Today I'm taking a quick look at Robinhood.

Robinhood is a fintech pioneer from the USAthat offers commission-free trading and modern financial services via a user-friendly app and web platform - comparable to Trade Republic or Scalable Capital in Germany.

The company was founded in 2013 and went public in 2021. In its early years, Robinhood struggled with a tarnished image in its early years - particularly due to accusations of "gamification" of investing and a massive shitstorm in 2021 when the company temporarily halted trading in certain "meme" stocks, including GameStop.

Robinhood has shed its former problem image after turbulent years, however shed and has developed excellently in operational terms.

So is Robinhood a promising investment for the future or a company to avoid?

We'll find out that and more in the next few minutes - enjoy reading!

Website:

https://robinhood.com/us/en/about-us/

Market capitalization: 66 billion US dollars

Risk profile: High

Core idea and vision

Robinhood was founded in 2013 by Vlad Tenev (current CEO) and Baiju Bhatt - with a clear mission: Finance for all - i.e. to democratize democratize access to financial markets.

The trigger: The founders had recognized that traditional brokers had high fees, complex user interfaces and high barriers for beginners. had. This discouraged young people in particular from investing.

Robinhood took a different approach:

- Commission-free stock trading: Robinhood was the first major broker in the US to offer commission-free trading. This triggered a revolution in the industry - many big players had to follow suit later (e.g. Charles Schwab, E*TRADE, Fidelity).

- "Mobile-First": Robinhood developed an extremely customer-friendly and intuitive app with a clear interface that is specifically tailored to younger target groups. Gamification elements such as animations or confetti made investing more "playful" - although this initially drew criticism.

- Fragments of shares: Robinhood made it possible to invest from just a few US dollars by allowing you to buy fractions of a share. This made diversified investing possible even with small amounts of capital.

- Round-the-clock trading: Share trading used to be restricted to certain time slots. Robinhood broke this down too. Since 2023, Robinhood has offered 24-hour trading five days a week (Monday to Friday) for selected US stocks.

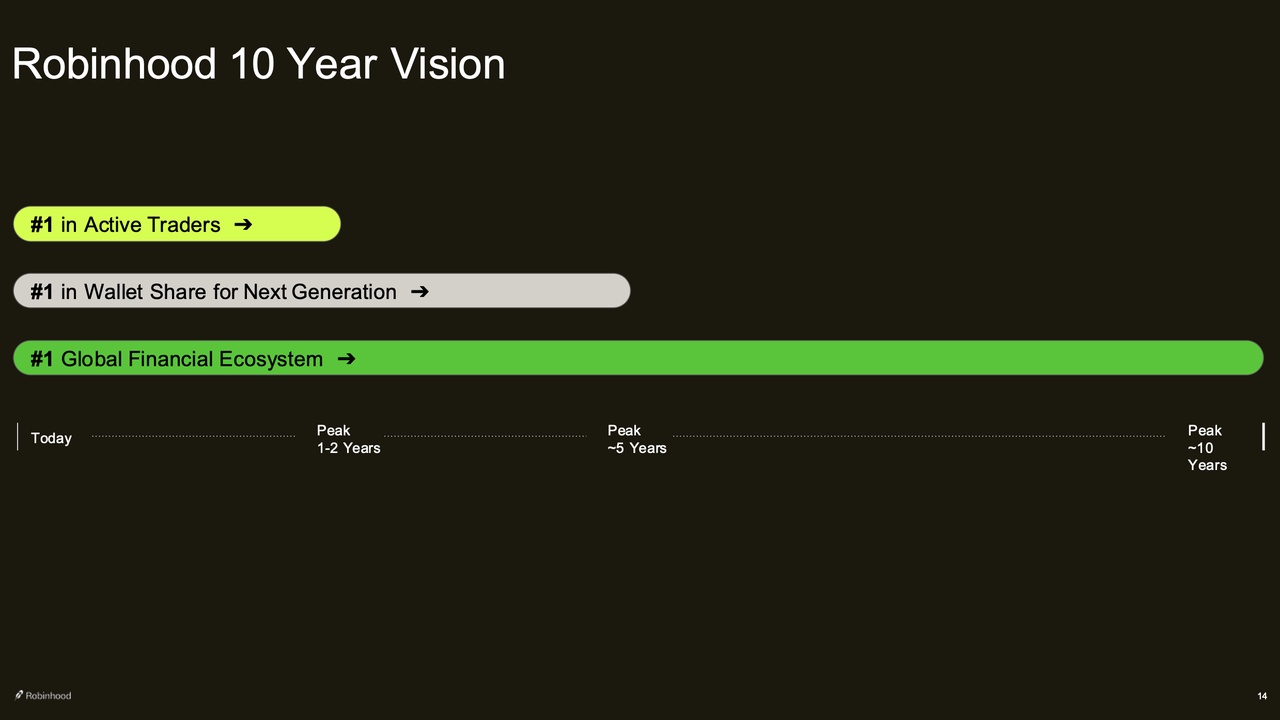

Robinhood is pursuing an ambitious growth strategy: From trading for beginners to a global super app for finance. Specifically, the company has set itself the following targets for the next 10 years the following three major goals (see chart below):

