Currently holds $MSTR (-6,56%)

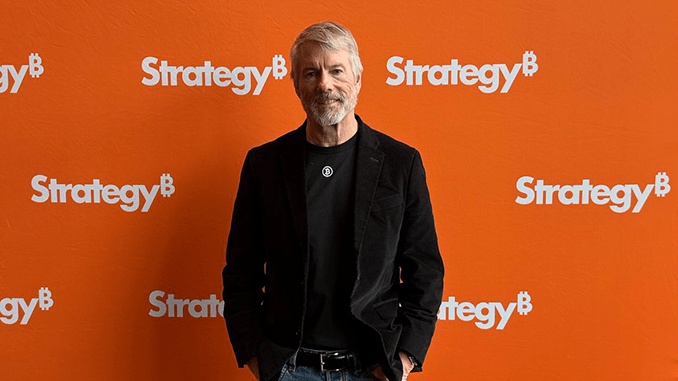

478,740 bitcoinswhich is more than any other company in the world. The current market value of these is around 49 billion US dollars. Michael Saylor is not afraid and is sticking to his own plan, because the next convertible bond issue is just around the corner.

Strategy announced in a press release on Thursday that it will raise a further 2 billion US dollars for Bitcoins by issuing a convertible bond.

The current market capitalization of $MSTR (-6,56%) amounts to approx. 82 billion US dollars.