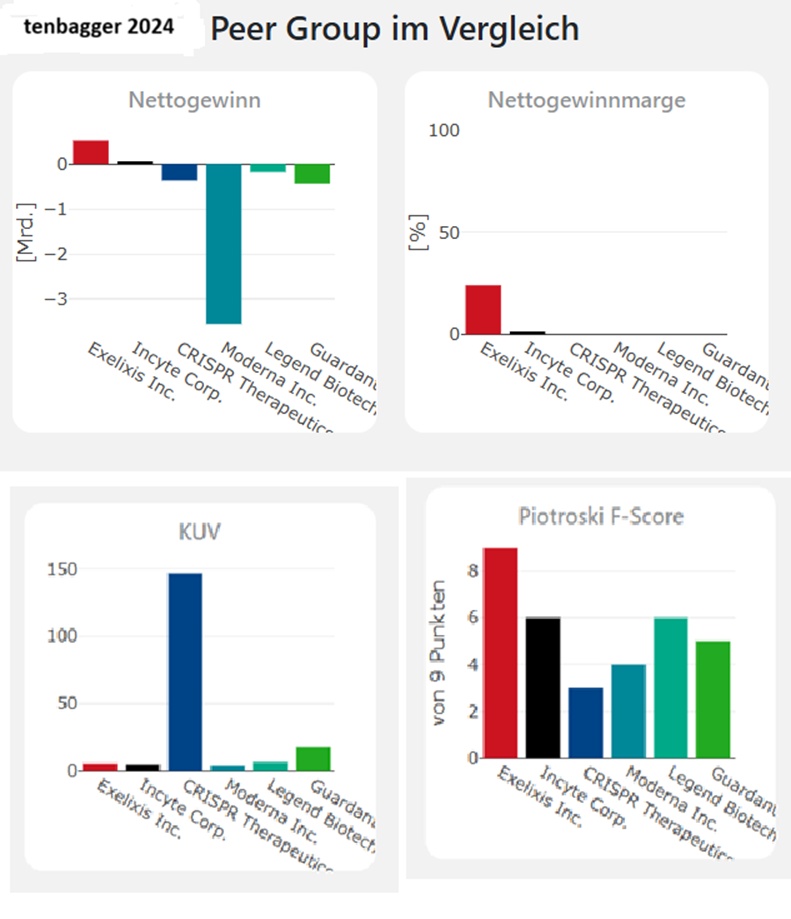

Moderna Inc.

$MRNA (-0.94%)

CRISPR Therapeutics AG

$CRSP (-1.54%)

Incyte Corp.

$INCY (-2.31%)

Guardant Health Inc.

$GH (+0.03%)

Exelixis Inc.

$EXEL (-0.52%)

Legend Biotech Corp. (ADRs)

$LEGN (+0%)

THANKS FOR READING!