- Short term (1-2 years): Robinhood wants to become the leading platform for active private investors. This means: focus on useful tools, large selection of asset classes, speed and user-friendliness.

- Medium term (5 years): Robinhood wants to become the central financial platform for millennials and Gen Z - not just for trading, but also for long-term investing/retirement planning, wealth management, traditional banking (salary and savings accounts, cash payments, credit cards, cash home delivery) and more. The aim is for young users to manage a large part of their assets ("wallet share") via Robinhood.

- Long term (10 years): Robinhood aims to build a global, fully integrated financial ecosystem - with an international presence, comprehensive product suite (investments, wealth management, banking) and a single point of access for all of the next generation's financial needs.

What do optimists say?

Here is a compact overview of the Robinhood investment hypothesis:

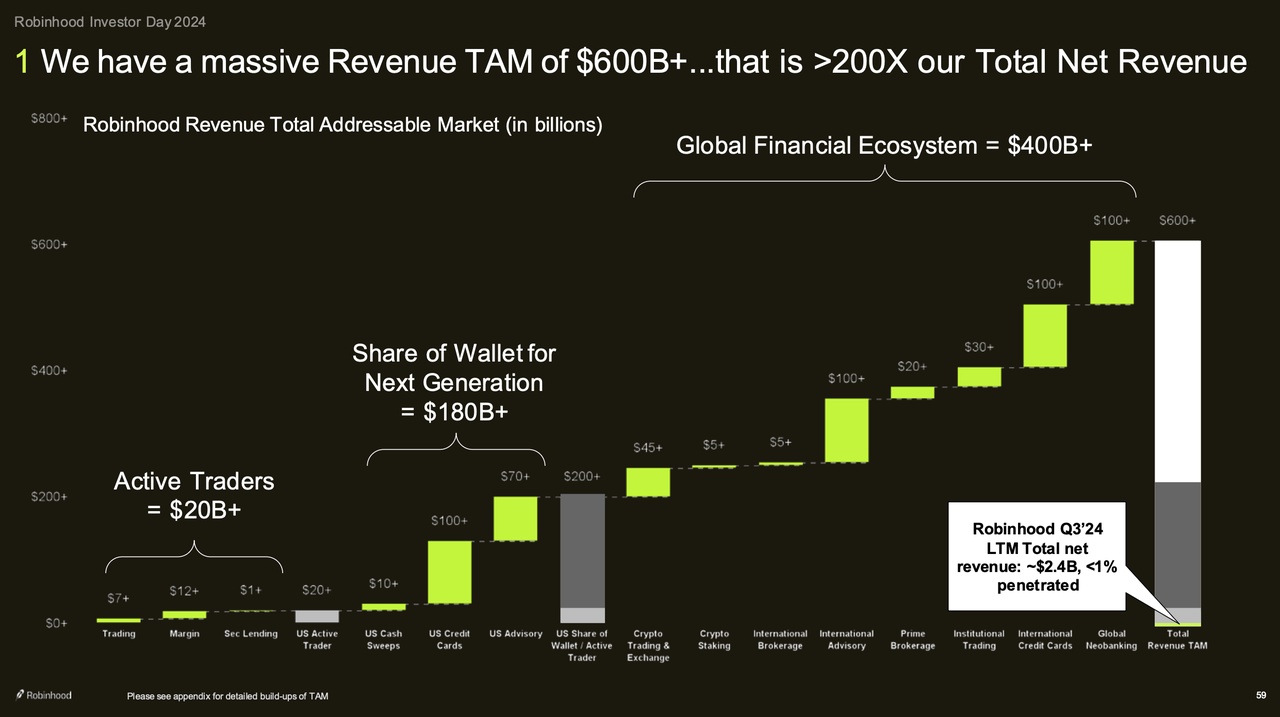

1) Large target market: Robinhood estimates its potential market at over $600 billion annually - more than 180 times its current revenue (~$3.3 billion). If this calculation is correct, the company currently has <1% market penetration - enormous growth potential over the next 10 years.

