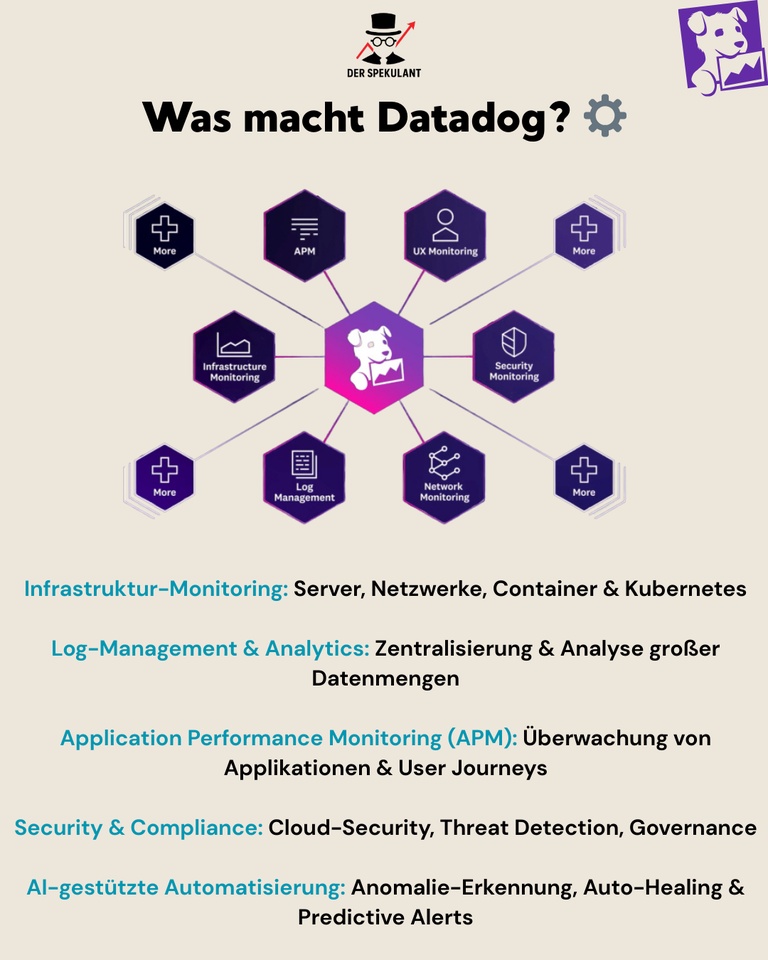

👉 Datadog is one of the leading providers in the field of monitoring, observability & security for cloud infrastructures. Founded in 2010, the US company has become an indispensable "operating system" for modern IT stacks - from servers and networks to applications and AI applications.

With a market share of ~20 % in the observability segment and a strong focus on upselling (security & AI modules), Datadog has established itself as a standard solution for hyperscalers, startups and Fortune 500 companies.

🚀 Growth driver

➡️ Cloud adoption & AI boom: Every company that uses the cloud needs monitoring - Datadog is one of the first port of call.

➡️ GLUE effect: Strong customer loyalty - once integrated, switching is extremely difficult (vendor lock-in).

➡️ UpsellingSecurity & AI modules drive margins up significantly.

➡️ Market potential: According to Gartner, the global observability market is growing at a double-digit rate and is expected to reach > USD 70 billion by 2030.

