$HBMN (-2,88%) - 20% discount on NAV

I took a look at HBM Healthcare Investments' quarterly report for June 2024 and would like to share the key points and figures with you. Here we go:

1. company profile and portfolio

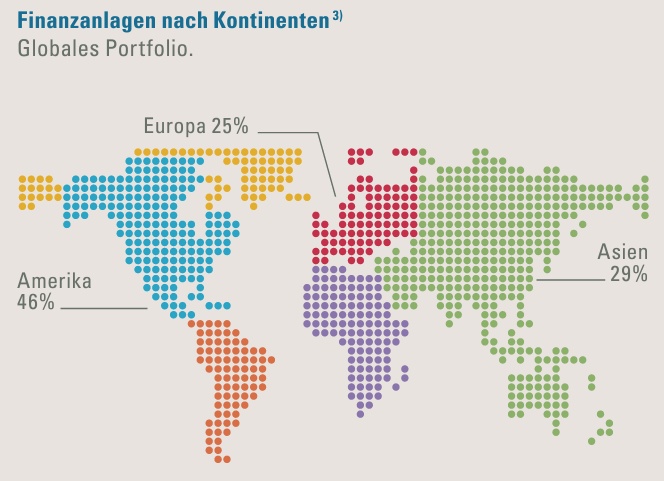

HBM Healthcare Investments specializes in the healthcare sector and manages a global portfolio. This includes companies in the fields of human medicine, biotechnology, medical technology and diagnostics. The company is listed on the SIX Swiss Exchange and offers an exciting alternative to large pharmaceutical and biotechnology companies.

2. financial overview

- Total assets: CHF 1.846 million

- Financial assets: CHF 1,669 million

- Net assets: CHF 1,722.4 million (as at June 30, 2024)

- Investments in private companies and funds: CHF 875.9 million

- Investments in listed companies: CHF 793.4 million

- Cash and cash equivalents: CHF 132.1 million

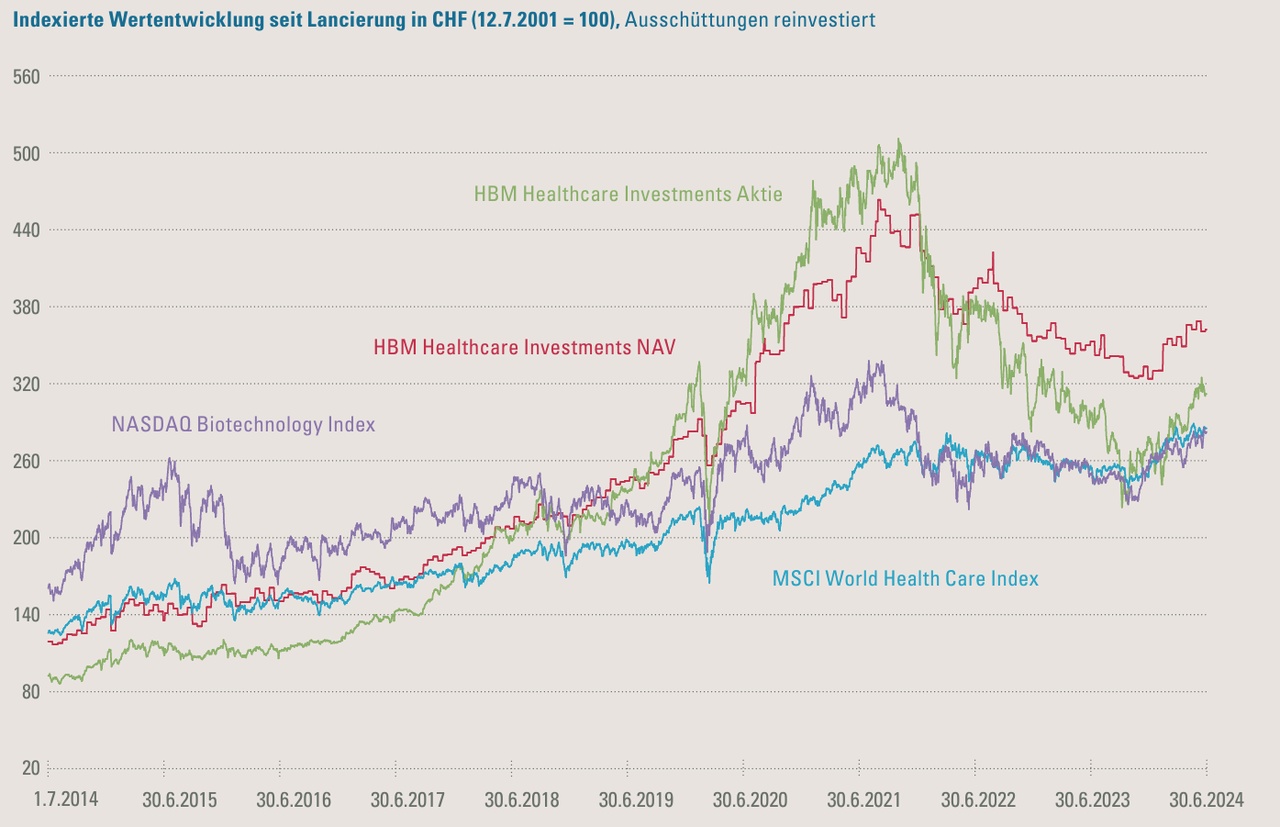

3. performance and key figures

- NAV (net asset value) per share: CHF 252.07

- Closing share price: CHF 205.00

- Quarterly result: CHF 26 million

- Earnings per share: CHF 3.72

4. significant developments in the portfolio

- Sale of Yellow Jersey Therapeutics: Johnson & Johnson acquired Yellow Jersey Therapeutics for USD 1.25 billion, resulting in a gain of CHF 59 million for HBM.

- IPO of Alumis Therapeutics: Alumis Therapeutics raised USD 250 million in new capital through an IPO on the Nasdaq.

- Acquisition of Laboratorios Biopas by Swixx BioPharma: Swixx BioPharma strengthened its market position through the acquisition of Biopas, which led to a significant increase in sales.

5 Strategic orientation and risk management

HBM Healthcare remains cautious in the current macroeconomic environment and has hedged one third of its USD currency risk against the Swiss franc. The asset allocation is broadly diversified and remains virtually unchanged.

6 Future prospects

The company assumes that central banks in the US and Europe will cut interest rates in the second half of the year, which could improve market sentiment for growth companies. Despite geopolitical uncertainties, HBM Healthcare is optimistic about the development of its portfolio.

My opinion:

HBM Healthcare Investments is robust and well positioned to benefit from future developments in the healthcare sector. The broad diversification and strategic focus provide a solid basis for long-term growth. I have been invested for some time, am slightly up and will continue to hold. Especially as the UG is trading below NAV, a "margin of safety" is already built in!

I hope you find this overview helpful. $HBMN (-2,88%) - an investment for you?

Happy Friday!

GG

#Finanzforum

#HBMHealthcare

#Investieren

#Gesundheitssektor

#Quartalsbericht

#FinanzielleFreiheit

#Aktienmarkt

#Vermögensaufbau

#Finanzplanung