Robinhood's target market is likely to be driven by structural tailwinds over the next few years:

- In the coming years, a transfer of wealth in the trillions to

millennials and Gen Z is imminent. Robinhood, whose users have a median age of 35, is in an excellent strategic position to benefit from this trend. The platform appeals particularly strongly to the younger generations - and could thus become a preferred destination for inherited capital.

- The proportion of US households owning shares has risen from 49% (2013) to 58% (2022) with further upside potential.

- The number of mobile banking users has risen from 43 million (2015) to 102 million (2024)- and the trend is still rising. Robinhood's user-friendliness and gamification meet this trend exactly.

- The young generation is crypto-savvy and Robinhood integrates crypto into its multi-asset platform alongside equities and other securities.

- Robinhood is able to use artificial intelligence (AI) radically improve access to research, recommendations and personalization.

- Young investors are thinking earlier about retirement planning and wealth accumulation. Robinhood addresses this with expanded offerings.

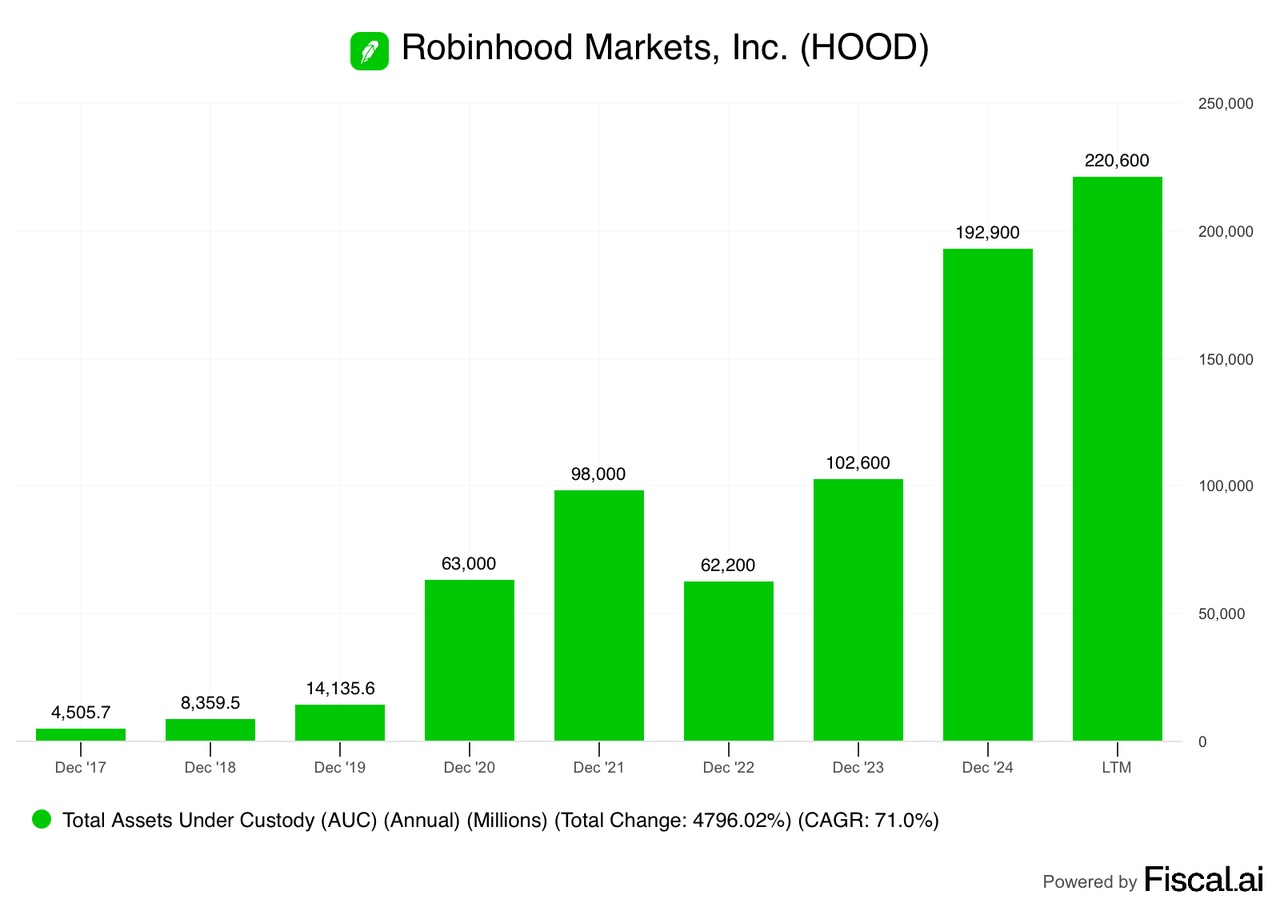

2) Strong market share gains: The customer assets held by Robinhood assets under custody (Assets Under Custody, AUC) has grown explosively in recent years, as the chart below shows. Today, the company has >220 billion US dollars in client assets under custody - more more than twice as much as in 2021.

