The biggest moat of Berkshire Hathaway ($BRK.B) (-1,93%) is the insurance float, a stream of capital that provides additional investment power year after year.

1. what is behind the float? 🏦

- Insurance companies collect premiums today, but often do not have to settle claims for years. During this time, Berkshire can invest the capital.

- Normal companies have to pay interest on capital. Berkshire, on the other hand, even gets paid for holding capital through solid underwriting.

- The float has grown from a few million dollars in the 70s to over 170 billion USD today.

2. why this is so strong 🔄

- Structural advantage: The float is not a random product, but an integral part of the insurance model.

- Independent of individuals: Buffett and Munger made the concept great, but it lives on through the strength of insurance subsidiaries like GEICO or General Re.

- Investment freedom: Capital flows continuously and can be flexibly invested in shares, bonds or entire companies.

3. opportunities for investors 📈

- Stability: The float remains in place even after a change of management.

- Crisis strength: In market downturns, Berkshire remains liquid while other companies experience capital problems.

- Growth: The larger the insurance division, the more capital is available for new investments.

4. conclusion 👉

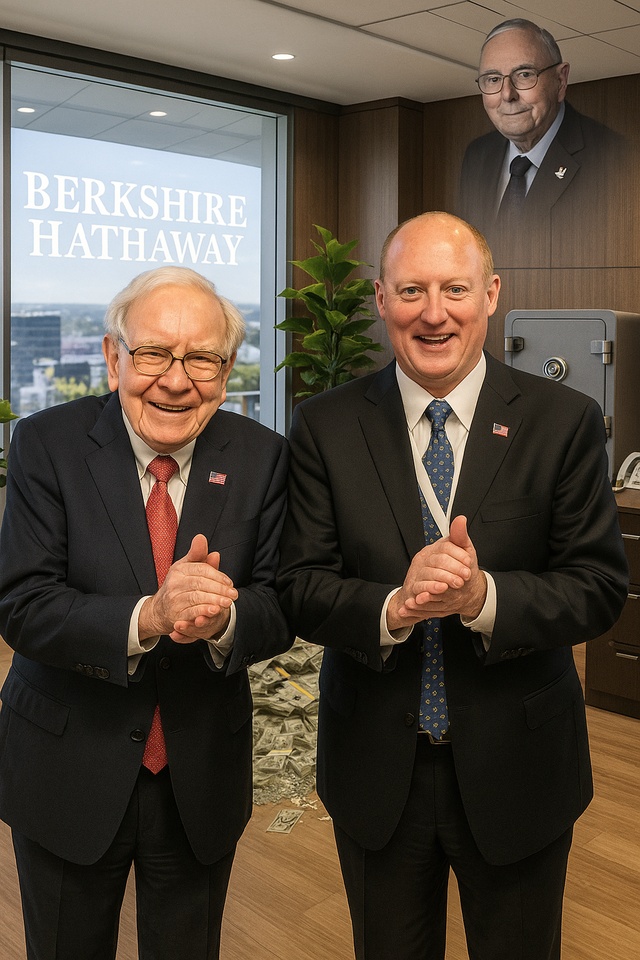

Buffett and Munger were the architects, but the float is the foundation.

For investors, this means that the float is the silent engine in the background and ensures that Berkshire retains its enormous investment power in the future.