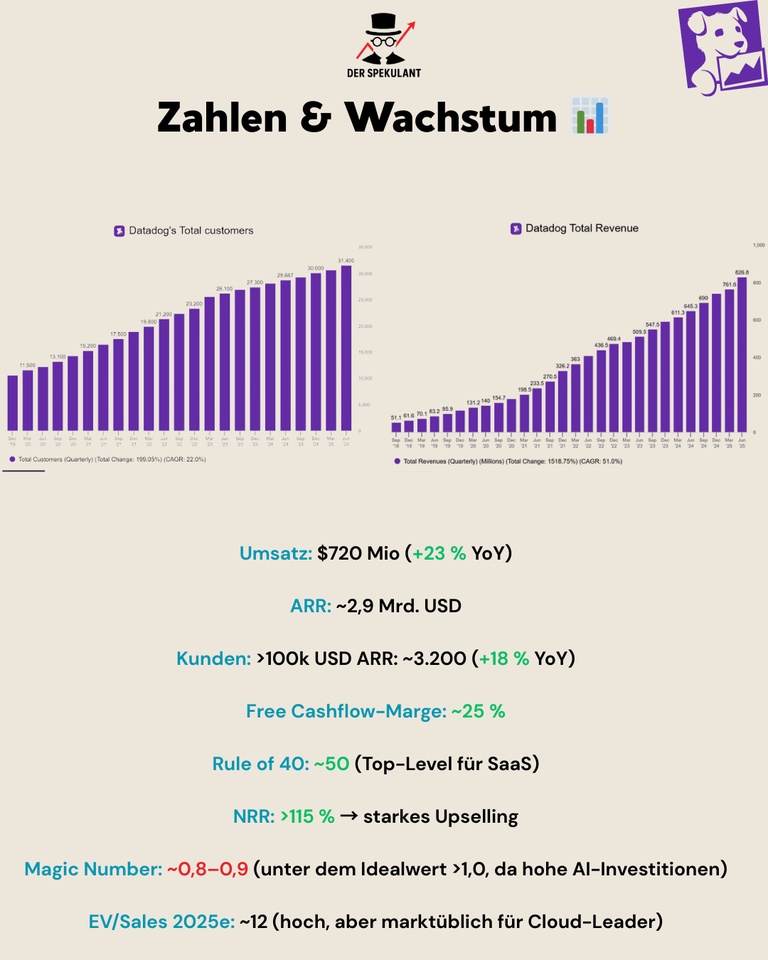

💰 Finances (Q2/2025)

📊 Sales: $720m (+23% YoY)

📊 ARR: ~$2.9bn

📊 Customers >100k ARR: ~3,200 (+18% YoY)

📊 Free cash flow margin: ~25 %

📊 Rule of 40: ~50 (top level for SaaS)

📊 NRR: >115 % → strong upselling

📊 Magic Number: ~0.8-0.9 (below ideal value >1, due to high AI investments)

⚖️ Valuation

➡️ EV/Sales 2025e: ~12x → high, but not unusual for market leaders in the SaaS sector

➡️ Comparison: Dynatrace ~8x, Splunk (before Cisco acquisition) ~5x → Datadog is clearly premium valued.

➡️ P/E ratio (2026e): ~45 → Profitability present, but growth story dominates.

🟢 Opportunities

🟢 Cloud & AI megatrend: Monitoring is mandatory infrastructure - whether for start-ups or Fortune 500.

🟢 Cross-selling: One customer → many modules (observability, security, APM, log management).

🟢 Scalability: SaaS model with high margins and enormous cash flow leverage.

🟢 First-mover advantage: Strong brand, community & developer ecosystem.

🔴 risks

🔴 Hyperscaler competition: AWS, Azure, GCP develop their own observability solutions.

🔴 High valuation: Execution risk - small disappointment = big price losses.

🔴 Dependence on IT budgets: Monitoring budgets are put on hold during recessions.

🔴 Competitive pressure: Dynatrace, Splunk, Elastic, New Relic - strong competition.

🧠 Conclusion

Datadog combines strong growth with profitability - a rarity in the SaaS sector. With a Rule of 40 of ~50 and >25 % FCF margin, the foundation is solid.

The high valuation remains the biggest risk - $DDOG (-0.63%) must continue to grow at double-digit rates to justify it.

👉 Will Datadog succeed in establishing itself in the AI age as the standard platform platform for monitoring + security in the AI age, it remains a potential compounder.

❓Question for the community:

Do you trust Datadog to maintain its premium multiple and overtake Splunk & Dynatrace in the long run - or is the stock currently too highly valued?