The main reasons for this sharp increase are user growth and above all the higher deposits per customer. While the average Robinhood customer had 4,000 US dollars on the platform 3 years ago, today it is >8,500 US dollars. Customers are therefore transferring more and more money to Robinhood - on average 75% of the money comes from new deposits and 25% from a transfer from other brokers. Robinhood is therefore successfully gaining market share over its competitors.

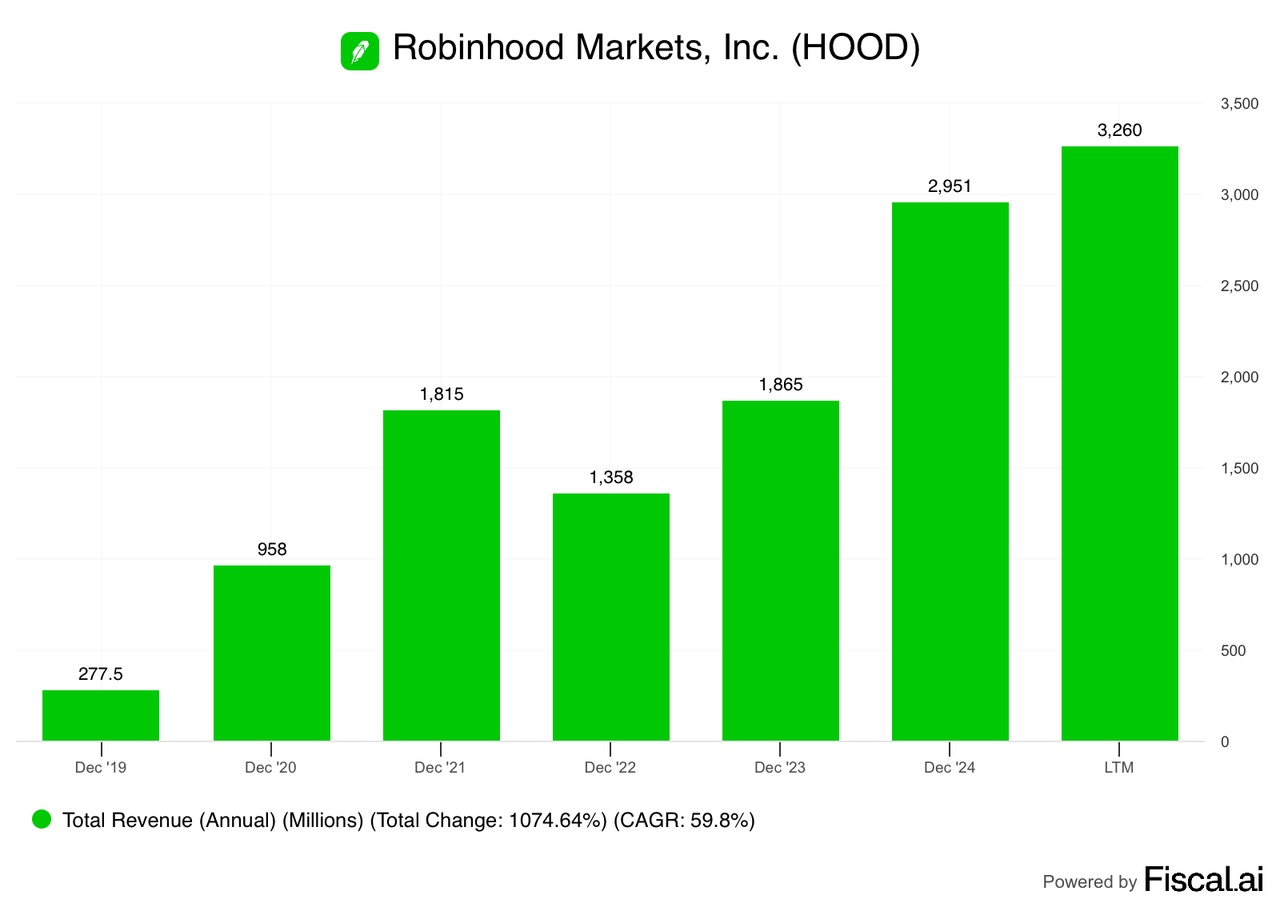

The increasing customer assets have a positive effect on the turnover of Robinhood (see chart below) - through higher trading frequency, larger volumes per trade and a growing interest business with customer funds. Accordingly, Robinhood's turnover has almost doubled since 2021. has almost doubled.

