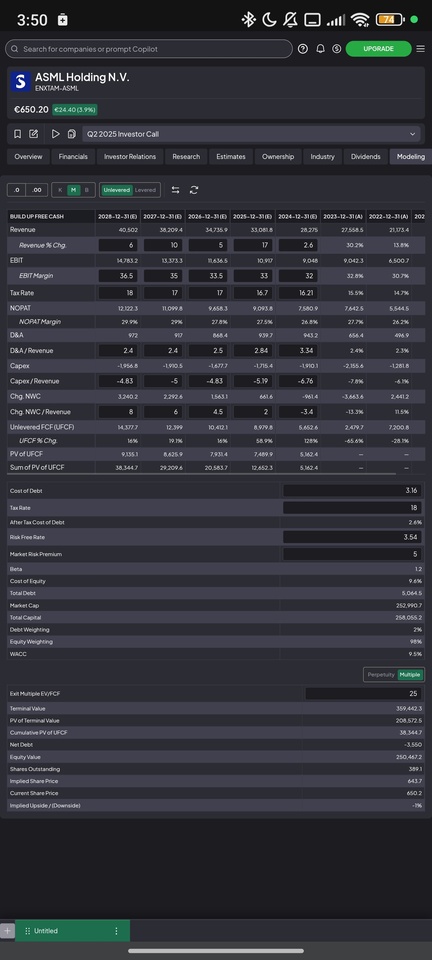

If you look at the stagnation of the share, despite the importance of the mechanical engineering company, you might ask yourself: Why isn't the share performing? I asked myself the same question and therefore made some basic assumptions. We look at the fair value, once conservatively and then the base case. This is what we came up with:

And what can we say: in the conservative DCF model, ASML is pretty close to fair value . This means that the current valuation leaves hardly any room for further growth; any increase in value would have to come primarily from the company growing into the current valuation.

The base case looks somewhat different: Here, the share is slightly undervalued. Looking at more optimistic scenarios, the value even moves towards EUR 900+.

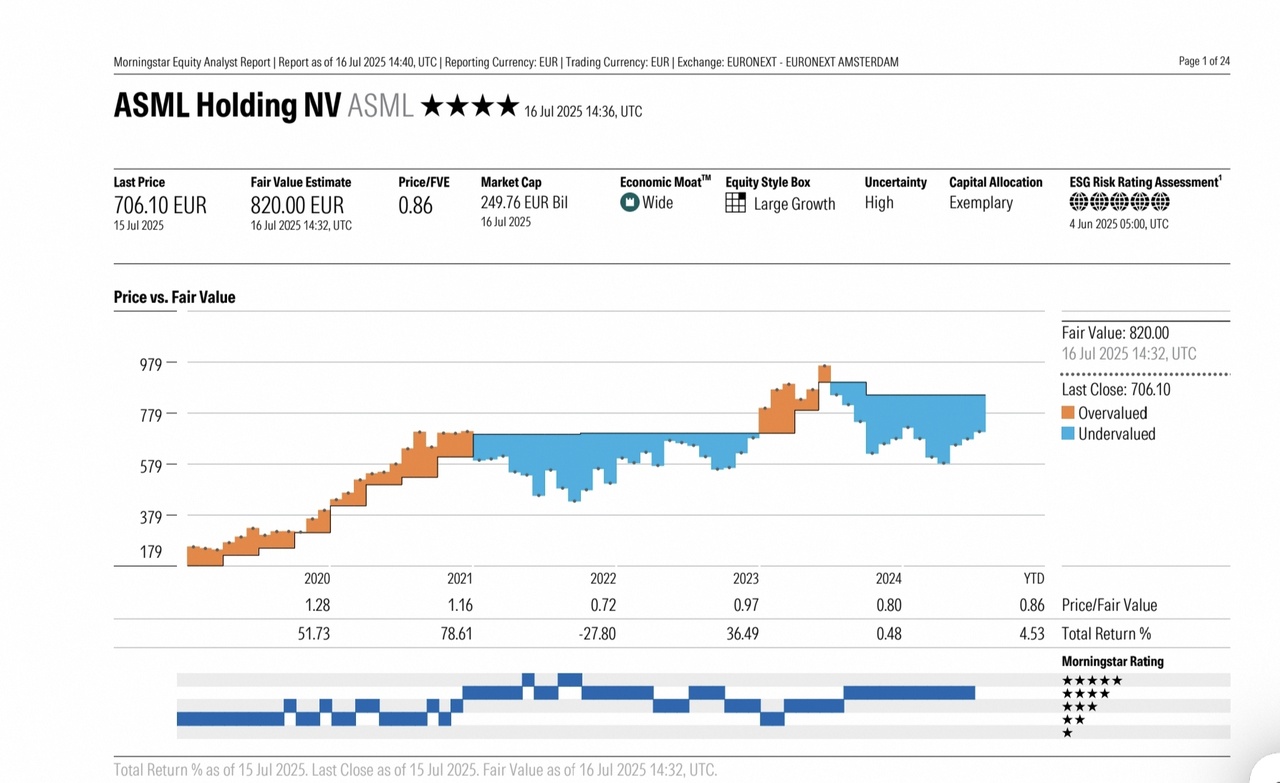

According to Morningstar, the fair value is even EUR 820, which is perhaps a small consolation for those who are worried.

The share also had to cope with a lot of negative news. The EUV sales ban to China, the tariffs and customer problems are clearly noticeable in such a complex company. If you would like to take a closer look at the figures and their impact, there may be a post, depending on who is interested. $ASML (+0,64%)

$NVDA (-1,45%)

$TSM (-1,33%)