This makes Robinhood the broker and crypto platform of choice for millennials and Gen Z in the US - more cheaper, more user-friendly and more innovative than the competition. No other provider combines consistently combines low costs, intuitive user experience and continuous innovation.

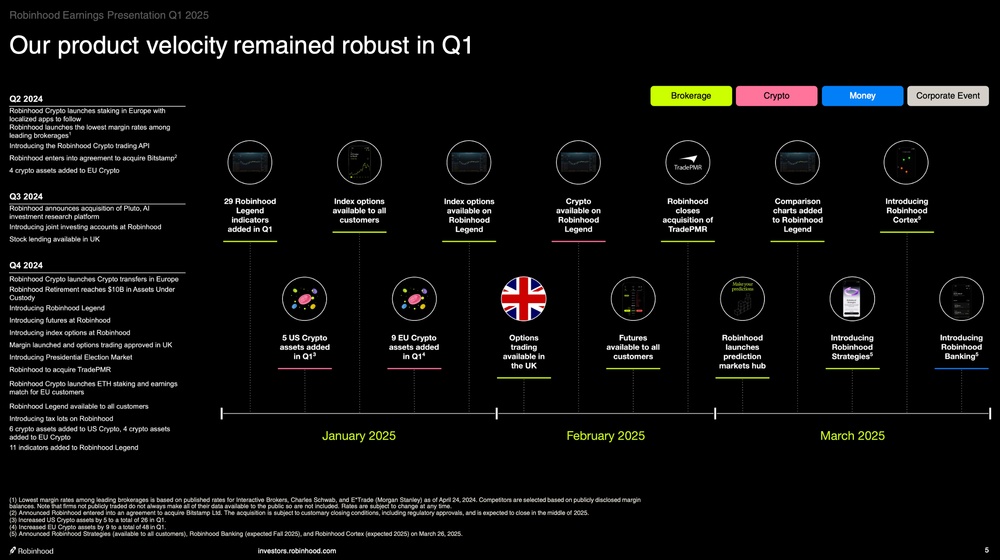

New products and functions appear with impressive speed - here is a current overview:

The latest highlights are futures contracts, index options and prediction markets (e.g. for elections or sporting events). Robinhood is also planning to offer more complex products in the future that were previously intended more for professionals - but which are simple, mobile usable and packaged for the masses.

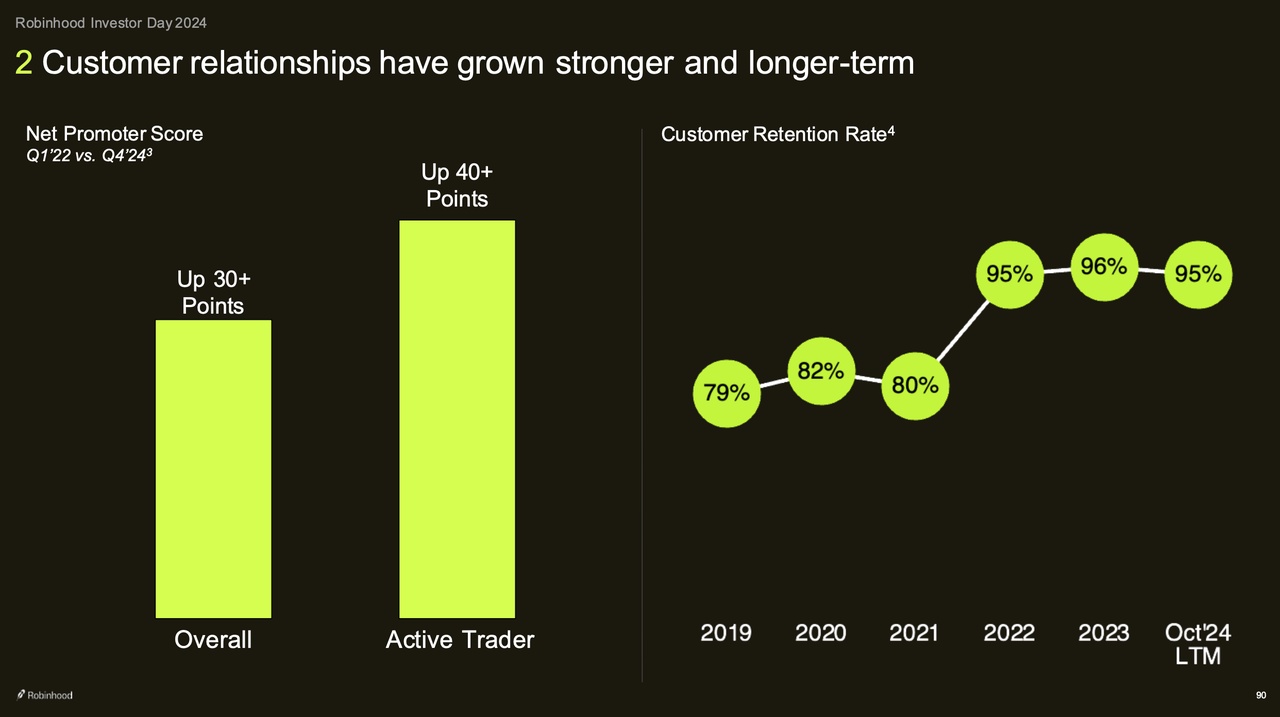

Through continuous innovation and the introduction of new products, Robinhood is able to integrate customers more closely into its own ecosystem. The more functions are used and assets are distributed across different products, the greater the customer loyalty - and the lower the likelihood of users switching to the competition (see chart below).

3) Diversification of the business: Robinhood makes money in three main ways:

- Trading business (58% of sales): In the trading business, the company makes money every time someone trades through Robinhood. Robinhood sends the orders to so-called "market makers" - and receives money in return (this is called "payment-for-order-flow"). This applies, for example, to the purchase of shares, options or cryptocurrencies. The more and more often people trade, the more Robinhood earns.

- Interest income (35% of turnover): Robinhood earns interest in a variety of ways: When users deposit money with Robinhood, it is invested - and Robinhood keeps a portion of the interest. Anyone who trades with borrowed money ("on margin") also pays interest. And lending shares to other investors also generates income.

- Subscriptions / extras (7% of turnover): Robinhood also offers premium features for which users pay voluntarily, e.g. the Gold subscription ($5 a month). Users then receive more attractive trading conditions, higher interest rates, access to borrowed money and other benefits.

The company is trying to further diversify its revenue streams and make itself less dependent on the trading business and its susceptibility to fluctuations. Robinhood now has 9 business areas which each generate over 100 million US dollars per year.

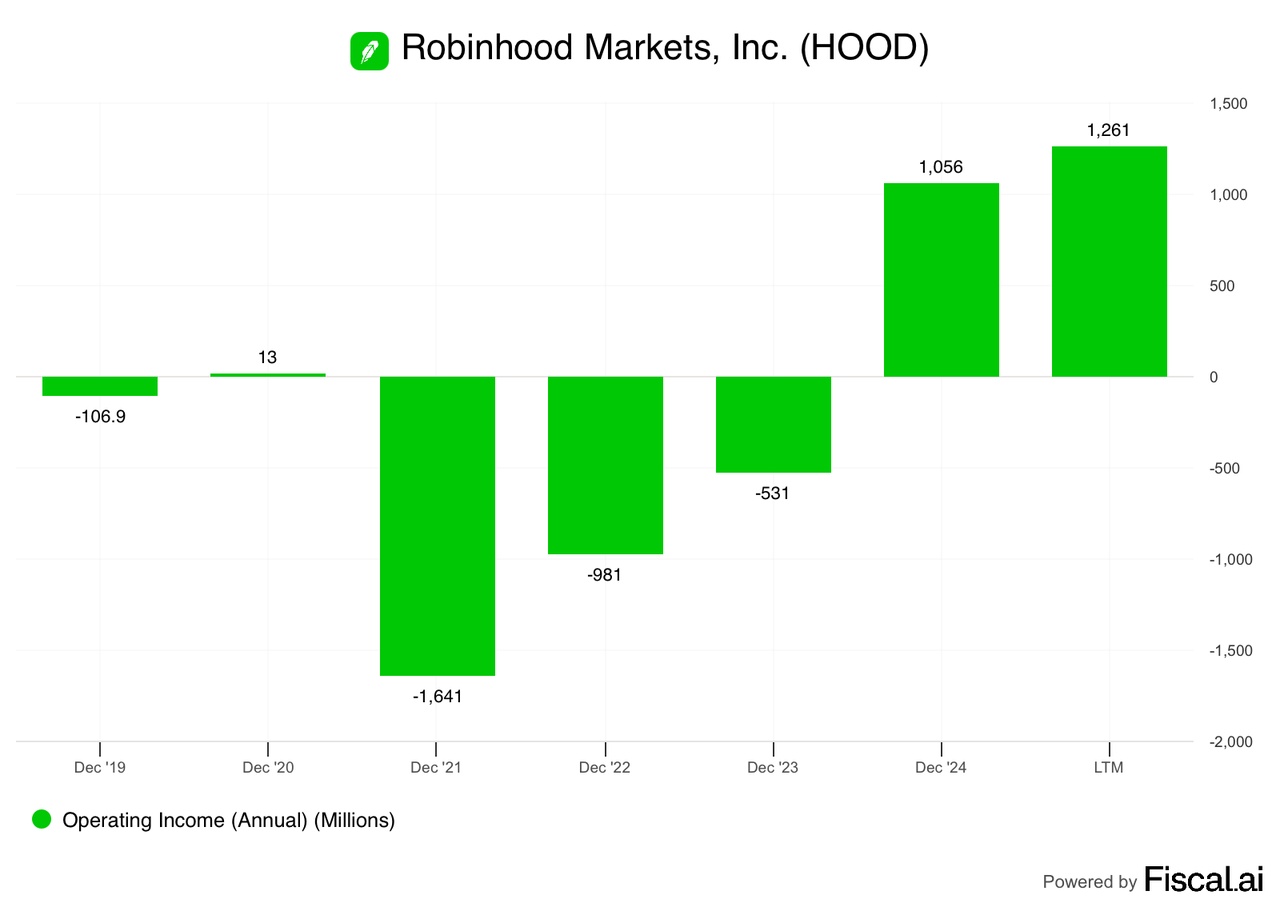

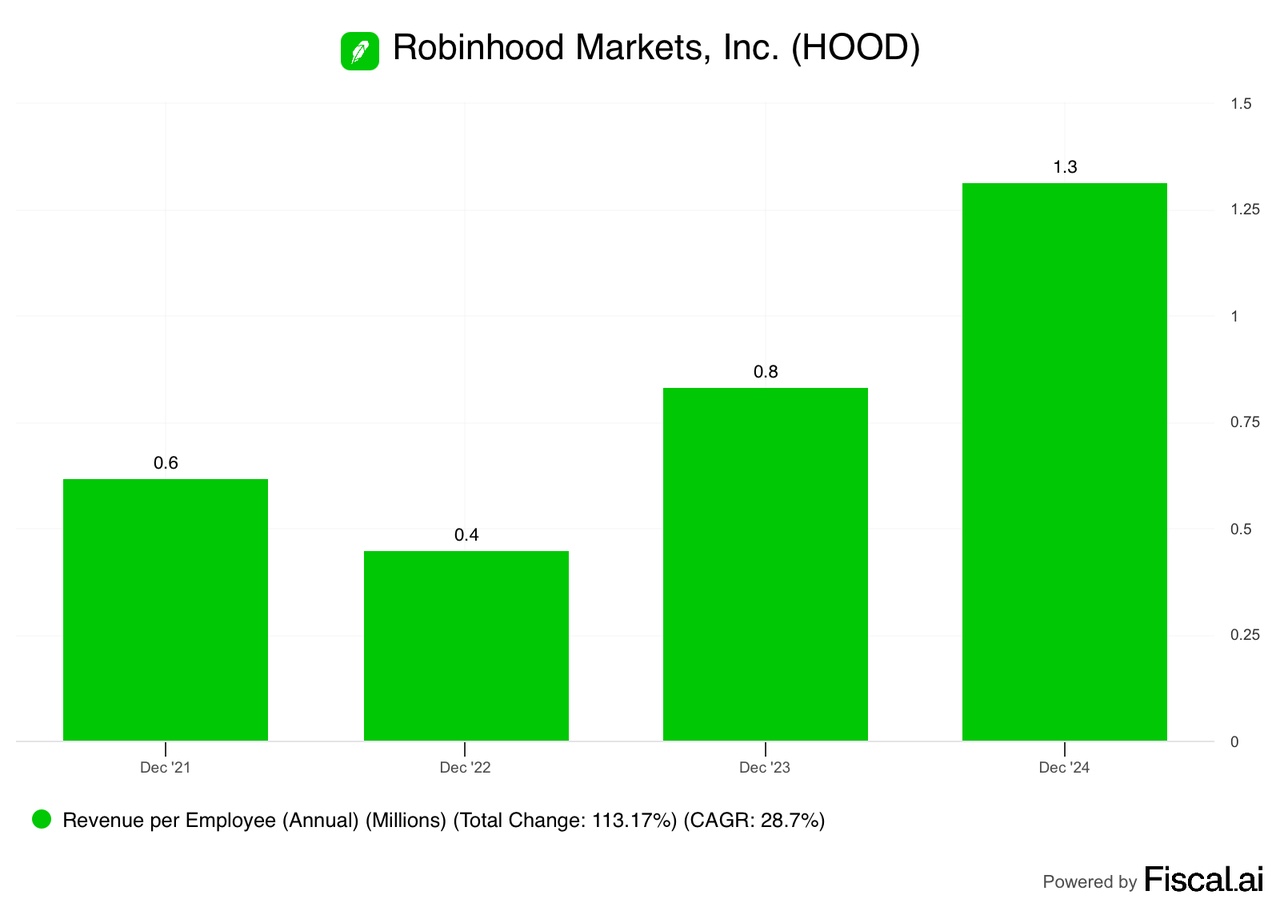

4) Increasing profitability: As a technology-driven company, Robinhood benefits from a scalable infrastructure - in contrast to traditional banks or brokers with cost-intensive, often outdated IT. This means that more users do not necessarily lead to proportionally higher costs, especially in areas such as software, infrastructure and product development. Profitability therefore increases disproportionately with an increasing number of users.

Robinhood also has a higher turnover per employee (see chart below) compared to traditional banks. Technology-driven processes (e.g. self-service support, automatic verification, in-app features) reduce personnel requirements. This leads to an efficient organization and lean structures.

What do skeptics say?

Here are some of the most common criticisms of the company and possible risks:

- Strong competition, little differentiation, low barriers to entry: Even though Robinhood is currently the market leader among young US investors, its core business remains highly competitive. Many functions (e.g. commission-free trading, appealing app experience) are increasingly being copied by competitors. International providers also want to enter the US market - which could dampen sales growth and increase margin pressure in the long term. Due to the low barriers to entry, new competitors must also be expected to enter the market at any time. Platform X, for example, has already announced its intention to offer banking solutions and investment opportunities.

- Cyclical business model: A large proportion of turnover continues to depend on the trading business - particularly in options and crypto. In a bear market (such as 2022) or when volatility is low, customers trade less - and Robinhood's revenues fall accordingly (see chart above). Although the company is trying to diversify through interest income and subscriptions / extras, its dependence on the trading business remains noticeable. Robinhood already had to experience this in 2022 when sales slumped by >30% compared to the previous year. Robinhood could therefore be significantly penalized in the next market downturn.

- Regulatory risks: The most important revenue model - payment by "market makers" for forwarding customer orders - is repeatedly criticized in the USA. Regulatory authorities regularly examine whether payment-for-order-flow (PFOF) is compatible with investor protection. A possible ban or restriction could jeopardize Robinhood's central source of income, even though the company is working on alternatives.

- Reputational risks: Robinhood has lost trust in the past due to incidents such as the GameStop crisis in 2021, technical failures and customer complaints. Even though the image has improved significantly recently, the brand remains a red flag for some investors. Future errors in communication, risk management or product execution could once again undermine customer trust.

Conclusion

Robinhood is undoubtedly one of the most exciting fintech companies of the last decade: a radical innovator, first-mover in commission-free trading and a platform that meets the younger generation where they are - mobile, digital and thinking for themselves.

- The strong operational performance of the company in recent months and years is now also reflected in the share price noticeable: This has risen by 243% in the last year alone and by over 100% since the IPO (see chart below).

- There is further upside potentialThe company's strong market position: large target market, structural tailwinds, e.g. from the upcoming transfer of wealth, strong brand position among millennials and Gen Z, and an increasingly diversified business model.

- At the same time, Robinhood is also a growth company with risks, e.g. high competition, cyclical sales, regulatory uncertainties around payment-for-order-flow (PFOF) and a still sensitive brand image.

- I myself am not currently invested in Robinhood, However, I am following the company with great interest - particularly with regard to future product developments, possible international expansion and the question of whether Robinhood will succeed in further expanding its user base and customer assets under custody despite strong competition.

- I personally see the fair value of the share in the range of 40-45€ - based on the assumption that Robinhood will grow sales by 15-20% per year over the next few years and at the same time slightly increase its profit margins.

Happy investing!